In a previous blog post, we explored the OE Tax Report in Sage Intacct, a feature within the Order Entry module. In today’s blog post, we’ll provide information of the SEZ AR Invoice Report in the Sage Intacct ERP system.

A Special Economic Zone (SEZ) AR invoice is an accounts receivable invoice issued for supplies made to SEZ units or developers, which qualify as zero-rated under GST. To comply, businesses must ensure that the invoice clearly states the supply is under a Bond or Letter of Undertaking (LUT) without payment of IGST and that proper supporting documents, such as endorsed invoices from SEZ authorities, are maintained.

Suppliers can either furnish an LUT to make supplies without charging IGST or pay IGST and claim a refund later. Accurate documentation and timely filing of GST returns are essential to avail of zero-rated benefits and avoid penalties, making it vital for businesses to follow best practices when preparing SEZ AR invoices.

New Stuff: – Dynamic Allocation in ERP: Smarter Resource Planning for Agile Businesses

In this blog, we are going to discuss about the SEZ AR Invoice Report in the sage Intacct.

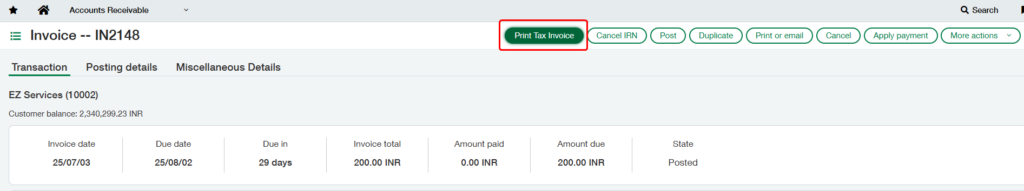

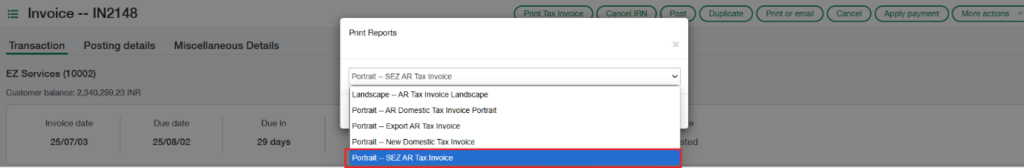

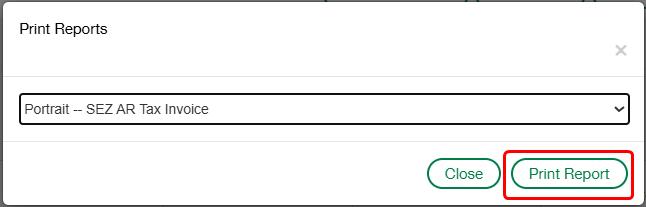

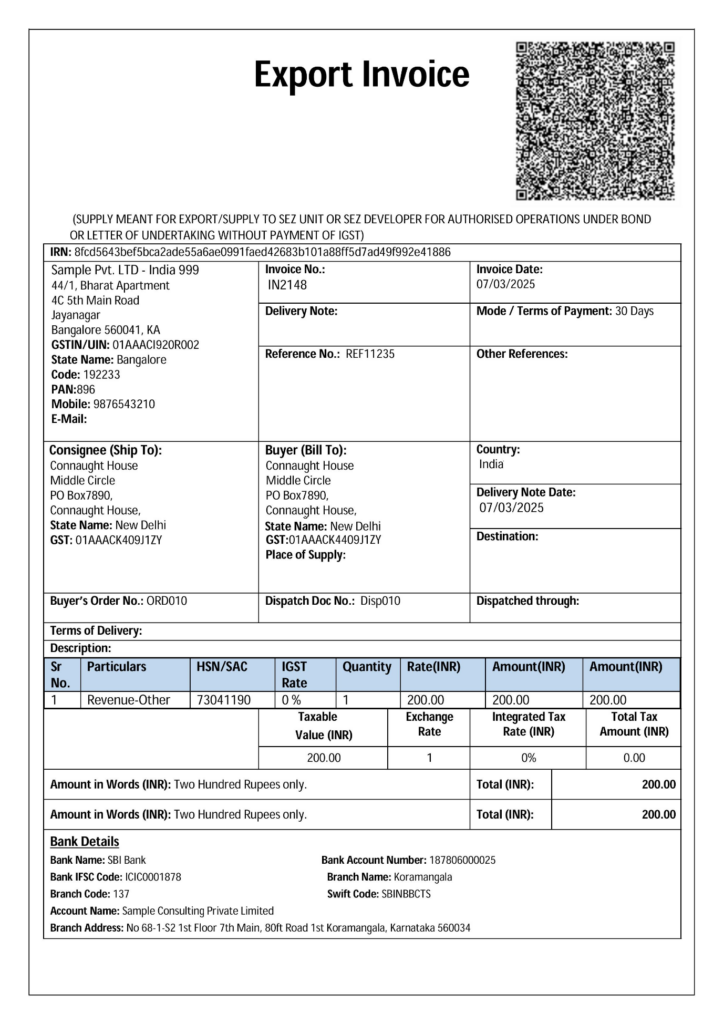

After clicking the “Print Tax Invoice” button (Refer Fig 1), a dropdown will appear displaying a list of available report names (Refer Fig 2). From this list, the user must select “Portrait — SEZ AR Tax Invoice” and then click the “Print Report” button (Refer Fig 3) to generate the SEZ AR invoice report in the chosen format, as shown in the screenshot below (Refer Fig 4).

The generated SEZ AR Tax Invoice Report includes key fields from the Accounts Receivable module’s Invoices screen and can be customized to suit your specific requirements. It covers the following details:

- Purpose of the Document:

This invoice is intended for export or supply to SEZ (Special Economic Zone) units or SEZ developers for authorized operations under a bond or Letter of Undertaking (LUT) without payment of Integrated Goods and Services Tax (IGST).

- Company Details:

Includes company details such as the company’s name, address, and GSTIN - Invoices Information:

The invoice generally contains fields for the Invoice Number, Date, Delivery Note, Mode/ Terms Payment, Reference Number, Other References, Country, Delivery Note Date, Destination, Buyer’s order No, Dispatch Doc No., Dispatch Through, Terms of Delivery and Description.

- Shipping Details:

This section includes the ‘Ship To’ details, which is the recipient’s address and GST information. - Billing Details:

This section contains the ‘Bill To’ information, which includes the recipient’s address and GST details.

- Transaction Details:

Provides item-specific information, including:- Particulars

- HSN/SAC

- GST Rate

- Quantity

- Rate

- Net Amount

- Other Details:

Amount in words, and Banking Details.

- Additional Information:

The document is signed by an authorized signatory and clearly marked as a computer-generated invoice.

About Us

Greytrix – a globally recognized and one of the oldest Sage Development Partner is a one-stop solution provider for Sage ERP and Sage CRM organizational needs. Being acknowledged and rewarded for multi-man years of experience and expertise, we bring complete end-to-end assistance for your technical consultations, product customizations, data migration, system integrations, third party add-on development and implementation competence.

Greytrix has a wide product range for Sage Intacct- a Cloud ERP. This includes migrations from QuickBooks | Sage 50 | Sage 100 | Sage 300 to Sage Intacct. Our unique GUMU™ integrations include Sage Intacct for Sage CRM | Salesforce | FTP/SFTP | Rev.io | Checkbook | Dynamics 365 CRM | Magento | Rent Manager | Treez | Avalara Avatax | Blackline SFTP. We also offer best-in-class Sage Intacct Development Services, Consulting services, integrated apps like POS | WMS | Payroll | Shipping System | Business Intelligence | eCommerce for Sage Intacct to Sage business partners, resellers, and Sage PSG worldwide. Greytrix constantly develops apps, products, and add-ons to enhance user experience. Sage Intacct add-ons include AR Lockbox File Processing.

Greytrix GUMU™ integration for Sage CRM – Sage Intacct, Sales Commission App for Sage Intacct, and Checkbook.io ACH/Digital Check Payments for Sage powered by GUMU™ are listed on Sage Intacct Marketplace.

The GUMU™ Cloud framework by Greytrix forms the backbone of cloud integrations that are managed in real-time for the processing and execution of application programs at the click of a button.

For more information on Sage Business Cloud Services, please contact us at sagecloud@greytrix.com. We will like to hear from you.