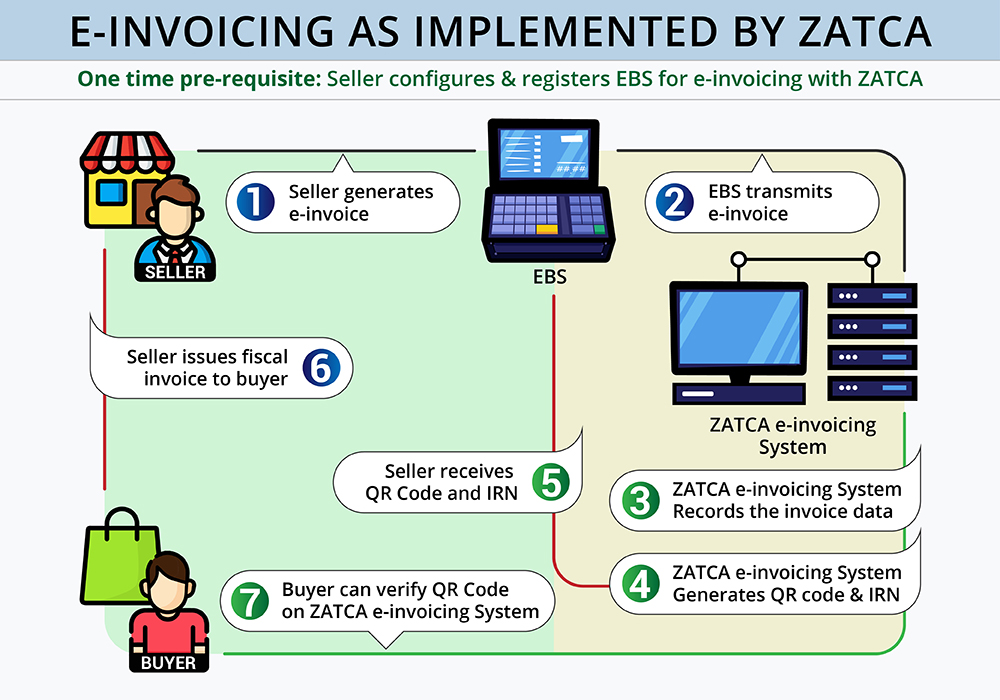

The Kingdom of Saudi Arabia (KSA) has launched various initiatives to digitize its economy. The General Authority of Zakat and Tax (GAZT), which has now merged with the Zakat, Tax, and Customs Authority (ZATCA), has rolled out e-invoicing, referred to as Fatoorah, across the country.

The Saudi government is focused on phasing out handwritten invoices in favor of a fully digital system. As a result, e invoicing has been implemented to help businesses operate more efficiently and securely.

Greytrix Africa supports businesses of all sizes in smoothly transitioning to e-invoicing (Fatoorah) systems by leveraging advanced technology and in-depth knowledge of ZATCA. Our customized solutions streamline billing processes, improve transparency, and enhance accountability in financial transactions. With our assistance, businesses can effectively navigate the complexities of e-invoicing regulations, leading to increased efficiency and reduced errors.

It is an invoice issued by one business to another (B2B), including all the elements of a tax invoice, particularly the VAT registration numbers of both the buyer and the seller.

A business typically issues a simplified tax invoice to a consumer (B2C), which contains the essential elements of a simplified tax invoice.

The Fatoorah system for Saudi Arabia enables smooth integration of electronic billing, enhancing efficiency and ease of use.

Our e invoicing solution streamlines processes and ensures data integrity with robust duplicate invoice protection, preventing redundancies and billing errors.

Customize your e-invoicing template to meet your requirements with our e-invoicing (Fatoorah) solution.

Our e-invoicing (Fatoorah) software automatically validates invoice data, ensuring complete accuracy in invoice generation.

Greytrix Africa provides comprehensive support, from consulting and system setup to API integration, testing, and continuous compliance assistance. Our team is dedicated to making your transition to the ZATCA e-invoicing framework as smooth and stress-free as possible. For help, feel free to reach out to sales@greytrix.com.