Let’s be real—month-end close can feel like controlled chaos. And when you’re dealing with multiple currencies? That chaos turns into a full-blown spreadsheet storm.

We’ve been there, manually tracking exchange rate changes, trying to figure out how much a single unpaid invoice has shifted in value. It’s tedious, error-prone, and honestly, not the kind of work that adds strategic value.

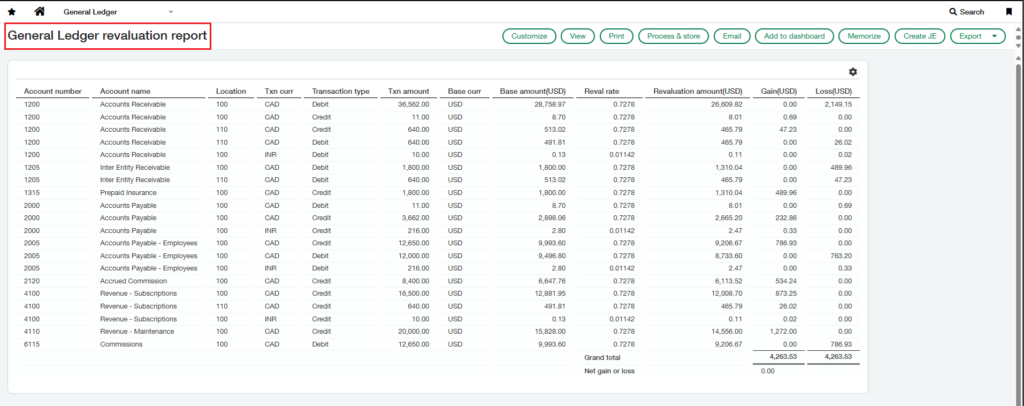

That’s why we rely on Sage Intacct’s GL Revaluation Report. It’s like having a smart assistant who quietly handles the most stressful part of foreign currency accounting. No more second-guessing or manual recalculations. The report automatically identifies unrealized gains and losses from open transactions—so our financials stay sharp, clean, and audit-ready.

It’s one of those tools that doesn’t just save time—it saves sanity.

So, What Exactly Is It Doing?

Imagine you’re running a business in India and you receive an invoice from a US-based software vendor for $1,000. When you first record the invoice, the exchange rate is ₹83 per dollar, so the transaction is booked at ₹83,000 in your accounting system.

Now, let’s say you haven’t paid the invoice yet, and by the end of the month, the exchange rate shifts to ₹86 per dollar. That same invoice now represents a liability of ₹86,000—even though you haven’t made the payment yet.

The GL Revaluation report catches this difference. It looks at all your open foreign currency transactions, applies the current exchange rate, and calculates the unrealized gains and losses. The best part? It can even create a draft journal entry for these adjustments, so you don’t have to manually create them.

Who Needs to Use It?

If your company has foreign currency transactions, this report is your best friend during the month-end close. You’ll want to run this report as a key step, typically after bank reconciliations but before you consolidate your financial data.

Think of it as a crucial checkpoint in your monthly routine:

• Reconcile bank accounts.

• Record accrual entries.

• Run the GL Revaluation report. (And its counterparts for AP and AR)

• Reconcile inter-entity transactions.

• Consolidate.

• Review and close the books.

By making this a regular part of your process, you ensure that your financial reports are based on the most current data, giving you and your stakeholders an accurate view of your company’s health.

Making the Report Work for You

When we first started using Sage Intacct’s GL Revaluation report, we’ll admit—we were a little overwhelmed. It’s packed with data, and if you’re not careful, it’s easy to get lost in the details. But over time, we figured out a few simple tricks that made it way more powerful and way less intimidating.

• Go Summary First If you’re dealing with a high volume of transactions (like we often are), running the report in summary format is a game-changer. It groups everything by account and currency, so you get a clean snapshot without drowning in line items.

• Group Your Accounts: We created a custom account group that includes every account we need to revalue. Now, instead of manually selecting them each time, we just click once and the report pulls exactly what we need. No missed accounts, no wasted time.

• Dig into the Details What we love about this report is how transparent it is. It doesn’t just spit out a number—it shows the original transaction amount, the base currency value, the revaluation rate, and the resulting gain or loss. That breakdown helps us understand why the numbers changed, not just how.

Path to access: General Ledger -> Reports -> General Ledger revolution.

Conclusion:

The GL Revaluation report takes the guesswork and grunt work out of multi-currency accounting. By automating this complex task, it frees you up to focus on what really matters: analyzing the data and guiding your company forward.

About Us

Greytrix has a wide product range for Sage Intacct- a Cloud ERP. This includes migrations from QuickBooks | Sage 50 | Sage 100 | Sage 300 to Sage Intacct. Our unique GUMU™ integrations include Sage Intacct for Sage CRM | Salesforce | FTP/SFTP | Rev.io | Checkbook | Dynamics 365 CRM | Magento | Rent Manager | Treez | Avalara Avatax | Blackline SFTP. We also offer best-in-class Sage Intacct Development Services, Consulting services, integrated apps like POS | WMS | Payroll | Shipping System | Business Intelligence | eCommerce for Sage Intacct to Sage business partners, resellers, and Sage PSG worldwide. Greytrix constantly develops apps, products, and add-ons to enhance user experience. Sage Intacct add-ons include AR Lockbox File Processing.

Greytrix GUMU™ integration for Sage CRM – Sage Intacct, Sales Commission App for Sage Intacct, and Checkbook.io ACH/Digital Check Payments for Sage powered by GUMU™ are listed on Sage Intacct Marketplace.

The GUMU™ Cloud framework by Greytrix forms the backbone of cloud integrations that are managed in real-time for the processing and execution of application programs at the click of a button.

For more information on Sage Business Cloud Services, please contact us at sagecloud@greytrix.com. We will like to hear from you.