In Sage 300 ERP, many useful inbuilt reports are already present including “Tax Tracking” report which helps companies in many ways. This report provides a complete listing of tax amounts charged for taxable transactions. This report captures all type of transactions whether it is sales relevant or purchase relevant

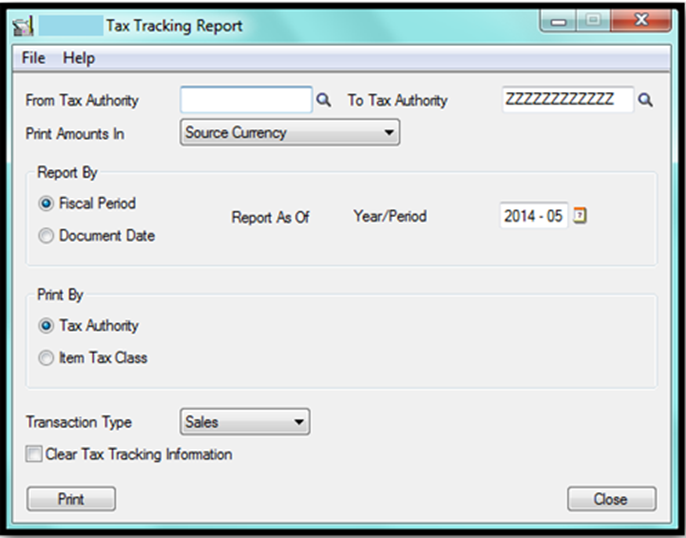

Please find below the UI screenshot of the “Tax Tracking” report of Sage 300 ERP (Accpac).

By viewing UI of the report you can see there are various parameters available, based upon which you can view the report as per your desired requirement.

Steps to print the report:

• Select the range of Tax Authorities to include on the report. For an e.g. County Tax, GST, State Tax, Service Tax 12.36% and so on for which you desire to see the report. Here either you can see the report for a specific tax authority or for multiple tax authority.

• If you use multicurrency accounting, specify the currency in which to report tax amounts.

• Specify whether to report amounts by fiscal period or by document date, then specify the fiscal year and period or the document date as of which to report.

• Select the transaction type (Sales or Purchases). In this report either you can view the report for sales transaction or purchase transaction at a time.

• If you are printing to a printer or saving file and you want to clear the tax information after printing the report, select Clear Tax Tracking Information.

Warning: The tax tracking information will not be available for the selected criteria once clear ‘tax tracking information’ is checked.

• Then lastly click on Print and view the output of the report.

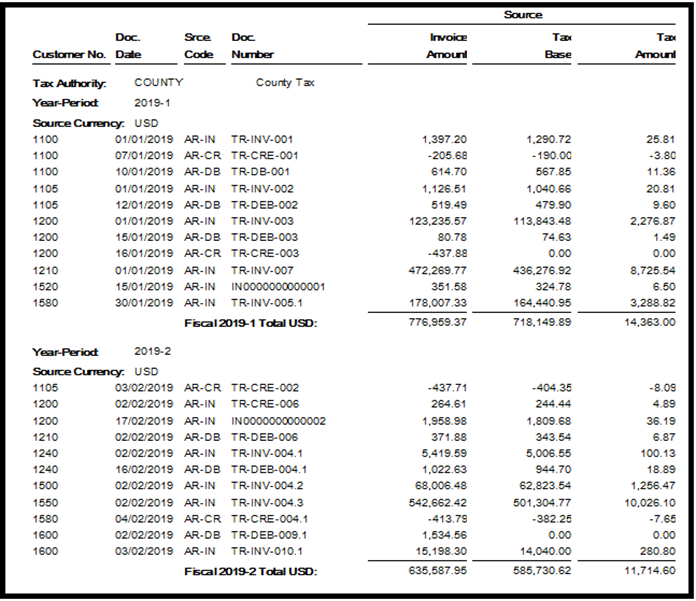

You can find below is the screen shot of the output for Tax Summary in Sage 300 ERP.

Information printed on this report

• Source currency code.

• Tax authority code.

• Year-Period.

• For each transaction, the customer or vendor number and name, transaction date, transaction source code, transaction number, invoice amount, tax base, and tax amount.

• Customer totals as for the selected date or fiscal year and period (in customer/vendor, functional, or tax reporting currency).

• Authority totals as for the selected date or fiscal year and period (in customer/vendor, functional, or tax reporting currency).

• A summary of totals, by tax authority, for the date or fiscal year and period.

This report helps you in return filing against the sales tax. You should print this report when you need tax information, or at the end of the reporting period when you want to submit the information to tax authorities. Complete reports required by government, such as for goods and services or value-added taxes, and as supporting documentation for such reports.

Also Read:

1. Tax Recovery Set-up in Sage 300 ERP

2. Setting up Price Inclusive of Taxes in Sage 300 ERP

3. Configure Reverse Charge Mechanism for Service Tax in Sage 300 ERP

4. Tax Calculation on the basis of Quantity in Sage 300 ERP

5. Handling Tax Deducted At Source (TDS) on Rent Paid in Sage ACCPAC ERP.