In today’s globalized business landscape the multinational corporations are like intricate puzzles, with pieces spread across diverse geographies in the form of subsidiaries, joint ventures, and equity investments. Imagine trying to understand the entire picture of a puzzle when its pieces are scattered and each has its own unique shape and color tone. This is where financial consolidation comes in the process of uniting all these separate bits of financial data into one coherent set of financial statements. It is not just a regulatory requirement, but also a strategic need. Let’s explore its importance and the correct way to achieve it.

Consolidation is an accounting process that combines the financial information of several subsidiary companies into the parent company’s financial statements. It links each subsidiary to the parent, matches accounting periods and accounts, and deals with issues like different currencies and partial ownership. This process provides a clear, real-time view of the overall financial position, making it easier for accountants and managers to review and adjust the data accurately across the whole company group.

To address this challenge, Sage Intacct an exceptional ERP platform/Service provider offers the following types of consolidation: Domestic, Global, and Advanced Ownership Consolidation. Each consolidation subscription allows you to consolidate books within a multi-entity shared company.

For example, let’s take multi-currency and multi-entity suppose if you have a head office is in USA additionally you operate offices in India and Singapore, you can use the Global consolidation where you can maintain your base currency as US and convert all transactions to USD with the assistance of global consolidation feature of Sage Intacct.

A good example of a company that would benefit from Domestic Consolidation is an entity having business operations within the same geography, like a small restaurant chain in USA.

Advanced Ownership Consolidation utilizes ownership forms to facilitate multi-level consolidations and automated non-controlling interest postings in a multiple entity company. We can dedicate a separate blog post to Advanced Ownership Consolidation to provide a deeper understanding of the topic.

How can you achieve it through Sage Intacct:

The initial step is to clearly identify your business needs and choose the consolidation process that best fits those needs. Think about your reporting requirements, the structure of your entities, and the exchange rate considerations just like the example mentioned earlier.

Steps to follow in Sage Intacct:

1. Define Your Book — Build the Foundation for Global Financial Reporting

First things first it’s time to set up your financial reporting book in Sage Intacct. Think of this as the foundation where all your financial data will come together, ready to be reported and analyzed.

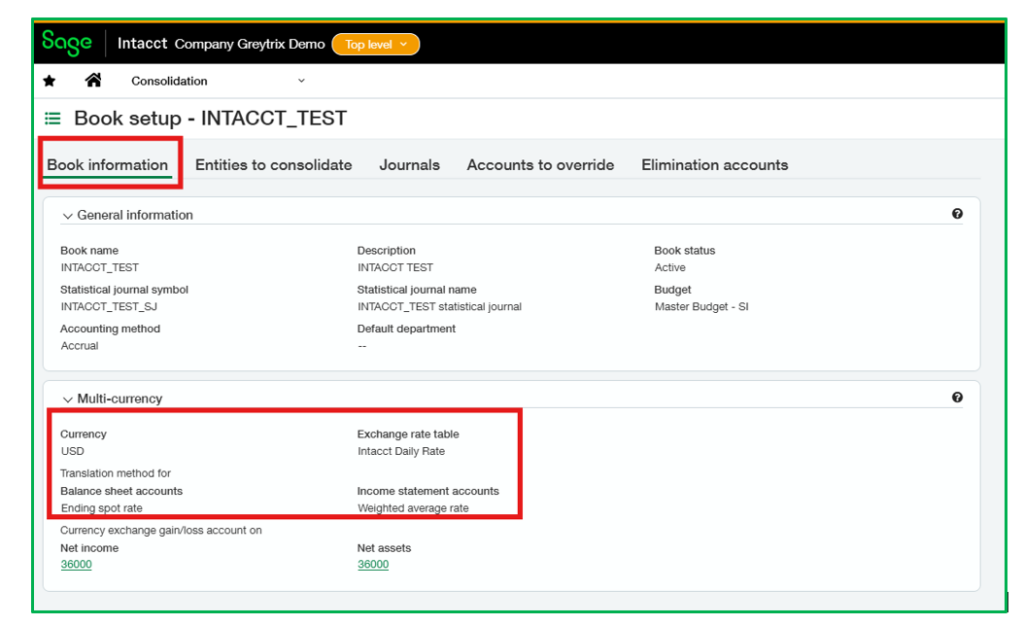

You’ll start by selecting your base currency, making sure all your reports speak the same financial language. Then, you’ll define the translation methods for your Balance Sheet and Income Statement accounts a must for companies operating across multiple currencies. You might be wondering, what exactly is a translation method? In some organizations, different exchange rates are applied to Balance Sheet and Income Statement accounts to better reflect financial reality. To support this, Sage Intacct provides a flexible translation method feature, allowing you to apply the appropriate rates for each type of account keeping your consolidated reports accurate and aligned.

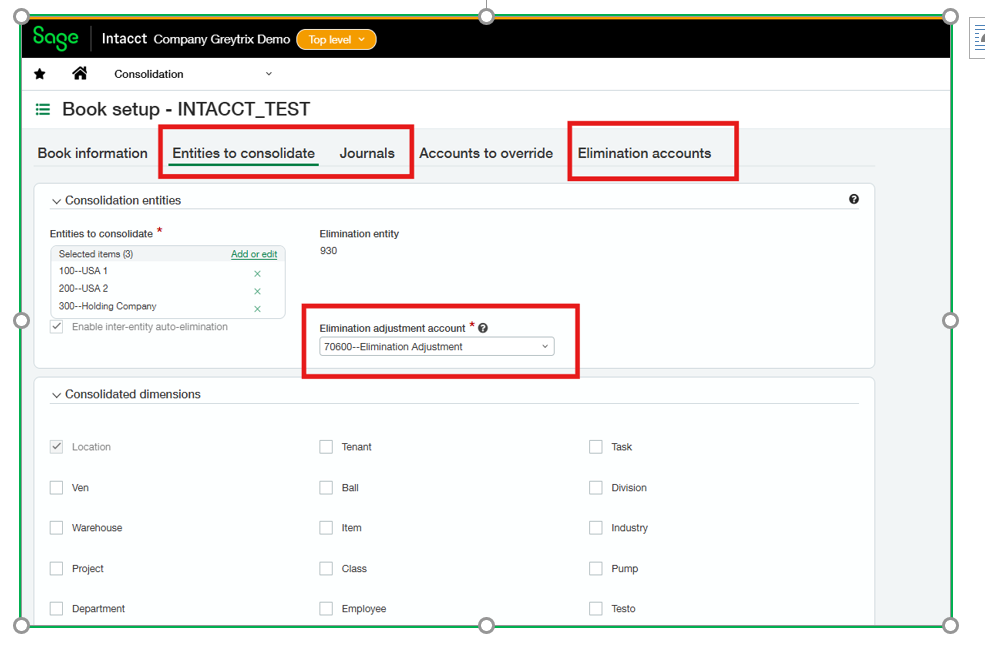

2. Once you’ve set up your financial reporting book, the next step is deciding what goes in it. Here, you’ll select the entities and journals you want to consolidate into your new financial reporting book. If you take a look at the image below, you’ll notice a field called “Elimination Adjustment Account.” This works hand-in-hand with the “Eliminate Accounts” tab.

Why does this matter? When consolidating reports, you often need to eliminate certain accounts especially inter-entity accounts to avoid double-counting. But simply removing them can leave your books unbalanced. That’s where the Elimination Adjustment Account comes in, it ensures any values tied to eliminated accounts are properly adjusted, so your final reports remain accurate and in balance. In short this is the behind-the-scenes magic that keeps your consolidated financials clean and trustworthy.

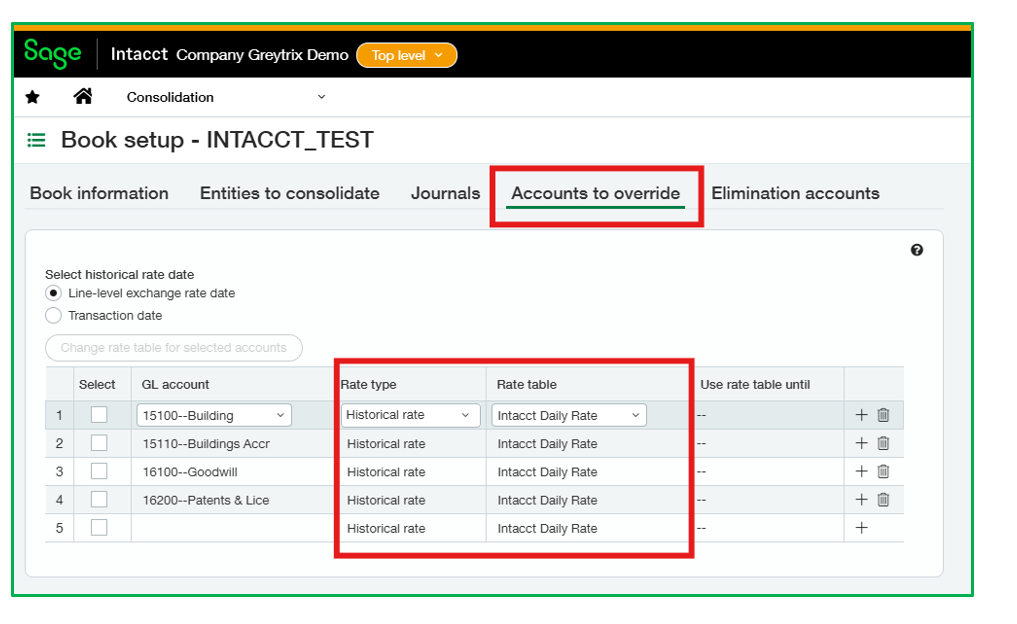

3. Accounts to Override — Fine Tune Your Currency Conversions

The Accounts to Override feature is a powerful tool during consolidation, especially when you’re dealing with accounts that require different exchange rate treatments. Not every GL Account follows the same rate logic and this is where overrides can save the day. With this feature, you can customize the Rate Type and Rate Table used for specific accounts, giving you full flexibility to align with your reporting needs.

You can choose from three Rate Types:

- Historical Rate

- Weighted Average

- Ending Spot Rate

And for Rate Tables, options include:

- Floating Exchange Rate

- Commission FX Rates

- Intacct Daily Rate

This level of control helps you handle even the most complex currency scenarios ensuring your consolidated reports are both accurate and aligned with your financial policies.

Importance of Financial Consolidation from the perspective of an organization:

1. To obtain a Comprehensive understanding of an organisation:

Financial consolidation allows for improved strategic planning as decisions can be made based on the overall performance of the entire organization, rather than individual units. It also enables proper benchmarking among subsidiaries to determine underperforming or top-performing units.

2. Better Decision-Making: Consolidated financial statements give proper and on-time information, which is critical in terms of Evaluating the profitability, liquidity, and solvency of the group. Taking well-informed decisions on investments, resource deployments, cost reductions, and expansions.

3. Better Financial Control: Management must ensure the proper utilization of financial resources. Consolidation assist in monitoring cash flows, intercompany transactions, and investments in subsidiaries. Identifying inefficiencies, duplications, or misdeployment of funds between business units.

4. Risk Management: A global view facilitates the identification and management of financial risks. It supports centralised risk assessment, such as currency, credit, and market risks. With this information, management can adopt effective risk mitigation strategies and group-wide policies.

5. Operational Efficiency: Modern consolidation usually entails automation and integration using software, which reduces administrative burden and minimizes manual errors. This allows finance groups to focus more on value-added analysis instead of mere data compilation.

Financial consolidation is a key function for international organizations that are looking to stay accurate, transparent, and in control of their financial activities. Sage Intacct is a strong solution in this regard, providing customized consolidation capabilities be it domestic, global, or complex ownership to meet the various structural intricacies of multinational corporations. With such tools, organizations can enable on-time, precise reporting while making better, data-driven decisions at all levels.

About Us

Greytrix has a wide product range for Sage Intacct- a Cloud ERP. This includes migrations from QuickBooks | Sage 50 | Sage 100 | Sage 300 to Sage Intacct. Our unique GUMU™ integrations include Sage Intacct for Sage CRM | Salesforce | FTP/SFTP | Rev.io | Checkbook | Dynamics 365 CRM | Magento | Rent Manager | Treez | Avalara Avatax | Blackline SFTP. We also offer best-in-class Sage Intacct Development Services, Consulting services, integrated apps like POS | WMS | Payroll | Shipping System | Business Intelligence | eCommerce for Sage Intacct to Sage business partners, resellers, and Sage PSG worldwide. Greytrix constantly develops apps, products, and add-ons to enhance user experience. Sage Intacct add-ons include AR Lockbox File Processing.

Greytrix GUMU™ integration for Sage CRM – Sage Intacct, Sales Commission App for Sage Intacct, and Checkbook.io ACH/Digital Check Payments for Sage powered by GUMU™ are listed on Sage Intacct Marketplace.

The GUMU™ Cloud framework by Greytrix forms the backbone of cloud integrations that are managed in real-time for the processing and execution of application programs at the click of a button.

For more information on Sage Business Cloud Services, please contact us at sagecloud@greytrix.com. We will like to hear from you.