Manufacturing Module for Sage 300 ERP also known as Sage ERP Accpac ERP is an industrial-strength. Manufacturing excise is a Greytrix Add-on that is designed for Sage 300 ERP.

In this Add-on, Manufacturing process maintains standard registration and statutory information like VAT, ECC, PAN Central Sales Tax, CE, Reg, RG32 details along with the Customer specific and Vendor specific Excise information and item details along with process, shipment & transfer with excisable locations.

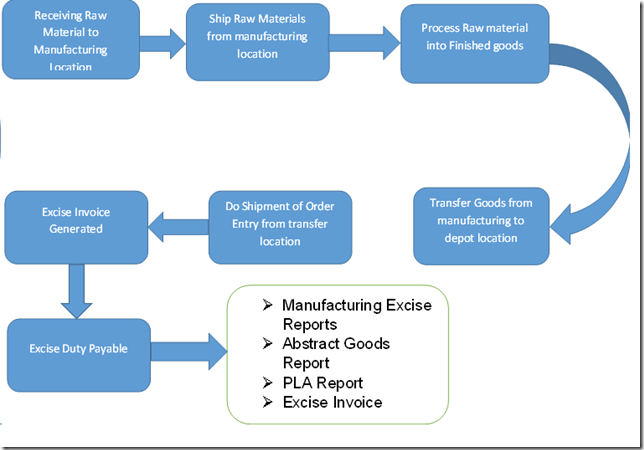

Following are excise standard Reports:-

1) Manufacturing Excise Reports.

2) Abstract Goods Report.

3) PLA Register Report.

4) Excise Invoice Report .

5) Annexure-II Challan Report.

6) RG -1 register Report.

7) CENVAT Credit Register Report.

8) RG 23 Part II Reports for Inputs and Capital Goods.

New Stuff: AP Invoice Report

Manufacturing Process:-

In manufacturing process, Excise goods are received from manufacturing location & finally through IC transfer it will be shipped to depot location that means raw materials can be manufacture & transferred into finished goods & shipped to depot location.

– Raw materials are received into manufacturing location, is called as PO receipt.

– Shipped raw material from manufacturing location to job work location

– Received finished goods job work

– Transfer Finished Goods from manufacturing location to Deport location, this process is called as Inventory Transfer, here we have to pay excise duty applicable for that inventory.

– After completion of the transfer of goods from manufacturing location to depot location, do shipment order from transfer location with required inventory.

This is the way in which manufacturing excise works in Sage 300 ERP.

Also Read:

1. Manufacturing and Sage 300 ERP

2. Manufacturing Costing and Sage 300 ERP

3. Transfer of Excise duties along with Inventory Transfer in Sage 300 ERP

4. Manufacturing and Subcontracting in Sage 300 ERP

5. Order Process for Manufacturing Company in Sage 300 ERP

Sage 300 ERP – Tips, Tricks and Components

Greytrix is one of the oldest Sage Development Partner of two decades and Reseller of Sage 300 ERP (formerly known as Sage Accpac ERP) and has been awarded "Sage Partner of the Year" multiple times for rendering quality services for Sage product lines both as developers and resellers. Greytrix has accumulated hundreds of man years of experience in Sage 300 ERP. In these blogs, Greytrix will endeavour to share its knowledge with regards to implementation, training, customisation, components, current technology trends and help users to understand in depth techno – functional aspects of Sage 300 ERP! Contact our team at accpac@greytrix.com

Greytrix is one of the oldest Sage Development Partner of two decades and Reseller of Sage 300 ERP (formerly known as Sage Accpac ERP) and has been awarded "Sage Partner of the Year" multiple times for rendering quality services for Sage product lines both as developers and resellers. Greytrix has accumulated hundreds of man years of experience in Sage 300 ERP. In these blogs, Greytrix will endeavour to share its knowledge with regards to implementation, training, customisation, components, current technology trends and help users to understand in depth techno – functional aspects of Sage 300 ERP! Contact our team at accpac@greytrix.com

Iconic One Theme | Powered by Wordpress