If you’ve ever had to manage customer refunds in your accounting system, you know the struggle. Credits pile up, refunds happen outside the system, and then you’re stuck juggling adjustments just to keep the books balanced. It’s messy, time-consuming, and—let’s be honest—nobody enjoys it.

With the 2025 R3 release, Sage Intacct has made life a lot easier with Customer refunds—a new feature designed to take the headache out of refund management.

Why this matters:

Refunds aren’t just about sending money back—they’re about keeping your financials accurate and your records clean. Until now, clearing refunded credits in Intacct often meant extra steps and manual work. But with the new Customer refunds functionality, you can:

✅ Stay accurate – Customer balances stay up-to-date, so your reports always tell the right story.

✅ Keep books tidy – Close out credits with a couple of clicks instead of long reconciliations.

✅ Handle inactive accounts – Easily zero out accounts with lingering credit balances.

✅ Build trust – Every refund leaves behind a clear audit trail, making reviews and audits much smoother.

How it works:

Here’s the beauty of it:

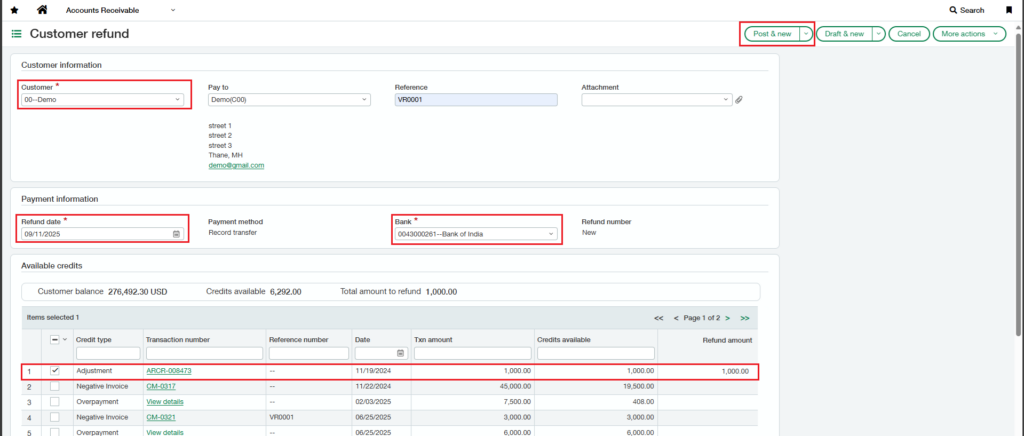

Head over to the new Customer refunds page.

Pick your customer and see all the credits you can refund—advances, adjustments, overpayments, or even negative invoices.

Decide whether you want to refund the credit in full or just part of it.

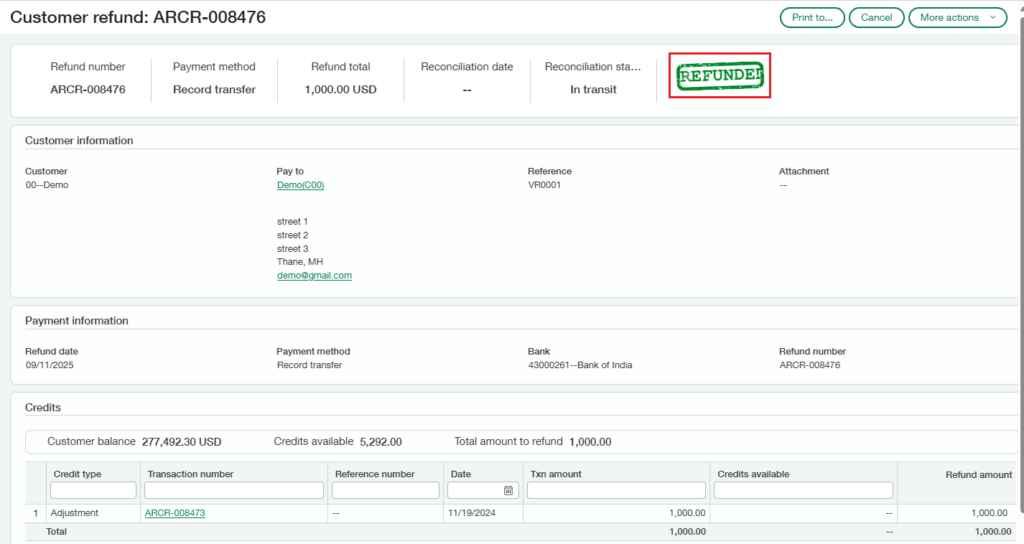

Post it. Intacct will automatically clear the selected credits behind the scenes.

That’s it. No more balance-adjusting acrobatics. Just a simple, clean process that works.

You even get a refunds list page to keep track of drafts and posted refunds, with drill-down options to see every detail.

A few things to know:

Like any new feature, there are some boundaries (for now):

Works only with the Record transfer payment method.

Supports AR adjustments, advances, overpayments, and negative invoices.

Full or partial refunds? Both are fine.

Invoices with positive line items can’t be refunded, even if they net to negative.

Only base currency → base currency refunds are supported today.

Refunds can also be imported via CSV or handled through the REST API.

Getting started

Before you can start refunding like a pro, there’s a quick setup:

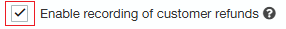

Create a journal for refunds and set up a document sequence.

Go to Accounts Receivable > Setup > Configuration and enable Customer refunds.

Assign the journal, document sequence, and permissions to the right users.

That’s it—you’re good to go.

Conclusion:

Refunds may not be the most glamorous part of accounting, but they’re important. With the new Customer refunds in Sage Intacct 2025 R3, you get cleaner books, fewer manual steps, and better transparency.

In other words: less time fixing credits, more time focusing on what really matters—running your business.

About Us

Greytrix has a wide product range for Sage Intacct- a Cloud ERP. This includes migrations from QuickBooks | Sage 50 | Sage 100 | Sage 300 to Sage Intacct. Our unique GUMU™ integrations include Sage Intacct for Sage CRM | Salesforce | FTP/SFTP | Rev.io | Checkbook | Dynamics 365 CRM | Magento | Rent Manager | Treez | Avalara Avatax | Blackline SFTP. We also offer best-in-class Sage Intacct Development Services, Consulting services, integrated apps like POS | WMS | Payroll | Shipping System | Business Intelligence | eCommerce for Sage Intacct to Sage business partners, resellers, and Sage PSG worldwide. Greytrix constantly develops apps, products, and add-ons to enhance user experience. Sage Intacct add-ons include AR Lockbox File Processing.

Greytrix GUMU™ integration for Sage CRM – Sage Intacct, Sales Commission App for Sage Intacct, and Checkbook.io ACH/Digital Check Payments for Sage powered by GUMU™ are listed on Sage Intacct Marketplace.

The GUMU™ Cloud framework by Greytrix forms the backbone of cloud integrations that are managed in real-time for the processing and execution of application programs at the click of a button.

For more information on Sage Business Cloud Services, please contact us at sagecloud@greytrix.com. We will like to hear from you.