Modern Finance teams can’t sit around waiting for tomorrow’s market shifts while wrestling with endless spreadsheet versions. Sage Intacct Budgeting & Planning (SIBP) brings budgeting, forecasting, and live teamwork straight into Intacct, so your plans stay fresh and actionable. You get faster cycles, clearer insights, and a true data-driven culture.

The Spreadsheet Ceiling

Big spreadsheets are error-prone 88% of them have serious mistakes and juggling emailed files only makes things slower and riskier. With SIBP all your budget data lives in one secure space, complete with Intacct’s accounts, dimensions, and actuals from day one. No more manual updates, no more version chaos just reliable planning.

What Is SIBP?

Sage Intacct Budgeting & Planning (SIBP) is a cloud-based Financial Planning & Analysis application that works hand-in-hand with your Sage Intacct general ledger you won’t need any extra tools or overnight data uploads. When you’re setting it up, all your Intacct data (GL accounts, departments, projects, locations, and custom tags) automatically flows into SIBP, so your finance team can start building models in just hours rather than waiting months. Many companies actually get up and running in only four days a huge improvement over typical Financial Planning & Analysis implementation.

Once you’re operational, SIBP gives you everything in one smooth workflow:

- Plan – Build driver-based financial models, headcount schedules, capex plans, and revenue waterfalls.

- Forecast – Keep your projections rolling forward automatically or create as many what if scenarios as you need for forecasting.

- Analyze – Jump into interactive dashboards to track trends, investigate variances, and discover insights on the spot and make right decisions.

- Report – Push your approved budgets back to Sage Intacct for reliable budget-vs-actual reporting.

Three Key Features that make SIBP Module Stand Out in the Market.

1. Scenarios Building in SIPB:

A scenario is basically a multiple set of assumptions which you can use to see various outcomes. You might require scenarios for:

- Creating Best-case, Worst-case, and Realistic Projections with your budget.

- New product rollouts or expanding into new markets.

- Merger analysis or unexpected disruptions due to supply chain or manufacturing fault.

With help SIBP you can easily copy your current budget plan, adjust key drivers like growth rates, staffing levels or costs and see how the changes play out in real time.

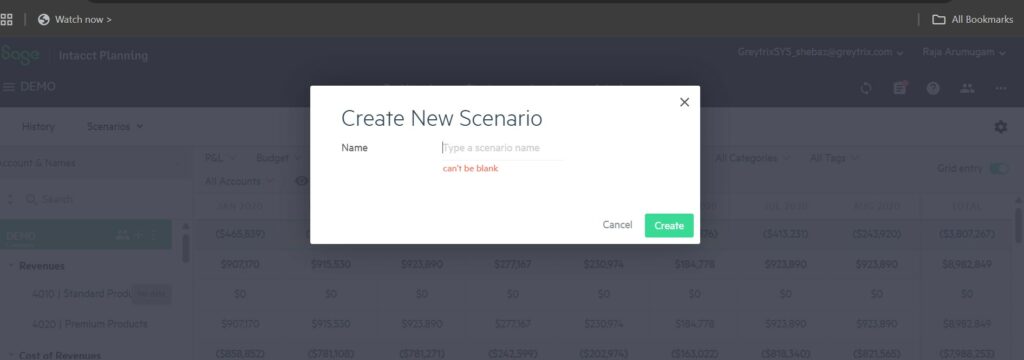

Example of Scenario Creation in SIBP:

- Create a new scenario and name the scenario accordingly. For this example, we will use the name “Economy Up”.

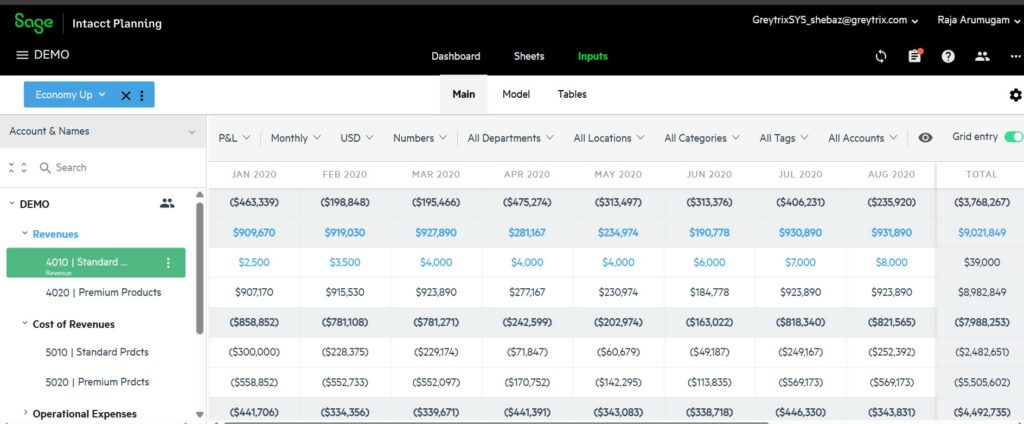

- Update your revenue assumptions by increasing your projected sales growth within 15% to 20%.

- Modify your revenue model to reflect higher monthly numbers. When you look at “Image 2” below, you’ll notice the increased figures stand out in blue, highlighting where positive changes were made.

- Take a look at the results: The system instantly updates your overall revenue outlook, operating costs, net profit margin, and cash flow so you can see the full impact of your adjustments right away.

2. Forecasting Using SIPB module:

Here’s a practical example of creating forecast in SIPB module:

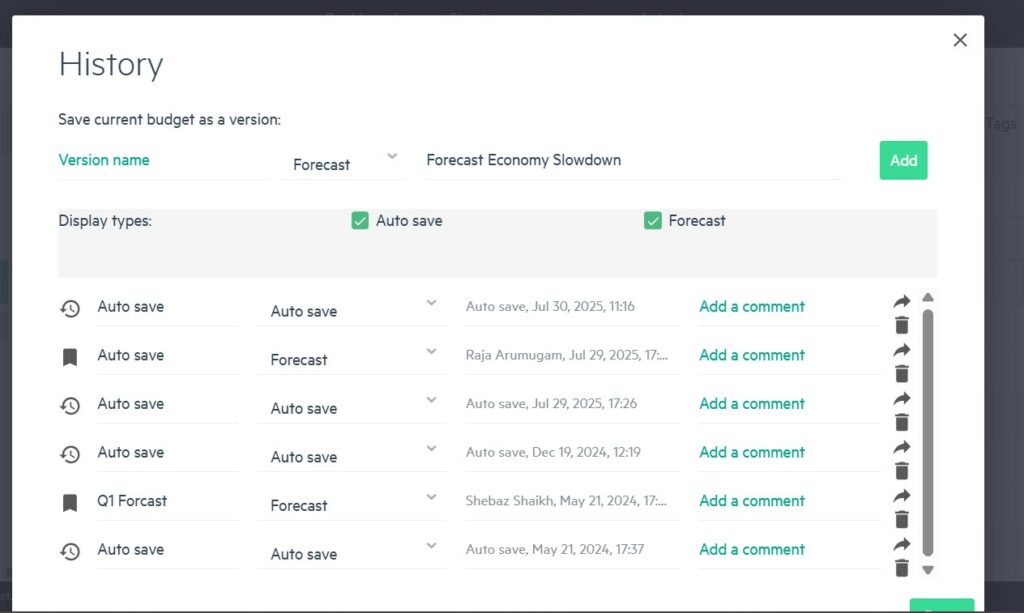

1. Save Your Base Budget

- Head to Inputs > Main > History.

- Give your budget version a name (like “Base Budget FY25”), mark it as your Base budget, and hit Add.

2. Create Your Forecast

- Head to Inputs > Main > History.

- Give your budget version a name (like “Base Budget FY25”), mark it as your Base budget, and hit Add.

3. Review and Update

- Flip between versions in the Sheets view to see how your base and forecast stack up against each other.

- Use the Budget vs. Actuals dashboard for a real-time performance check.

- As new data rolls in, keep your forecast fresh by updating and saving each new version.

This continue and efficient process lets you maintain accurate, rolling forecasts that reflect both original assumptions and current business performance.

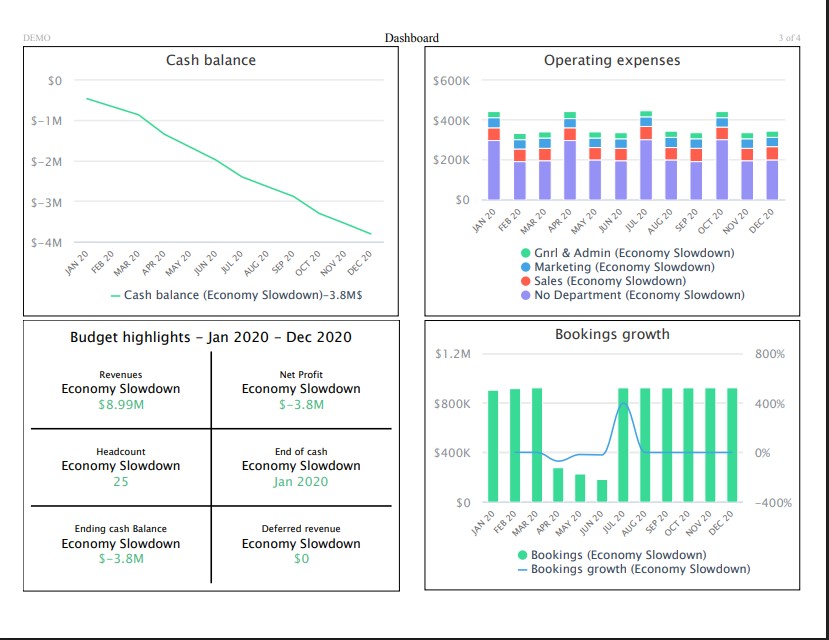

3. Visual Dashboards in SIBP:

SIBP’s visual dashboards turn your budget numbers into charts and graphs you can actually work with in real time. You can identify trends, dig into what’s causing variances/problems, and see how different scenarios stack up all through visuals that you can customize however you need them. The best part is that your team can work and collaborate, making affective and quick decisions based on what the colorful charts and KPI cards are telling you, all while staying connected to your real-time Sage Intacct data.

Implementation Tips for Success

1. Align your Chart of Accounts & Intacct Dimensions First

Using clear naming conventions in Intacct can really speed up your SIBP deployment and help you avoid remapping down the line.

2. Focus on High Important Factors.

Before considering or working with the less important GL lines, start by structuring important variables like revenue volume, pricing, and headcount compensation. Gaining some early successes will contribute to the development of trust among your stakeholders.

3. Take Advantage of Pre-Built Templates

Utilizing ready-made templates for personnel, SaaS revenue, and operating expenses can significantly cut down your modeling time. Only tweak formulas where your business logic genuinely differs.

4. Plan for Frequent and Short Iterations.

Instead of considering budgeting as a once a year or half a year task you can keep managers interested by updating forecasts on a weekly or monthly basis.

5. Incorporate Spend Management in Sage Intacct.

After your budgets are operational, activate Intacct Spend Management to prevent budget creep by automatically enforcing purchase limits.

Conclusion

Sage Intacct’s SIBP module completely changes how budgeting works instead of looking backward through endless spreadsheets, you’re doing real-time strategic planning. Research on small and medium businesses shows that companies using SIBP are saving over $300,000 each year just from being more productive, doing less rework, and making faster strategic changes. Sage’s own data shows customers are cutting their budgeting time in half and reducing planning work by 75%, which means finance teams can actually analyze data instead of just moving it around.

Finance leaders get the agility they need to handle market changes, the ability to test different scenarios, and a platform that gets everyone on the same page with reliable data. If your organization has maxed out what spreadsheets can do, SIBP gives you a quick, low-risk way to modernize your FP&A processes and the return on investment proves it works.