If your business still juggles paper-based cheque requests, delayed approvals, and scattered supporting documents, it’s time for a smarter solution. A Cheque Approval and Document Attachment System isn’t just a digital upgrade—it’s a game-changer across industries.

If your business still juggles paper-based cheque requests, delayed approvals, and scattered supporting documents, it’s time for a smarter solution. A Cheque Approval and Document Attachment System isn’t just a digital upgrade—it’s a game-changer across industries.

In the construction and real estate industries, the system streamlines vendor payments and subcontractor disbursements by ensuring that contracts, BOQs, and invoices properly back each cheque.

For manufacturing firms, it automates supplier payments, linking each transaction to critical documents like purchase orders (POs) and goods receipt notes (GRNs), giving plant managers better control over operational cash flow.

In healthcare and pharma, where speed and compliance matter most, the system enables faster cheque issuance for emergency purchases, while storing sensitive documents securely and audit-ready.

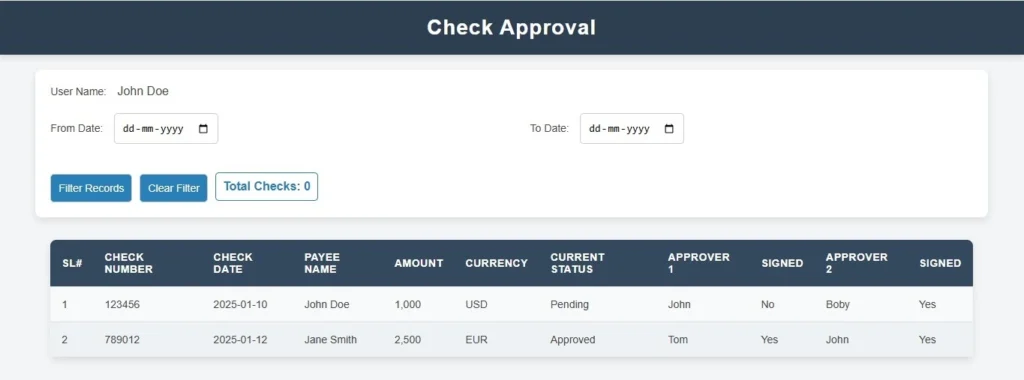

Financial institutions and insurance companies benefit from complete approval workflows and a crystal-clear audit trail, ensuring every loan payout, client reimbursement, or claim settlement is well-documented and fraud-proof.

Government agencies and the public sector can implement layered approval processes, ensure transparency in spending public funds, and streamline reporting for audits. Meanwhile, educational institutions and NGOs appreciate how effortlessly the system organizes grant disbursements, staff reimbursements, and donor fund tracking—all with the right paperwork attached and retrievable in seconds.

Even professional service providers like law firms, consultants, and accountants use the system to process client-related payments with digital signatures, compliance-ready records, and zero ambiguity. It lets them process client-related payments with full documentation, digital signatures, and zero room for ambiguity.

No matter your industry, if you handle cheque payments, approvals, and sensitive documents, this system doesn’t just help—it transforms.

Say goodbye to paper trails, delays, and compliance headaches—and hello to a more efficient, transparent, and secure way to manage financial disbursements.

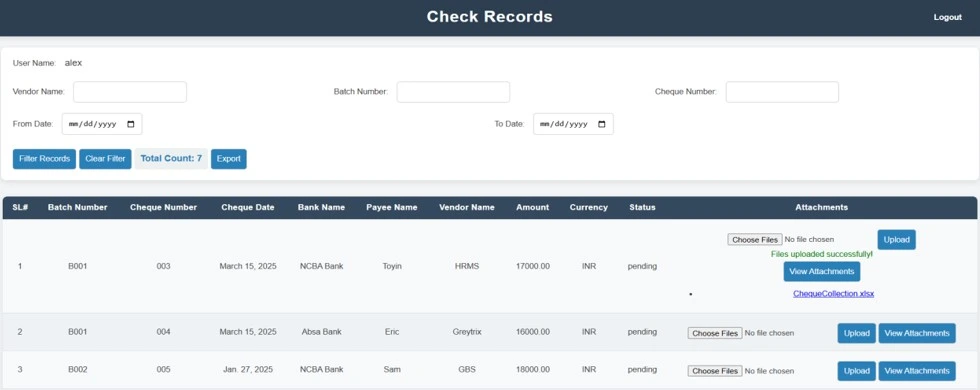

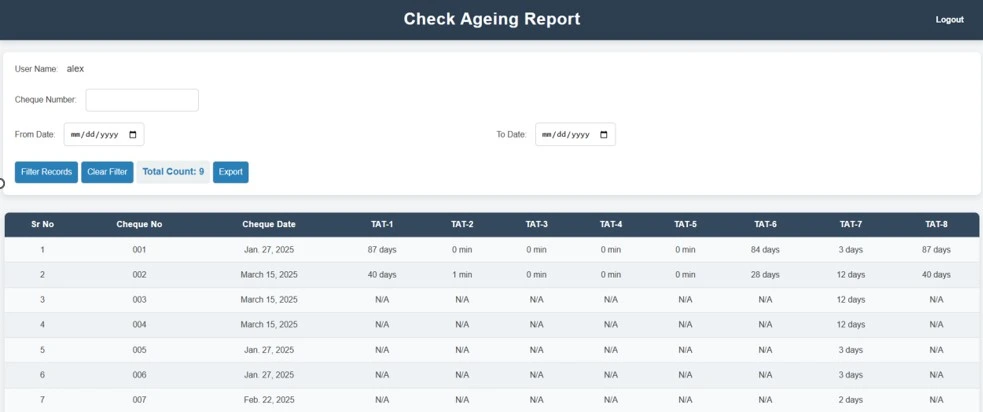

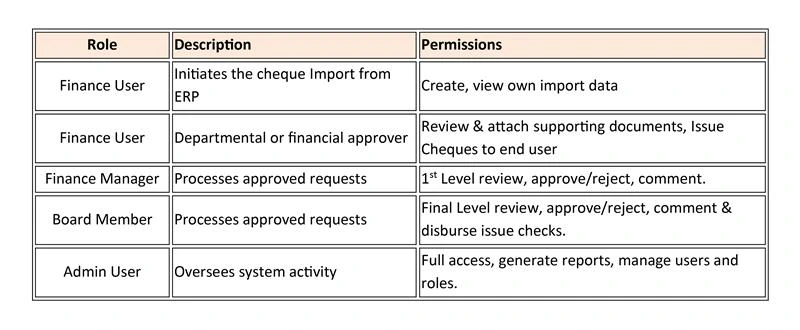

The Cheque and Document Workflow System is an integrated platform designed to digitize, streamline, and control the entire cheque processing and related document management lifecycle. It automates the approval workflow for cheque issuance while ensuring that all supporting documents are securely attached, properly archived, and easily retrievable for future reference.

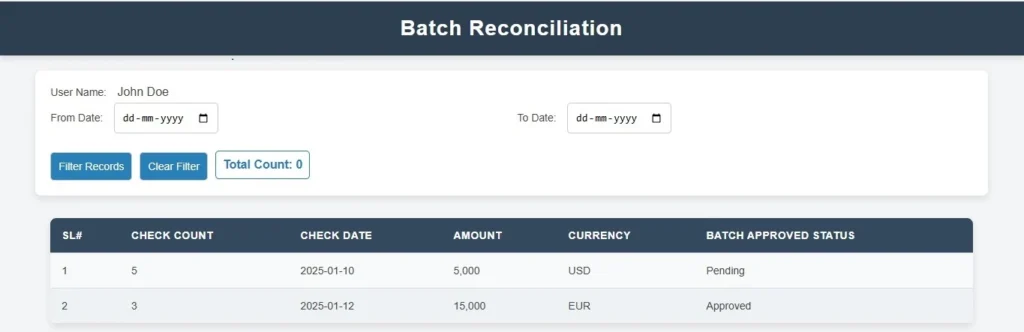

By enhancing transparency, reducing paperwork, and accelerating approval cycles, the system ensures that all financial disbursements via cheques are thoroughly documented, approved, and traceable in compliance with both internal policies and external audit requirements.

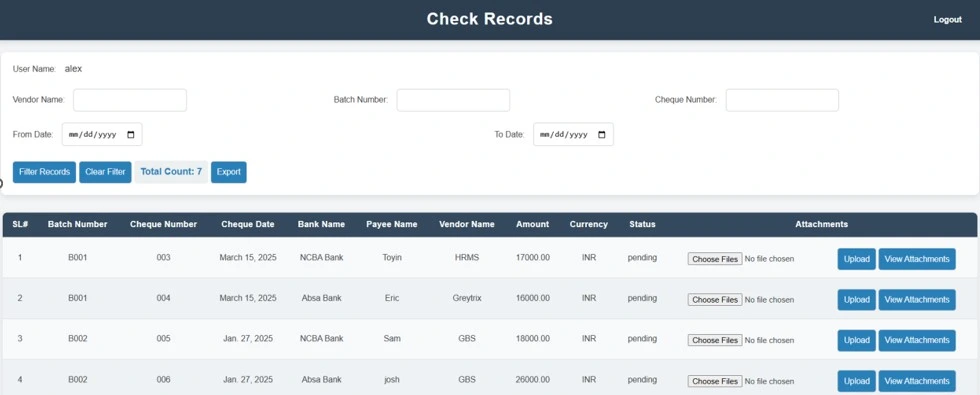

To ensure seamless operation and complete visibility, the system integrates key data elements related to each cheque request. These typically include:

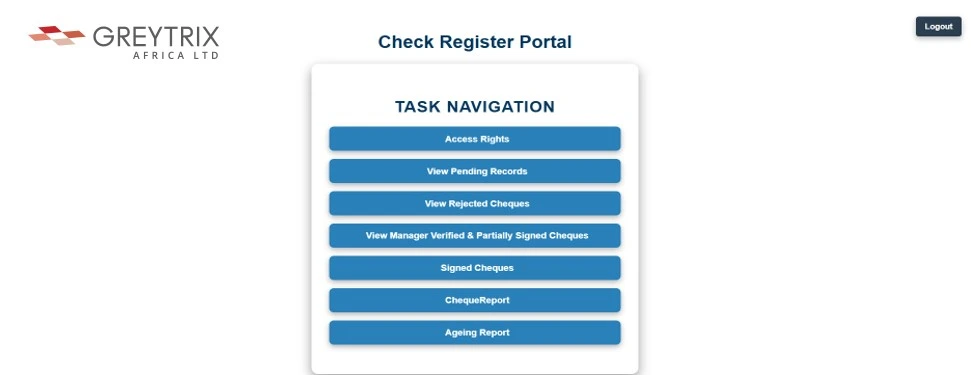

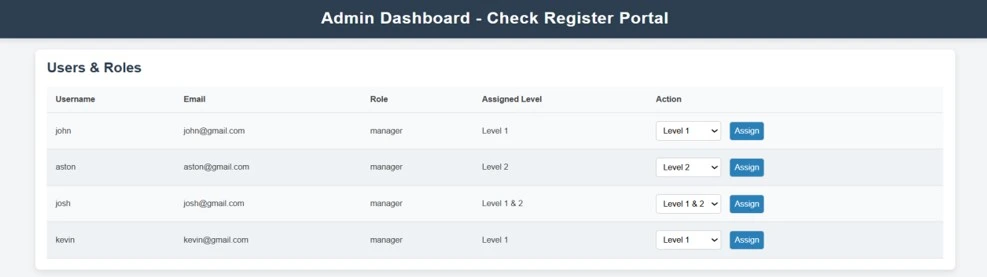

Landing Page – Showcasing different sections performing specific tasks as per user Roles & Functionality.

O Middleware or integration service.

A Cheque Approval and Document Attachment System empowers modern businesses with efficiency, accountability, and control over financial disbursements. Whether you’re in real estate, healthcare, finance, or the public sector, digitizing your cheque workflow isn’t just a convenience—it’s a must-needed upgrade.