In our previous blog, we discussed the Export Supply AR Adjustment Report in Sage Intacct, which is part of the Accounts Receivable Module. In today’s blog, we will provide a detailed overview of the AR Invoice Tax Reports in Singapore with Sage Intacct ERP.

Accounts Receivable (AR) invoices in Singapore requires businesses to follow GST rules carefully, keep documents accurate, and comply with IRAS standards. To avoid errors and penalties, invoices must clearly show the correct GST rate, tax registration details, and be reported within the required timelines.

By improving AR processes and adopting digital solutions, companies can make invoicing faster, reduce risks, and ensure smoother financial operations while staying compliant with Singapore’s tax regulations.

New Stuff: – OE Tax Invoice Report In Singapore Localization with Sage Intacct

In this blog, we are going to discuss about the AR Invoice Tax Reports in Singapore with sage Intacct.

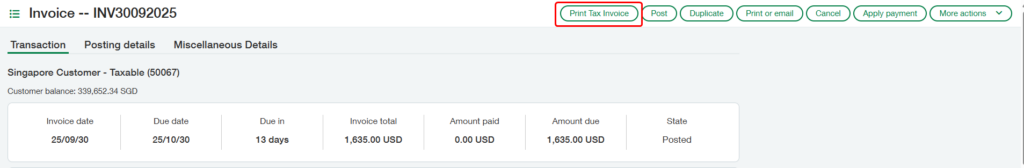

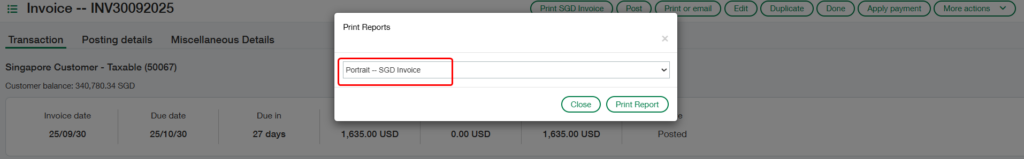

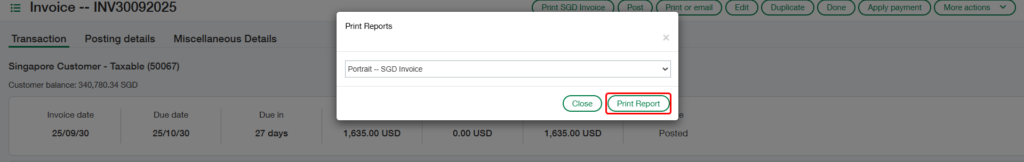

After clicking the “Print Tax Invoice” button (Refer Fig 1), a dropdown will appear displaying a list of available report names (Refer Fig 2). From this list, the user must select “Portrait — SGD Invoice” and then click the “Print Report” button (Refer Fig 3) to generate the AR Invoice Tax Reports report in the chosen format, as shown in the screenshot below (Refer Fig 4).

The generated AR Invoice Tax Report includes key fields from the Accounts Receivable module’s Invoice screen and can be customized to suit your specific requirements. It covers the following details:

- Purpose of the Document:

This Tax Invoice is issued for a taxable supply in Singapore. It serves as a legal record of the sale, includes the calculation of Goods and Services Tax (GST), and ensures compliance with Singapore’s GST regulations. As the transaction falls under customer accounting, the responsibility for reporting and accounting the GST lies with the recipient.

- Company Details:

The invoice begins with the seller’s company information, including name, registered address, contact details, and GSTIN. These details establish the supplier’s identity for tax and legal compliance.

- Invoice Information

Key identifiers such as the invoice number, date, due date, and page number are provided. These are essential for tracking, reconciliation, and audit purposes, ensuring the invoice can be uniquely referenced.

- Billing Details (Sold To)

The “Bill To” section specifies the customer’s legal name, address, and GST number. This ensures that the buyer’s tax registration and address are correctly recorded for GST compliance and accounting.

- Shipping Details (Ship To)

The “Ship To” section captures delivery address and GST details of the recipient. Often, this matches the billing party, but may differ if goods are delivered to a different location. This distinction is important for logistics and audit trails.

• Reference / Other Information

This section includes reference numbers such as PO Number, Customer Number, Terms of Payment, and Salesperson information. These fields help align the invoice with the original purchase order, clarify payment terms, and establish internal tracking for sales and receivables.

• Transaction Details

The invoice provides a line-item breakdown including account codes, tax codes, GST rate, tax amounts, and totals.

• Remittance Details

A “Remit To” section is included, guiding the customer on where payments should be made. It repeats the buyer’s information under customer accounting rules, emphasizing that the buyer is responsible for GST compliance.

• Other Details

The invoice includes amounts expressed both in numbers and in words to avoid ambiguity. It also mentions discounts, due dates, and terms of payment. This ensures clarity in settlement expectations and helps avoid disputes.

• Additional Information

The invoice explicitly notes that GST is to be accounted for under customer accounting. It is also computer-generated, meaning no physical signature is required. Such statements add legal clarity and prevent misuse of the document.

About Us

Greytrix – a globally recognized and one of the oldest Sage Development Partner is a one-stop solution provider for Sage ERP and Sage CRM organizational needs. Being acknowledged and rewarded for multi-man years of experience and expertise, we bring complete end-to-end assistance for your technical consultations, product customizations, data migration, system integrations, third party add-on development and implementation competence.

Greytrix has a wide product range for Sage Intacct- a Cloud ERP. This includes migrations from QuickBooks | Sage 50 | Sage 100 | Sage 300 to Sage Intacct. Our unique GUMU™ integrations include Sage Intacct for Sage CRM | Salesforce | FTP/SFTP | Rev.io | Checkbook | Dynamics 365 CRM | Magento | Rent Manager | Treez | Avalara Avatax | Blackline SFTP. We also offer best-in-class Sage Intacct Development Services, Consulting services, integrated apps like POS | WMS | Payroll | Shipping System | Business Intelligence | eCommerce for Sage Intacct to Sage business partners, resellers, and Sage PSG worldwide. Greytrix constantly develops apps, products, and add-ons to enhance user experience. Sage Intacct add-ons include AR Lockbox File Processing.

Greytrix GUMU™ integration for Sage CRM – Sage Intacct, Sales Commission App for Sage Intacct, and Checkbook.io ACH/Digital Check Payments for Sage powered by GUMU™ are listed on Sage Intacct Marketplace.

The GUMU™ Cloud framework by Greytrix forms the backbone of cloud integrations that are managed in real-time for the processing and execution of application programs at the click of a button.

For more information on Sage Business Cloud Services, please contact us at sagecloud@greytrix.com. We will like to hear from you.