In Sage 300 ERP, you can setup prices inclusive of taxes. In this article we will provide guidelines on setting up price inclusive of taxes.

The New Stuff : Multicurrency in Greytrix TDS

First of all you need to setup or identify the tax authority where taxes charged by authority can be included in selling price.

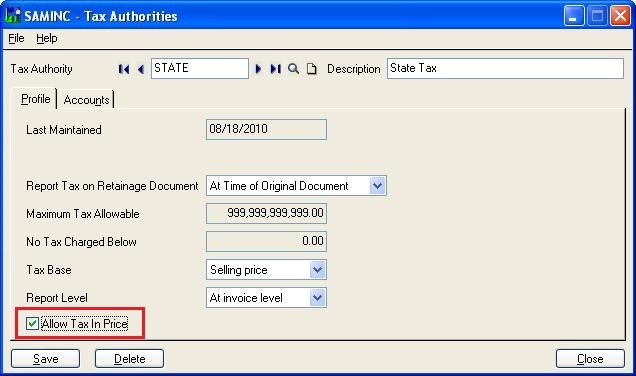

1) In order to configure the Tax Authority to allow tax in price; go to Common Services Module>>Tax Service>>Tax Authorities

2) Select Allow Tax in Price option. In the given example we have configured Authority State for allowing the tax in prices.

Note: Do not select this option if you have customers who are tax exempt, because tax is not extracted from the item price. You would need to adjust the price for the customer.

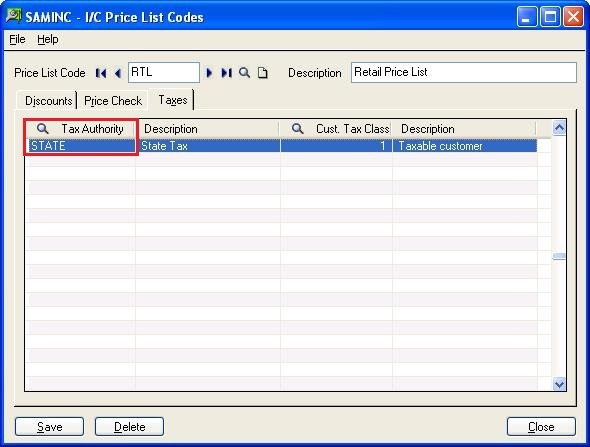

3) Now you need to setup Price Lists and add tax authorities which allow tax in prices.

(Inventory Control>>IC Setup>>Price List code)

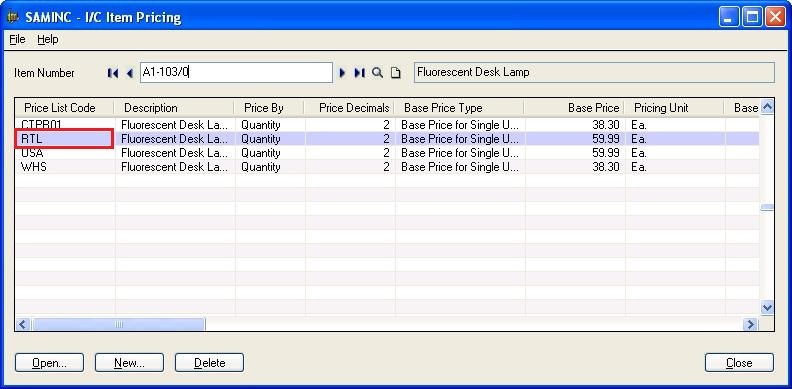

4. Assign the price list to the desired Items.

(Inventory Control>>I/C Items and Price Lists>>Item Pricing)

Now you are able to setup item prices inclusive of taxes.

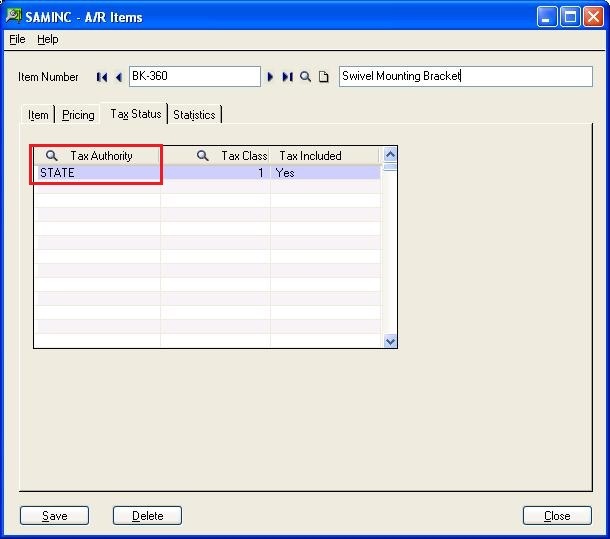

5. For A/R Items; you need to attach tax authorities which allow tax in prices.

(Accounts Receivable>>A/R Setup>>Items)

About Us

Greytrix – a globally recognized and one of the oldest Sage Development Partners is a one-stop solution provider for Sage ERP and Sage CRM organizational needs. Being acknowledged and rewarded for multi-man years of experience, we bring complete end-to-end assistance for your technical consultations, product customizations, data migration, system integrations, third-party add-on development, and implementation competence.

Greytrix offers unique GUMU™ integrated solutions of Sage 300 with Sage CRM, Salesforce(listed on Salesforce Appexchange), Dynamics 365 CRM, and Magento eCommerce, along with Sage 300 Migration from Sage 50 US, Sage 50 CA, Sage PRO, QuickBooks, Sage Business Vision and Sage Business Works. We also offer best-in-class Sage 300 customization and development services and integration services for applications such as POS | WMS | Payroll | Shipping System | Business Intelligence | eCommerce for Sage 300 ERP and for Sage 300c development services we offer, upgrades of older codes and screens to new web screens, latest integrations using Data and web services to Sage business partners, end users and Sage PSG worldwide.

Greytrix offers 20+ add-ons for Sage 300 to enhance productivity such as GreyMatrix, Document Attachment, Document Numbering, Auto-Bank Reconciliation, Purchase Approval System, Three-way PO matching, Bill of Lading, and VAT for the Middle East. The GUMU™ integration for Dynamics 365 CRM – Sage ERP is listed on Microsoft Appsource with an easy implementation package.

The GUMU™ Cloud framework by Greytrix forms the backbone of cloud integrations that are managed in real-time for processing and execution of application programs at the click of a button.

For more details on Sage 300 and Sage 300c Services, please contact us at accpac@greytrix.com, We will like to hear from you.