In our previous blog, we discussed the AR Tax Invoice Report, which is part of the Accounts Receivable module. In today’s blog, we will provide a detailed overview of the PO Tax Report in Sage Intacct ERP.

A Purchase Order (PO) Tax Report offers a concise overview of the taxes associated with purchase orders during a given period. It typically includes key information such as the PO number, vendor details, order date, type of tax (e.g., GST), tax rates, tax amounts, and the total value including taxes.

This report plays a vital role in tracking tax liabilities, maintaining compliance with tax laws, and supporting smooth financial reconciliation. It’s a valuable resource for accurate procurement records, audits, and overall financial management.

New Stuff: – AR Tax Invoice in Sage Intacct

In this blog, we are going to discuss about the PO Tax Report in the sage intacct.

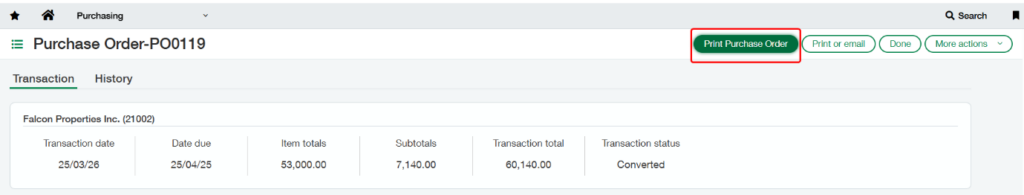

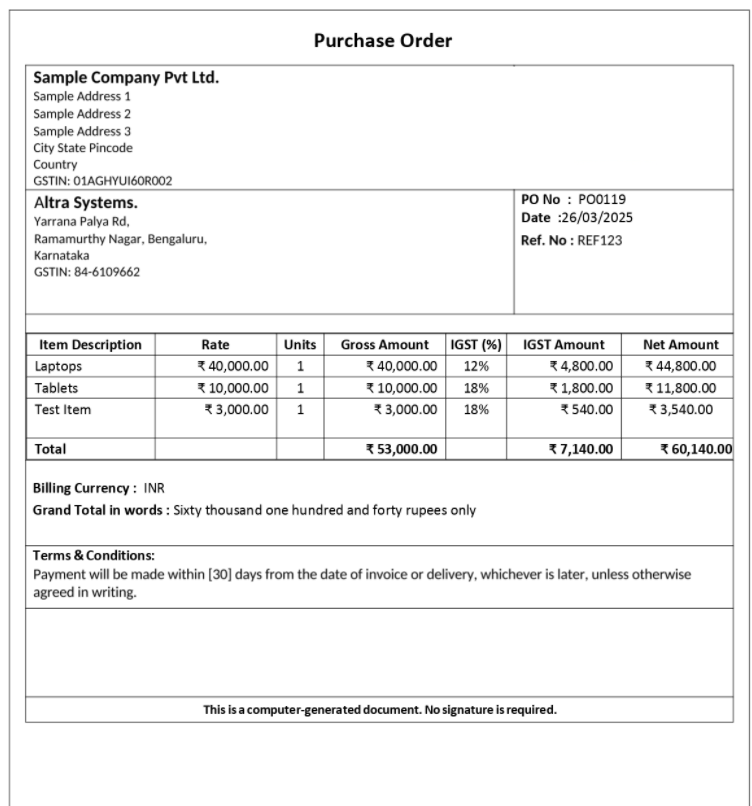

After clicking the “Print Purchase Order” button, the report will be generated in the selected format, as shown in the screenshot below.

The generated PO Tax Report includes key fields from the Purchase Order screen and can be customized to suit your specific requirements. It covers the following details:

- Company Details: Name, Address, and GSTIN

- Invoice Information: PO Number, Date, and Reference Number.

- Billing Details: Bill To (Address & GST).

- Transaction Details: Item Description, Rate, Quantity, Gross Amount, GST Percentage, GST Amount, and Net Amount

- Other Details: Billing Currency, Amount in Words, and Terms & Conditions.

About Us

Greytrix – a globally recognized and one of the oldest Sage Development Partner is a one-stop solution provider for Sage ERP and Sage CRM organizational needs. Being acknowledged and rewarded for multi-man years of experience and expertise, we bring complete end-to-end assistance for your technical consultations, product customizations, data migration, system integrations, third party add-on development and implementation competence.

Greytrix has a wide product range for Sage Intacct- a Cloud ERP. This includes migrations from QuickBooks | Sage 50 | Sage 100 | Sage 300 to Sage Intacct. Our unique GUMU™ integrations include Sage Intacct for Sage CRM | Salesforce | FTP/SFTP | Rev.io | Checkbook | Dynamics 365 CRM | Magento | Rent Manager | Treez | Avalara Avatax | Blackline SFTP. We also offer best-in-class Sage Intacct Development Services, Consulting services, integrated apps like POS | WMS | Payroll | Shipping System | Business Intelligence | eCommerce for Sage Intacct to Sage business partners, resellers, and Sage PSG worldwide. Greytrix constantly develops apps, products, and add-ons to enhance user experience. Sage Intacct add-ons include AR Lockbox File Processing.

Greytrix GUMU™ integration for Sage CRM – Sage Intacct, Sales Commission App for Sage Intacct, and Checkbook.io ACH/Digital Check Payments for Sage powered by GUMU™ are listed on Sage Intacct Marketplace.

The GUMU™ Cloud framework by Greytrix forms the backbone of cloud integrations that are managed in real-time for the processing and execution of application programs at the click of a button.

For more information on Sage Business Cloud Services, please contact us at sagecloud@greytrix.com. We will like to hear from you.