In Sage Intacct, an Asset Exchange is most commonly carried out within the Fixed Assets module. It represents the exchange of an old asset for a new one—usually in the form of a trade-in or replacement. Sage Intacct focuses on cloud-based modularity, and Fixed Assets functionality can be dependent upon having the Fixed Assets module enabled.

Prerequisites:

- The Fixed Asset module must be enabled and properly configured.

- Asset Depreciation schedules will run based on company’s setting.

- Confirm the asset book value is correct.

- Make sure proper GL accounts are linked for gains/losses and additions of asset.

Step-by-step process :

- Dispose an Old Asset

- Add a New Asset

- Payment of AP Bill

- Review GL Postings

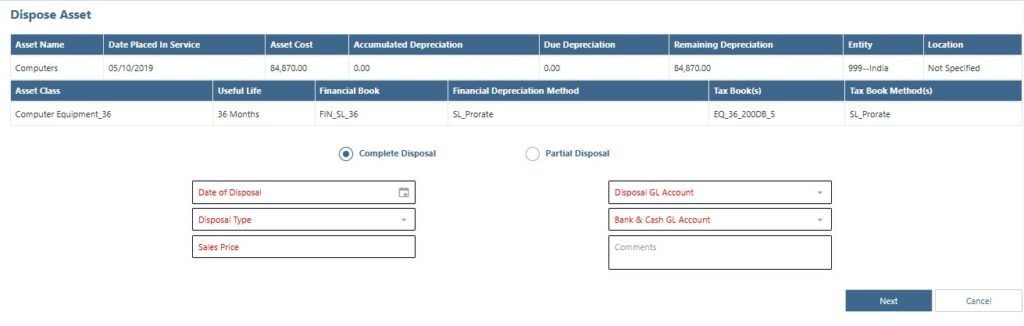

- Dispose an Old Asset.

To dispose of an old asset in Sage Intacct using the Fixed Assets module, you’ll follow a clear process to retire or sell the asset. This will ensure depreciation and gain or loss calculations are managed correctly.

Steps to Dispose of an Asset in Sage Intacct:

- Navigate to “Fixed Asset” module.

- Go to: Applications > Fixed Asset > Assets

- Search and select the Asset.

- Locate the Asset that needs to be disposed

- Click on “View” to open the asset record

- Initiate Disposal

- Choose “Dispose” from the asset record.

- Enter Disposal detail.

- Date of Disposal – When the asset is being disposed

- Disposal Type – Type of disposalSales Price – Selling price of an asset

- Disposal GL Account. – GL account for disposal

- Bank & Cash GL Account. – Expense account

- Save the Disposal

- After entering all the mandatory details, Click on “Next” button

- Click on “Done”. Asset is now successfully disposed

- Add a New Asset (Through AP Bill)

There are two different ways in Sage Intacct where you can add fixed asset. One way is from Fixed Asset module another is from Accounts Payable module by creating a bill. Posting an asset in Sage Intacct via Accounts Payable (AP) bill is a typical procedure for simplifying the acquisition of assets and determine that fixed assets will be automatically created when a vendor bill is entered.

Steps to Add a new asset through AP bill.

- Create an AP bill

- Go to: Accounts Payable > All > Bills > Add

- Enter bill details.

- Enter vendor and other bill details.

- In 1st line item, select:

- GL Account: Relevant fixed asset account

- Location/Department: Based on setup

- Amount: Cost of Asset

- In show details, enter:

- Asset GL posting date: Posting Date

- Date placed in service: Date when asset will be in service

- Asset Name: Name of the asset

- In 2nd line item, select:

- GL Account: GL account that was used while disposal (Bank & Cash GL Account)

- Location/Department: Based on setup

- Amount: Selling cost of old asset in negative

- Post the Bill.

- Click on “Post” button. Bill is now created successfully

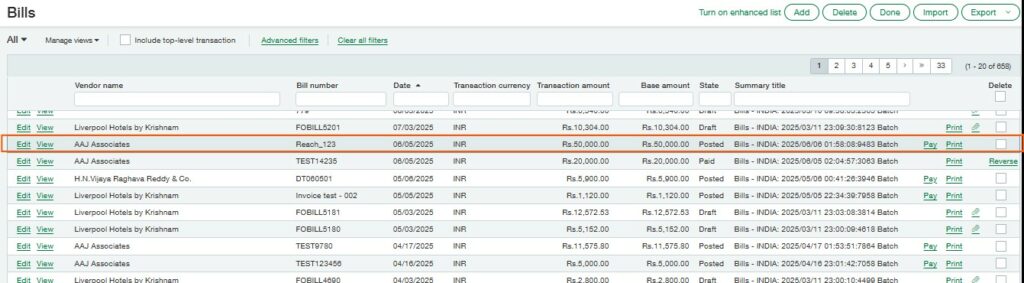

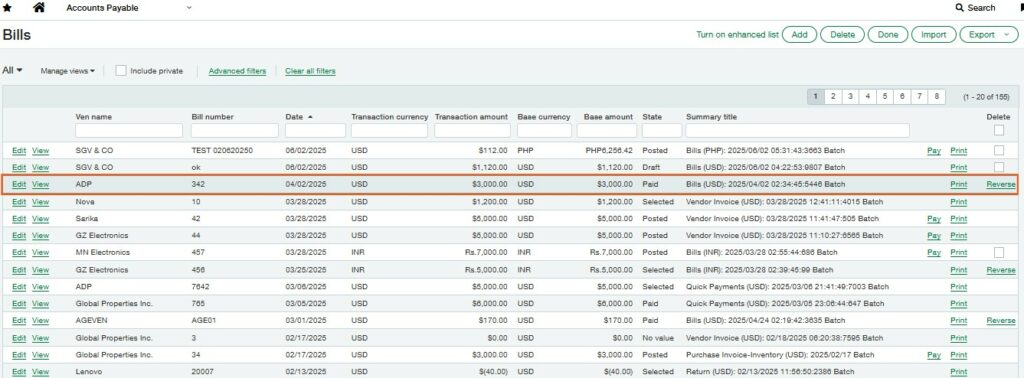

- Payment of AP bill

In Sage Intacct, paying an AP bill involves selecting an approved or posted bills, choosing a payment method, and processing a payment.

Steps to make an AP bill payment

- Navigate to the “Account Payable” module.

- Go to Accounts Payable

- Select the bill.

- Click on Pay option

- Enter payment details.

- Choose:

- Bank Account

- Payment Date

- Payment Method

- Choose:

- Select the bill.

- Submit payment.

- Click on Pay Now option

- Enter memo, Doc No (Optional)

- Enter “Amount paid by bank”

- Click on save button

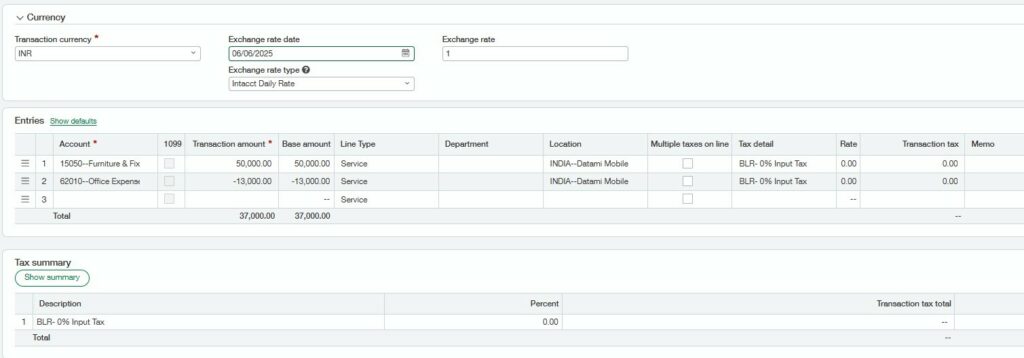

For Example:

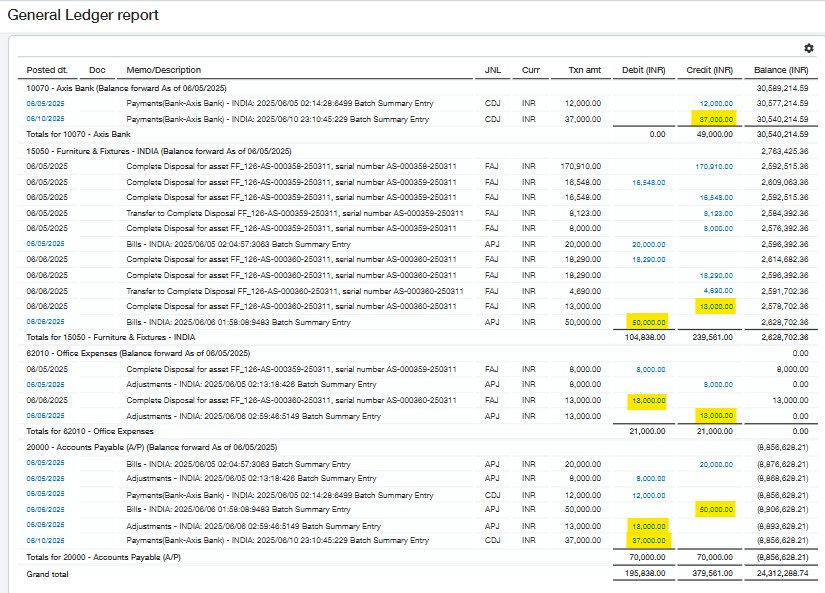

You dispose an old asset at 13000 whose actual asset cost was 40000 using an expense account and the remaining depreciation was 14000. Now you buy a new asset worth 50000. You will create an AP bill using an expense account (same account used at the time of disposal) with amount 50000 at 1st line level and in 2nd line level select a GL account & enter the negative selling amount of old asset i.e. -13000. So now at the time of AP bill payment, the amount paid will be 37000. Accordingly, there will be GL effect as shown below for reference.

About Us

Greytrix has a wide product range for Sage Intacct- a Cloud ERP. This includes migrations from QuickBooks | Sage 50 | Sage 100 | Sage 300 to Sage Intacct. Our unique GUMU™ integrations include Sage Intacct for Sage CRM | Salesforce | FTP/SFTP | Rev.io | Checkbook | Dynamics 365 CRM | Magento | Rent Manager | Treez | Avalara Avatax | Blackline SFTP. We also offer best-in-class Sage Intacct Development Services, Consulting services, integrated apps like POS | WMS | Payroll | Shipping System | Business Intelligence | eCommerce for Sage Intacct to Sage business partners, resellers, and Sage PSG worldwide. Greytrix constantly develops apps, products, and add-ons to enhance user experience. Sage Intacct add-ons include AR Lockbox File Processing.

Greytrix GUMU™ integration for Sage CRM – Sage Intacct, Sales Commission App for Sage Intacct, and Checkbook.io ACH/Digital Check Payments for Sage powered by GUMU™ are listed on Sage Intacct Marketplace.

The GUMU™ Cloud framework by Greytrix forms the backbone of cloud integrations that are managed in real-time for the processing and execution of application programs at the click of a button.

For more information on Sage Business Cloud Services, please contact us at sagecloud@greytrix.com. We will like to hear from you.