In our previous blog, we discussed the AR Invoice Tax Reports in Singapore with Sage Intacct, which is part of the Accounts Receivable Module. In today’s blog, we will provide a detailed overview of the AR Adjustment Tax Reports in Singapore with Sage Intacct ERP.

Credit and debit notes in AR adjustments play a vital role in ensuring accurate financial and GST reporting in Singapore. A credit note is used to reduce invoice amounts for returns, discounts, or overbilling, while a debit note increases the amount for additional charges or underbilling. Each transaction is assigned a unique UUID, providing clear traceability and compliance with IRAS audit requirements.

These adjustments are automatically captured in the AR Adjustment Tax Reports, offering a detailed summary of both taxable and non-taxable changes. This ensures precise GST reporting, transparent audit trails, and smooth financial reconciliation for businesses.

New Stuff: – Sage Intacct 2025 Release 4 (R4) — What’s New in Accounts Payable

In this blog, we are going to discuss about the AR Adjustment Tax Reports in Singapore with sage Intacct.

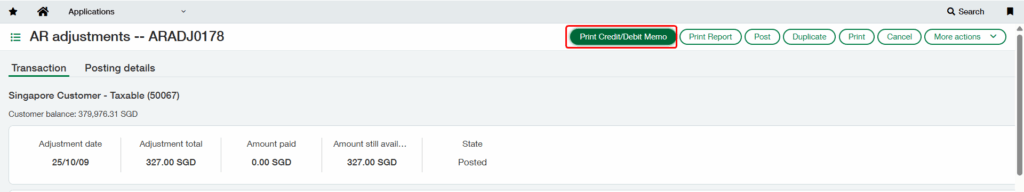

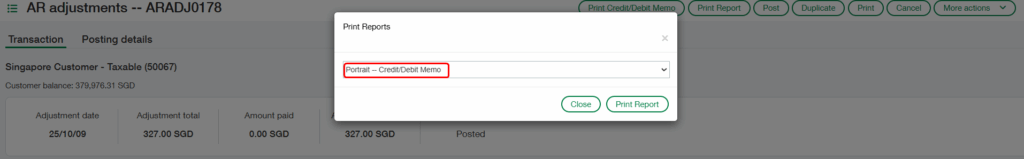

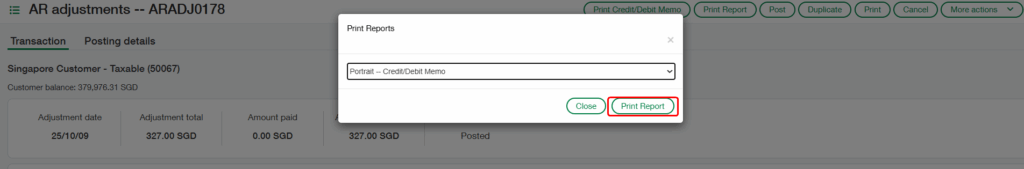

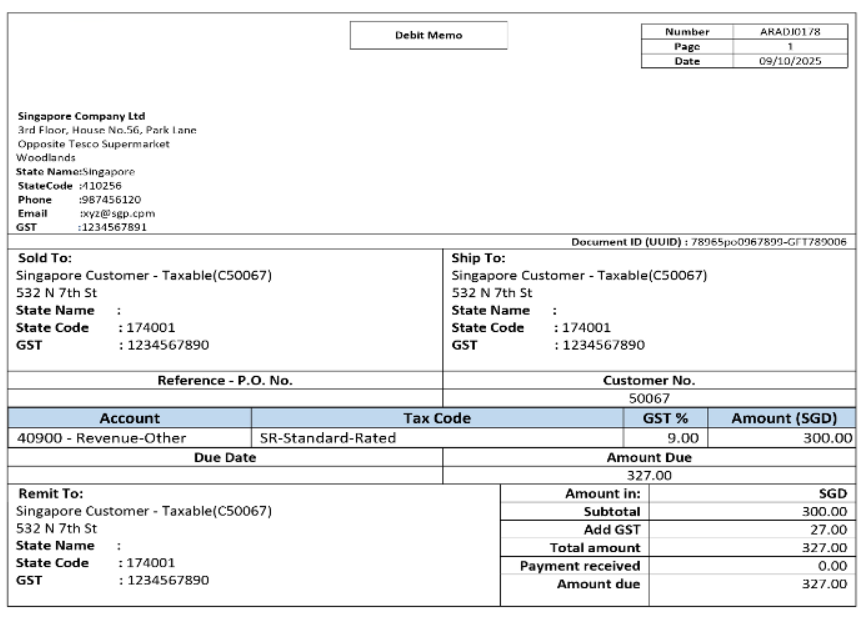

After clicking the “Print Credit/Debit Memo button (Refer Fig 1), a dropdown will appear displaying a list of available report names (Refer Fig 2). From this list, the user must select “Portrait — Credit/Debit Memo” and then click the “Print Report” button (Refer Fig 3) to generate the AR Adjustment Tax Reports report in the chosen format, as shown in the screenshot below (Refer Fig 4).

The generated AR Adjustment Tax Report includes key fields from the Accounts Receivable module’s Adjustment screen and can be customized to suit your specific requirements. It covers the following details:

- Purpose of the Document:

The AR Adjustment Tax Report is issued to record taxable adjustments related to customer invoices, including credit and debit notes. It serves as a legal document for GST-compliant reporting and ensures transparency in post-invoice modifications. As the transactions fall under customer accounting, the responsibility for reporting and accounting for GST rests with the recipient.

- Company Details:

The invoice begins with the seller’s company information, including name, registered address, contact details, and GSTIN. These details establish the supplier’s identity for tax and legal compliance.

- Adjustment Information

Essential identifiers such as the Adjustment Number (e.g., ARADJ0178), Document ID (UUID), Date, and Page Number are displayed. These details are critical for tracking adjustments, reconciling with original invoices, and maintaining clear audit trails.

- Billing Details (Sold To)

The “Sold To” section captures the customer’s name, billing address, and GST number. This ensures the correct recording of buyer information for GST reporting and helps maintain consistency with the original sales document.

- Shipping Details (Ship To)

The “Ship To” section records the delivery details of the customer. While often identical to the billing address, this may differ for logistical or branch-based reasons. The inclusion of both addresses ensures proper documentation and clarity during audits.

• Reference / Other Information

The report includes references such as P.O. Number and Customer Number. These fields assist in linking the adjustment with corresponding sales or purchase orders, ensuring smooth reconciliation and tracking within the AR ledger.

• Transaction Details

Each AR Adjustment line item provides a detailed breakdown including:

Account Code (e.g., 40900 – Revenue-Other)

Tax Code (e.g., SR – Standard-Rated)

GST Rate (%) (e.g., 9%)

Amount (SGD)

This section ensures accuracy in financial reporting by clearly outlining how adjustments affect revenue and tax calculations.

• Remittance Details

A “Remit To” section mirrors the buyer’s information, emphasizing the customer accounting rule where the recipient bears responsibility for GST declaration and payment. This ensures full compliance with IRAS (Inland Revenue Authority of Singapore) requirements.

• Document Type

he AR Adjustment Tax Report may represent either a Credit Memo or Debit Memo, depending on whether the transaction decreases or increases the invoice value. Both forms are essential for maintaining accurate AR balances and ensuring GST compliance.

• Additional Information

The report includes clarifying notes such as:

“GST is to be accounted for under customer accounting.”

“This document has been generated electronically and is valid without a physical signature.”

These statements provide legal assurance and help prevent unauthorized document alterations or misuse.

About Us

Greytrix – a globally recognized and one of the oldest Sage Development Partner is a one-stop solution provider for Sage ERP and Sage CRM organizational needs. Being acknowledged and rewarded for multi-man years of experience and expertise, we bring complete end-to-end assistance for your technical consultations, product customizations, data migration, system integrations, third party add-on development and implementation competence.

Greytrix has a wide product range for Sage Intacct- a Cloud ERP. This includes migrations from QuickBooks | Sage 50 | Sage 100 | Sage 300 to Sage Intacct. Our unique GUMU™ integrations include Sage Intacct for Sage CRM | Salesforce | FTP/SFTP | Rev.io | Checkbook | Dynamics 365 CRM | Magento | Rent Manager | Treez | Avalara Avatax | Blackline SFTP. We also offer best-in-class Sage Intacct Development Services, Consulting services, integrated apps like POS | WMS | Payroll | Shipping System | Business Intelligence | eCommerce for Sage Intacct to Sage business partners, resellers, and Sage PSG worldwide. Greytrix constantly develops apps, products, and add-ons to enhance user experience. Sage Intacct add-ons include AR Lockbox File Processing.

Greytrix GUMU™ integration for Sage CRM – Sage Intacct, Sales Commission App for Sage Intacct, and Checkbook.io ACH/Digital Check Payments for Sage powered by GUMU™ are listed on Sage Intacct Marketplace.

The GUMU™ Cloud framework by Greytrix forms the backbone of cloud integrations that are managed in real-time for the processing and execution of application programs at the click of a button.

For more information on Sage Business Cloud Services, please contact us at sagecloud@greytrix.com. We will like to hear from you.