GTA is a service tax, in relation to the transport services. Organizations are required to collect and deposit the tax with the government authority on behalf of the transporters. This is a mandatory compliance which all companies need to follow to avoid any legal issues with the authorities.

New Stuff: Generate POs from requisitions in Sage 300 ERP

Service Receiver will pay GTA service tax to the government authority in calculation with new service tax of 14%.

In this case the calculation that will take place, is shown below with example:

Suppose we get Invoice from a transporter of Rs. 20,000/- then tax calculation is

14% Service Tax on 30% of Invoice amount i.e. 6,000 is 30% amount of invoice 20,000

So, the tax will be calculated 14% of 6,000 = 840

Otherwise we can also calculate tax (Invoice amount*30%*14%) i.e. 4.20% of 20,000 = 840

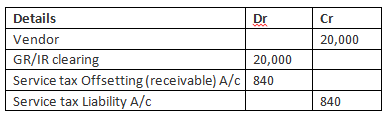

In this scenario we need to pass the entry as shown in below:

Now in Sage 300 ERP, we need to pass the entry where our Tax Liability accounts get credited and our Tax expense (receivable) account gets Debited.

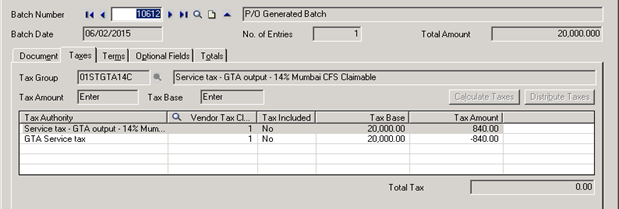

For that, first we need to create a two tax authority for GTA service tax one with the rates of 4.20 and another one with -4.20 so that Sage 300 ERP (Previously known as Accpac) will be credited with that amount in the specified account.

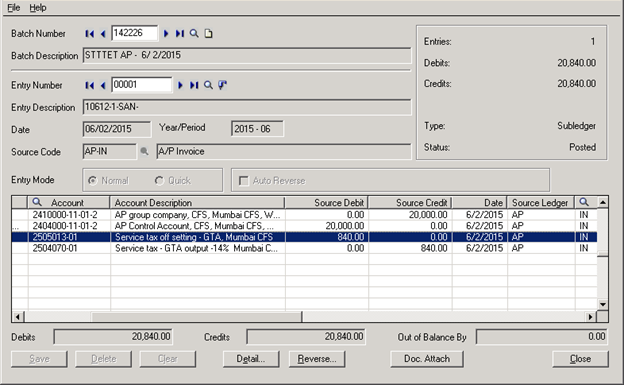

For the reference please check below Invoice screen shot.

And below is the GL entry screen where exact entry is passed.

Also Read:

1. Auto- Application of Taxes at Item Level

2. Tax Audit Report

3. Taxes in Sage 300 ERP

4. Automatic insertion of Item Wise Detail Tax

5. Automatic Tax Calculations Option in Sage 300 ERP