In Sage Intacct, the Domestic Supply Credit Note Report is essential for handling adjustments under the GST regime. This report ensures accurate documentation of credit notes issued against domestic transactions, helping businesses remain compliant while maintaining financial transparency.

The OE Credit Note is issued when a business needs to adjust or reverse all or part of an existing Order Entry invoice. This could be due to returns, discounts, corrections, or other post-invoice modifications. Through the India Localization Suite, Sage Intacct generates a structured, GST-compliant OE Credit Note Report that ensures both financial accuracy and legal compliance.

New Stuff : Greytrix Introduces the Singapore Localization Suite for Sage Intacct

In this blog, we are going to discuss about the Domestic Supply OE Credit Note Report in the sage Intacct.

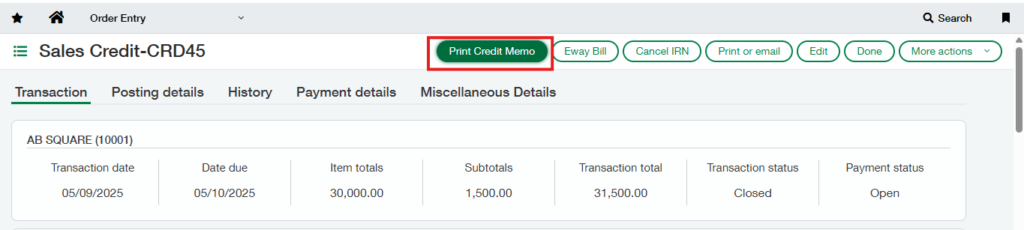

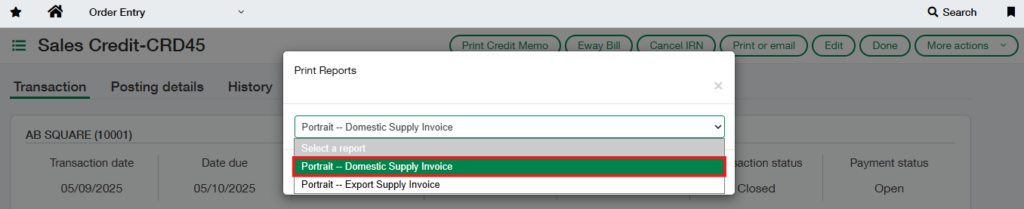

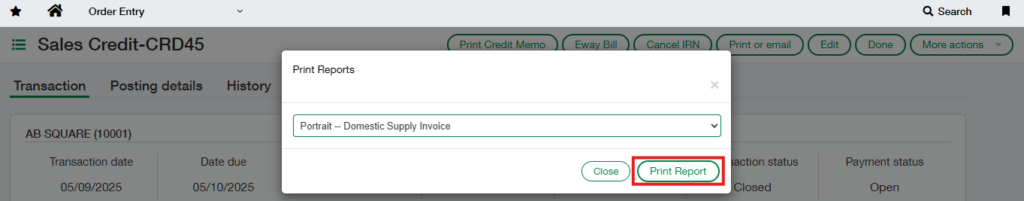

In the OE module, you can generate the Domestic Supply Credit Note Report in just a few steps. Select the transaction and click the “Print Credit Memo” button (Refer Fig.1).A dropdown will appear with a list of available reports (Refer Fig. 2).From the list, choose “Portrait – Domestic Supply Invoice”. Click the “Print Report” button (Refer Fig. 3). The system will then generate the Domestic Supply Credit Note Report in the selected format (Refer Fig 4).

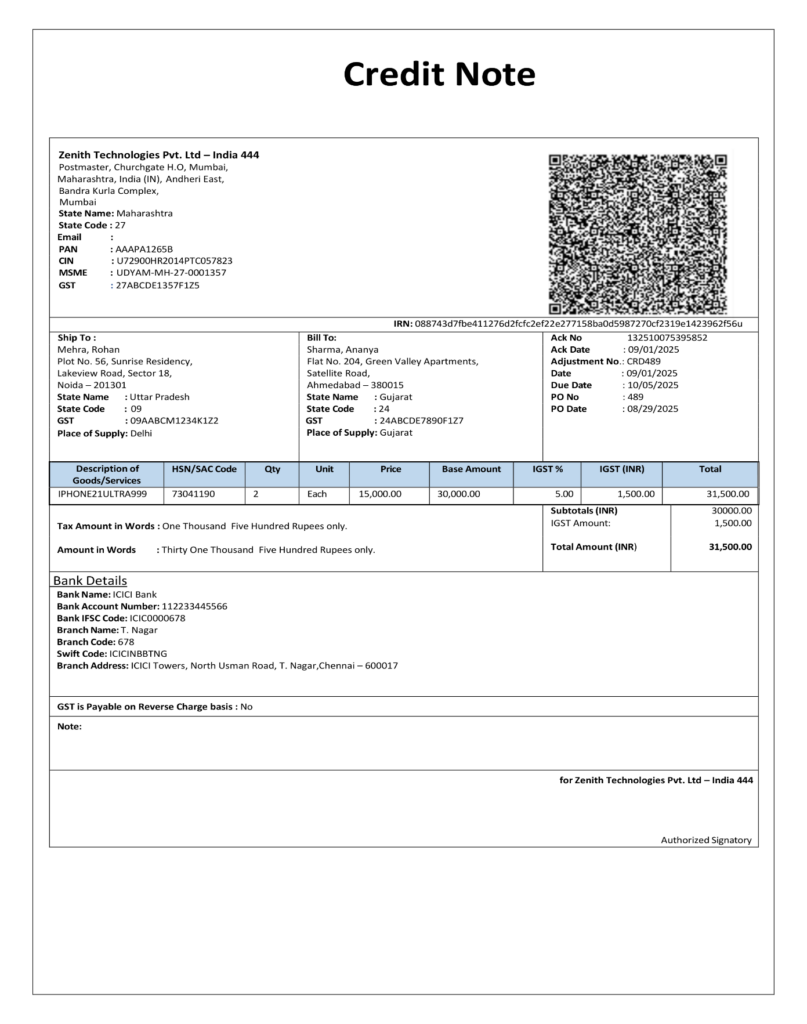

The Domestic Supply OE Credit Note Report captures essential fields from the Order Entry module’s Sales Credit screen and can be tailored to meet specific business requirements. It covers the following details:

- Purpose of the Document :

A Credit Note is issued as part of the OE process when businesses need to adjust previously issued invoices. This could be due to returns, discounts, corrections, or post-invoice changes. The Domestic Supply Credit Note is specifically intended for domestic supply of goods and services within India.

- Company Details :

Capturers essential company details such as Company name, address, GSTIN/CIN and PAN. - Adjustment Details :

Adjustment fields include Adjustment Number, Adjustment date, Ack Date, Ack No., and PO No and Date - Shipping Details :

“Ship To” includes recipient’s address , GST Details and Place of supply. - Billing Details :

“Bill To” includes recipient’s address, GST Details and Place of supply. - Transaction Details :

Transaction table provides an itemized breakdown, including: - Description

- HSN/SAC Code

- Unit and Quantity

- Base Amount

- GST information

- Total

- Other Details :

The Report also includes Tax Amount in words , Amount in words, Bank Details and reverse charges - Additional Information :

The document is signed by an Authorized Signatory and clearly marked as a computer-generated invoice, ensuring legal authenticity.

About Us

Greytrix has a wide product range for Sage Intacct- a Cloud ERP. This includes migrations from QuickBooks | Sage 50 | Sage 100 | Sage 300 to Sage Intacct. Our unique GUMU™ integrations include Sage Intacct for Sage CRM | Salesforce | FTP/SFTP | Rev.io | Checkbook | Dynamics 365 CRM | Magento | Rent Manager | Treez | Avalara Avatax | Blackline SFTP. We also offer best-in-class Sage Intacct Development Services, Consulting services, integrated apps like POS | WMS | Payroll | Shipping System | Business Intelligence | eCommerce for Sage Intacct to Sage business partners, resellers, and Sage PSG worldwide. Greytrix constantly develops apps, products, and add-ons to enhance user experience. Sage Intacct add-ons include AR Lockbox File Processing.

Greytrix GUMU™ integration for Sage CRM – Sage Intacct, Sales Commission App for Sage Intacct, and Checkbook.io ACH/Digital Check Payments for Sage powered by GUMU™ are listed on Sage Intacct Marketplace.

The GUMU™ Cloud framework by Greytrix forms the backbone of cloud integrations that are managed in real-time for the processing and execution of application programs at the click of a button.

For more information on Sage Business Cloud Services, please contact us at sagecloud@greytrix.com. We will like to hear from you.