Have you ever faced the situation where your accounting records are inaccurate? I mean, you made it sure that you entered correct accounting entries but at the end of a month or period you wonder, why am I seeing unmatched figures or adjustments while comparing two sets of accounts? Did I just see overdraft values and few unauthorized payments… Feeling something obscure?

Sage 300 Bank reconcile method makes sure you match sets of accounts and keep financial statements error free.

What is Bank reconciliation? It refers to a process of comparing two sets of records. Make sure the money leaving an account must match actual money spent on the other side. It means all the transactions that you did in your books of accounts match those of your bank statement and vice versa. So Bank reconciliation will catch the errors and adjustment in accounting if any.

New Stuff: Validate Optional Field in Sage 300 ERP

Apparently it is not a tough job but an accounting procedure to match the records and find errors which eventually create proper financial statements for your company. And when you have Sage 300, you got the accounts software that will take care of this nitty-gritty.

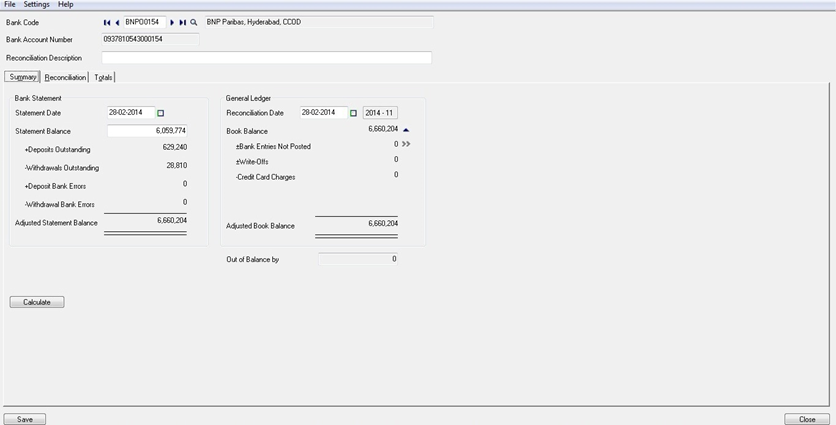

SAGE 300 – Bank services – Reconciliation Under Bank Transactions you open Bank Reconcile Form. Now you will see bank statements and General ledgers in left and right respectively. Check the balances as a summary of accounts.

Under Bank Transactions you open Bank Reconcile Form. Now you will see bank statements and General ledgers in left and right respectively. Check the balances as a summary of accounts.

How do we do?

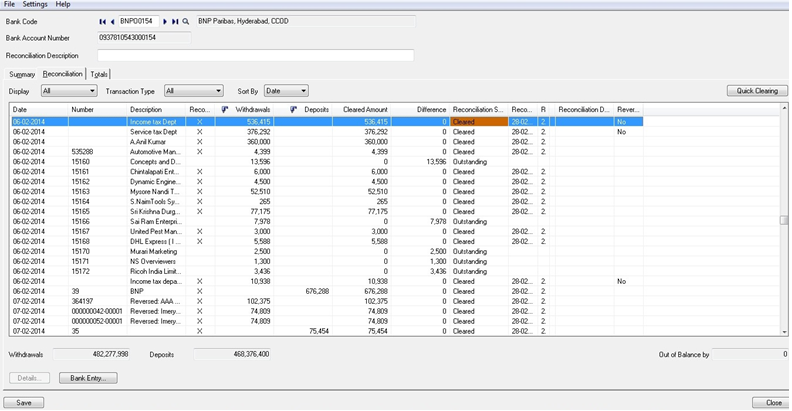

Once you select date for Bank and general ledgers statement, click calculate. To get details of transactions, click the reconciliation tab. This way you have all cleared and outstanding transactions with descriptions. It’s easy to check the withdrawals, deposits and the un-reconciled records. There is a column where you can select a transaction to be cleared, outstanding or reversed. To clear a set of consecutive transactions quickly, use Quick Clearing button.

Wait, if you find out a difference and got to know you missed one entry back in days, you can use Bank Entry button to post the missing entry. All you need is to give a double click to an entry and reconcile it.

You can also view the Bank book balance and your G/L balance. Before you save reconciliation check the balances and make sure they should be matching. Sage 300 presents accurate figures once the inputs are correct and Sage 300 helps you to identify precise financial statements with a single click which can be used for day to day operations as well as your internal and external audits.

Also Read:

1. I/C Physical Inventory Reconciliation Process

2. Bank Reconciliation Reports in Sage 300 ERP

3. Create Bank Entry from Reconciliation Screen

4. Post Bank Entries from Reconciliation Screen in Sage 300 ERP

5. Working of Auto Bank Reconciliation in Sage 300 ERP