For businesses with minimal transactions, accessible via eCitizen.

This is designed for individuals and sole proprietors and can be accessed through the short code *222#.

Tailored for service sector taxpayers, excluding goods supply.

A downloadable software for goods or combined goods/services taxpayers, supporting multiple branches and pay points.

It facilitates seamless system integration for taxpayers with extensive transactions or bulk invoicing.

Enables system integration for taxpayers using online invoicing systems.

It refers to the purchaser's Personal Identification Number (PIN). Capturing this information is necessary only when the buyer intends to claim input tax for the VAT paid. In such cases, the buyer should provide their PIN details.

The Kenya Revenue Authority (KRA) issues this unique number to identify the Electronic Tax Register (ETR).

This unique number is generated by the ETR for each tax invoice issued.

This code is included on the tax invoice to confirm validity.

The Einvoicing system for Kenya and Mauritius enables smooth integration of the electronic billing system, promoting efficiency and ease of use.

Our advanced e invoicing solution streamlines processes and ensures data integrity with robust duplicate e-invoice protection, safeguarding against potential redundancies or billing errors.

Customize your einvoicing template to meet your requirements with our e-invoicing software.

Our e-invoicing solution can automatically validate your invoice data, ensuring complete accuracy in invoice generation.

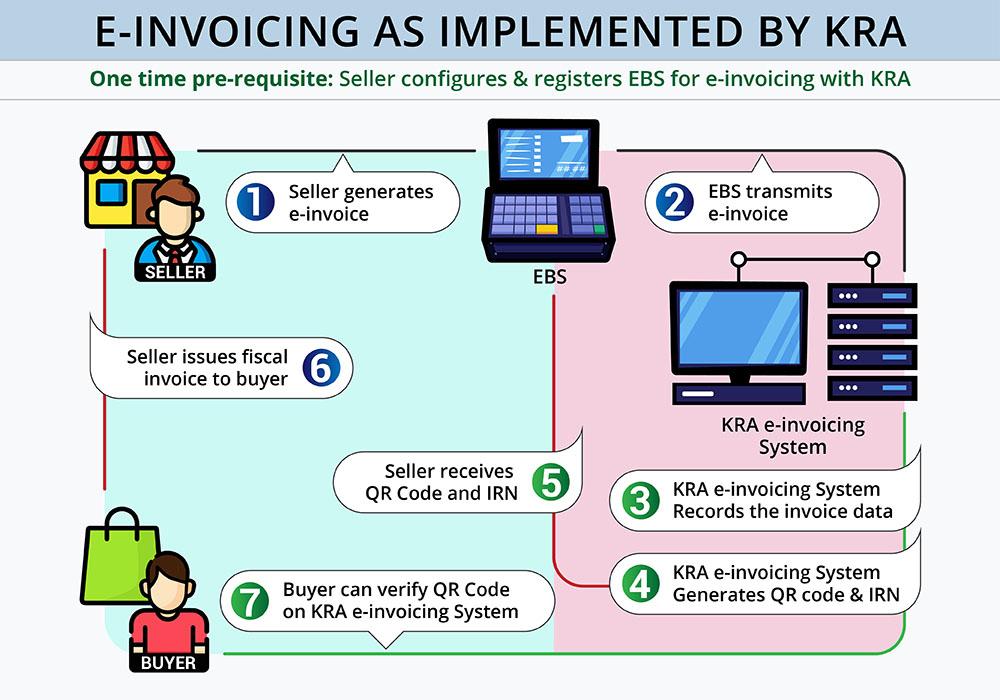

eTIMS, or the Electronic Tax Invoice Management System, is a digital invoicing tool rolled out by the Kenya Revenue Authority (KRA). It’s now a must for all businesses in Kenya, whether they’re VAT-registered or not, to create and submit tax-compliant electronic invoices using a Sage ERP system.

Unlike TIMS, which relied on physical devices to send invoice data, eTIMS is fully online. Businesses can easily create and submit invoices via web portals or directly from integrated Sage ERP systems like Sage X3, Sage Intacct, and Sage 300.

A proper e-invoice should include a unique invoice number, the supplier and buyer PINs, the transaction date, details of the items or services, applicable tax amounts, and a QR code generated by KRA for verification.

Absolutely! The KRA mandates that both VAT-registered and non-VAT-registered businesses issue electronic invoices for all transactions using eTIMS.

Greytrix Africa makes it easy to integrate eTIMS with Sage ERP, automating the processes of invoice creation, submission, and validation with KRA systems. This means less manual work and minimizing compliance errors.

eTIMS Lite is a streamlined version of the platform designed specifically for micro and small enterprises. It offers a user-friendly invoicing tool without the need for complex system integrations.

Automation speeds up the invoicing process, ensures instant validation from KRA, reduces human errors, and keeps all invoice data securely in the cloud. This makes compliance smooth and hassle-free for businesses in Kenya.