New File Validation Utility version 3.6 has been released on September 25th, 2012 by NSDL. eTDS file must be validated with file validation utility version 3.6 for current filing.

We have made changes in our Greytrix TDS for Sage 300 ERP (formerly known as Sage Accpac ERP) for this.

Applying the e-TDS Patch: To generate e-file in TDS Module you need to apply the patch. The following instructions will help you in applying the Patch.

1. It is recommended that a complete backup of application and data should be done before performing the below task.

2. Please follow below steps to copy DLL files;

a. If Sage (Accpac) 300 ERP (Version 6.0A) – Copy the file “HF6.0-ETDS-with-3.6FVU.zip” into <Sage>\DT60A

b. If Sage (Accpac) 300 ERP (Version 5.6A) – Copy the file “HF5.6-ETDS-with-3.6FVU.zip” into <Sage>\DT56A

c. If Sage (Accpac) 300 ERP (Version 5.5A) – Copy the file “HF5.5-ETDS-with-3.6FVU.zip” into <Sage>\DT55A

3. Run below SQL Query against Sage (Accpac) 300 ERP company database in SQL Server “TRUNCATE TABLE DTEFILE”

4. Go to Sage (Accpac) 300 ERP desktop >>Tax Deducted at Source >>D/T Setup->Upgrade and click on proceed button

5. Re-open the company

6. Now you can generate e- file, which is required for quarterly return of TDS from Greytrix TDS module. Kindly follow the below steps to generate the e–TDS file for TDS return.

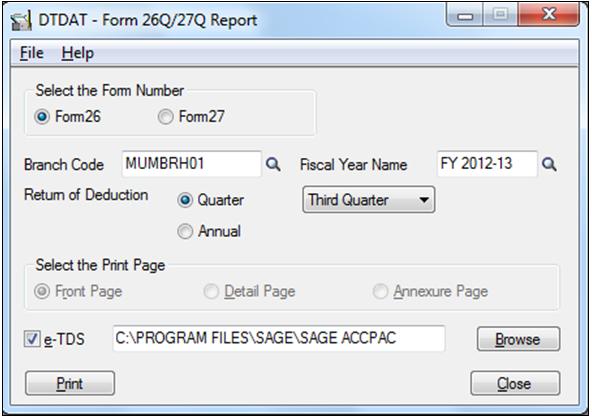

Generate e-file from TDS module: Now that you have applied the patch you are all set to generate the e-TDS Quarterly return. To generate the file go to the Tax Deducted at Source >>D/T TDS Forms >>Form 26Q/27Q.

Provide the required parameter and select the quarter for which you want to generate e-file.

Important: The e-file should have valid Pin Code, Pan Card numbers of Party, etc. So ensure you have correct values entered in the TDS Module Validation part which are required to generate E-file from TDS module. Below is a list which is validated by NSDL

– PINCODE should be valid in Sage (Accpac) 300 ERP company profile

– PIN CODE should be valid in Responsible person screen [e.g. 400071].

– Telephone number and mobile number should be valid in Responsible person screen [(e.g. 02265425865)(e.g. 9845125463)]

– Responsible person email should be valid (@ & . are compulsory)

– Pan card number of party detail should be valid

– PAN TAN, Tel no and email in TDS OPTIONS screen should be valid

– All documents should be posted in Remittance screen, and Challan number, Challan date, BSR code should be provided for all remitted transaction.

Validating the e-File with NSDL FVU3.6

Before you submit the file, ensure that the file is correct in all aspects by validating the same using the validation utility provided by NSDL. Please follow the below process to perform the validation.

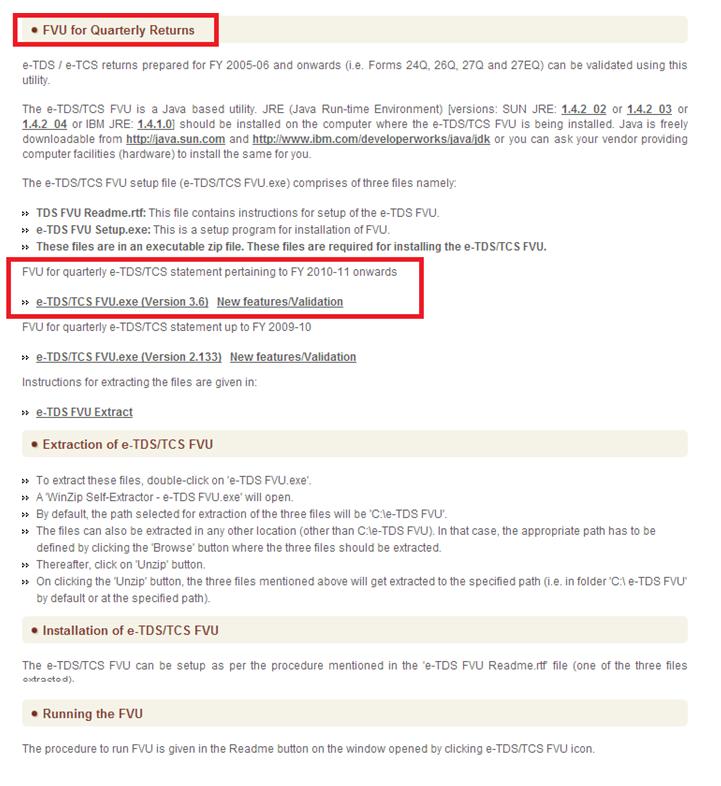

1. Once you have Generated e-file, next step would be to download TDS Validation utility from NSDL and install it on your system.

2. Refer below screen, to install the validation utility:

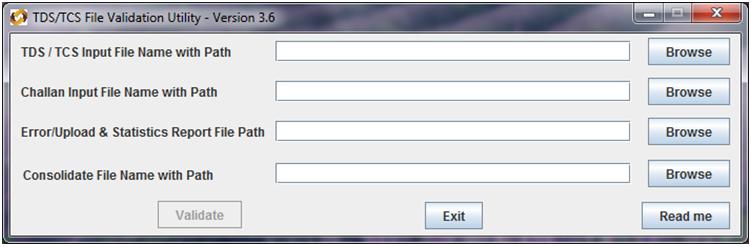

3. Once you successfully installed the software, follow below steps:

a. Navigate to directory path where you have installed e-TDS validation utility [e.g. D:\TDS_FVU_3.6]

b. Click on “TDS_FVU.bat” you can view below screen

c. TDS/TCS Input File

i) Specify the name (with the .txt extension) of the input file (including the path) i.e. the name of the e-TDS/TCS statement prepared as per file format to be validated by the FVU.

ii) Input filename should not be more than 12 characters (including the .txt extension) and should not contain any special characters e.g. : , \ / etc.,. Extension of Input file should be in small case. For example Filename can be FORM26EQ.txt

d. Challan Input File Name with path: Challan File is now mandatory during validation, please provide the CSI file path.

How to generate CSI file

1. Upto FVU version 3.5 , challan file ( with extension .csi ) was optional. With version 3.6 , this file will be mandatory while validating eTDS file

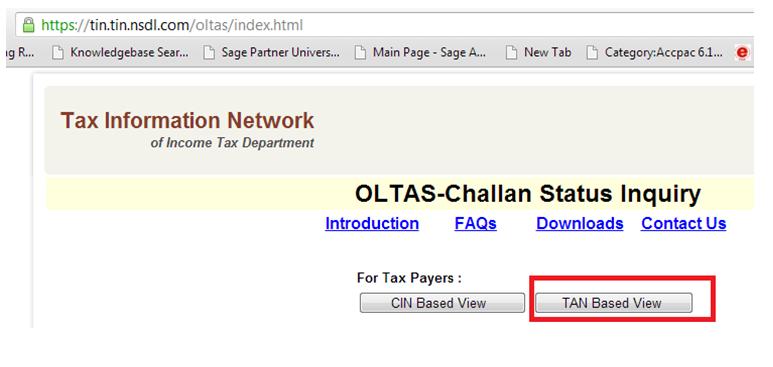

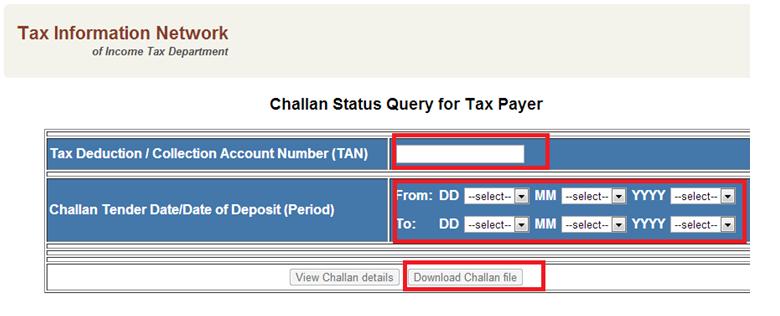

2. The challan file can be downloaded from TIN web site under the link Challan Status Enquiry

If you click on TAN based Views in above screen then new screen will open, provide the required information and download challan file.

3. Challan file is required for validating regular statements. For correction statements , it is required only when a new challan is added or existing challan is updated.

e. Error/Upload & Statistics Report File: Specify the path where either an ‘error’ or ‘upload & statistics report files’ generated by the FVU on completion of validation should be saved. The path can be same as the input file path or different. Do not specify any filename, only provide the path.

f. Consolidation file name with path: Please keep this path as empty

g. Click on validate button, if error occurred then please check error file [e.g. F26Q124err.html]

h. If validated successfully then provide the soft copy, .fvu and html file [for example F26Q124.txt, F26Q124.fvu and F26Q124.html]

You can “Download” the sample soft copy of quarterly return for your reference.