In our last blog we have discussed about the Fiscal Year, Responsible person, Branch Details, Nature of Deduction that need to be setup properly before starting up for Greytrix TDS module. In this blog we will explore few more important settings that allows proper functioning of Greytrix TDS module for Sage 300 ERP

For Part I: Configuring Greytrix TDS in Sage 300 ERP

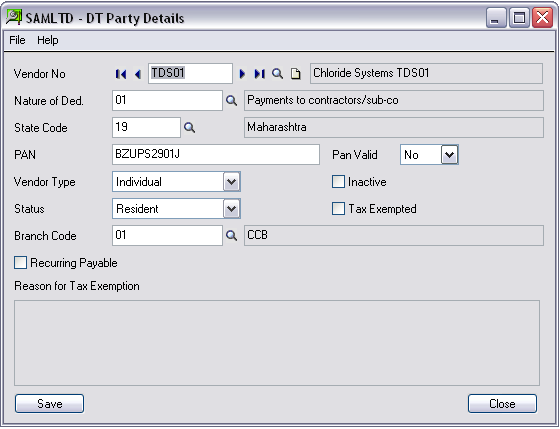

DT Party (TDS Vendor) Details:

For TDS calculation user must provide the vendor details by defining the vendor and their service type (nature of Deduction) in Party details screen. Before adding the details in the party details, user needs to make sure that he/she has added the vendor in the AP vendor screen in Sage 300 ERP.

The New Stuff: Backup your Company Database in Sage 300 ERP

In Party Details user needs to define

• Vendors PAN number which is mandatory field during E filling,

• Vendor Type

• Vendor Statue: Residential / Non Residential

Note: Service type (Nature of deduction) defined here gets automatically populated during the AP transaction but user can change the Service type (Nature of Deduction) manually.

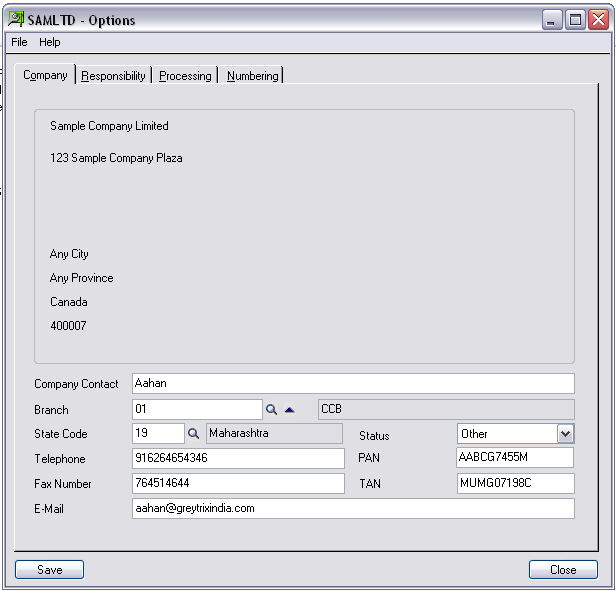

DT Options (TDS Setup Options): DT Option is a core of Greytrix TDS module. If you want your TDS module should work properly; is important to set up all correct information in this screen. The information on DT Options screen is mandatory during the e-filing so always make sure that you have provided correct and complete information here.

Let’s see each tab:

• Company tab: Here user can set Company Contact person, PAN, TAN, Email and Status if is Government or Other (Private)

• Responsibility tab: Here user can set Company’s responsible person

• Processing tab: Here user has to set correct fiscal year for which he\she is doing the transactions. Eg. 2013-2014

Here user can integrate TDS module with PJC by setting up “Yes” on processing tab. refer below link for more information: Greytrix TDS with PJC Integration

Numbering tab: The system defaults the Prefixes/Length/Next Number when the TDS module is activated. However user definitely has an option of changing the numbering system. In this tab user can set numbering sequence for Form16A and Remittance entry as per his/her preference

We will discuss more about TDS sections and State codes in our next blog

Also Read:

1. Greytrix TDS for Sage Accpac ERP – Generating file for Quarterly etds returns

2. Handling Tax Deducted At Source (TDS) on Rent Paid in Sage ACCPAC ERP

3. Greytrix TDS for Sage ACCPAC ERP now with Manual TDS Entry

4. Greytrix TDS v2.2 for SAGE 300 ERP

5. TDS Screen popup blank for TDS Vendor

Sage 300 ERP – Tips, Tricks and Components

Greytrix is one of the oldest Sage Development Partner of two decades and Reseller of Sage 300 ERP (formerly known as Sage Accpac ERP) and has been awarded "Sage Partner of the Year" multiple times for rendering quality services for Sage product lines both as developers and resellers. Greytrix has accumulated hundreds of man years of experience in Sage 300 ERP. In these blogs, Greytrix will endeavour to share its knowledge with regards to implementation, training, customisation, components, current technology trends and help users to understand in depth techno – functional aspects of Sage 300 ERP! Contact our team at accpac@greytrix.com

Greytrix is one of the oldest Sage Development Partner of two decades and Reseller of Sage 300 ERP (formerly known as Sage Accpac ERP) and has been awarded "Sage Partner of the Year" multiple times for rendering quality services for Sage product lines both as developers and resellers. Greytrix has accumulated hundreds of man years of experience in Sage 300 ERP. In these blogs, Greytrix will endeavour to share its knowledge with regards to implementation, training, customisation, components, current technology trends and help users to understand in depth techno – functional aspects of Sage 300 ERP! Contact our team at accpac@greytrix.com

Iconic One Theme | Powered by Wordpress