Sage 300 provides the reverse transactions for Accounts Payable, Accounts Receivable & bank Services. In this blog post, we will discuss the Reverse Transaction for Bank services. We can reverse the posted bank entries for selected bank.

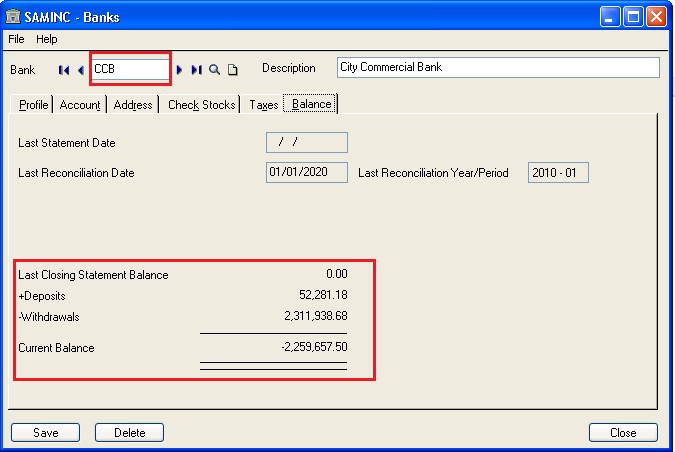

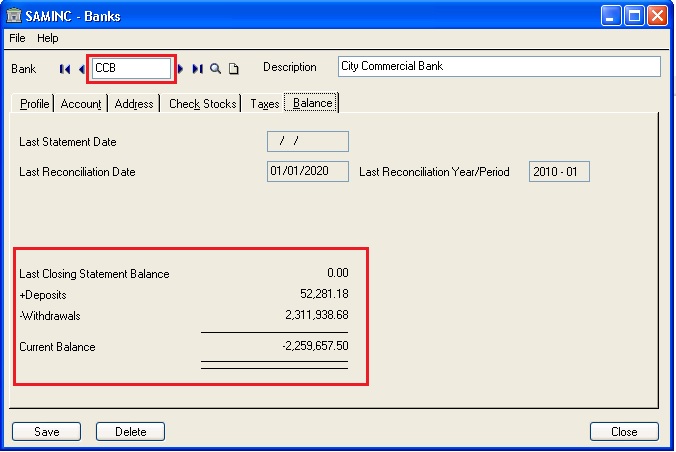

To view the updates after posting AP, AR & bank transactions bank services automatically updates into particular bank master screen, to analyze the last closing statement balance, deposits, withdrawals & current balance, navigate to Common Services–>Bank Services–>Banks, refer below screenshot:-

New Stuff: Account Range Selection Made Simpler in Business Intelligence

Let’s take an example, in above screen to view the Bank book balance with last closing statement balance, deposits, withdrawals & current balance.

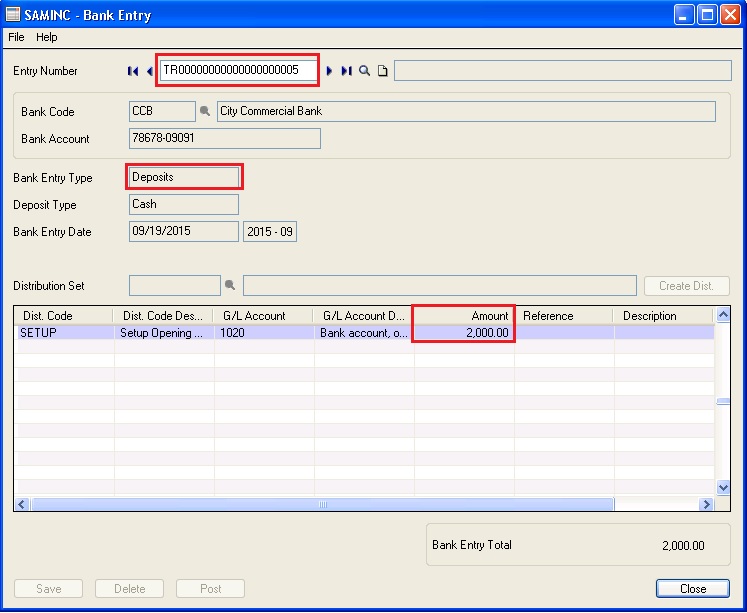

Now create new Bank entry transactions, to create new Bank entry navigate to Common Services–>Bank Services–>Bank Transactions–>Bank Entry. Create new Bank entry transactions, select bank code=CCB, select entry type as Deposits, add disc code with amount=2000, entry no will be generated after posting this bank entry= TR00000000000000000005, GL batch was generated automatically, and refer below screenshot:-

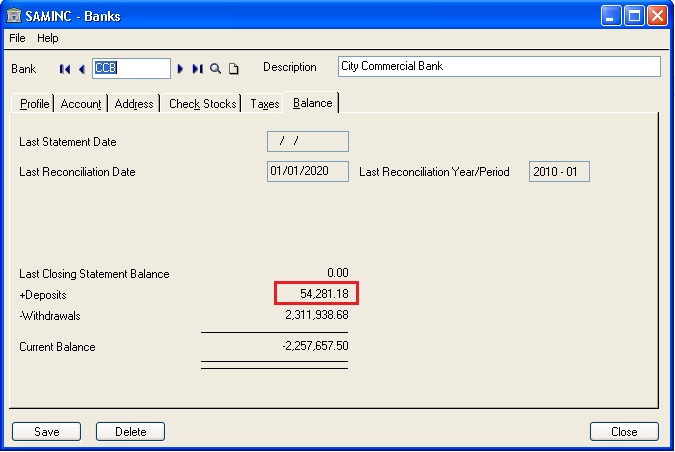

After posting bank entry, bank master screen for a particular bank will be updated automatically, deposit amount=2000 will be updated, the following amount will be calculated and displayed: 52281.18+2000=54281.18, refer below screenshot:-

Deposits are increased by 2000 & Current balance is decreased by 2000 & now it is 2,257,657.50.

Reverse Transactions (Bank Reverse):

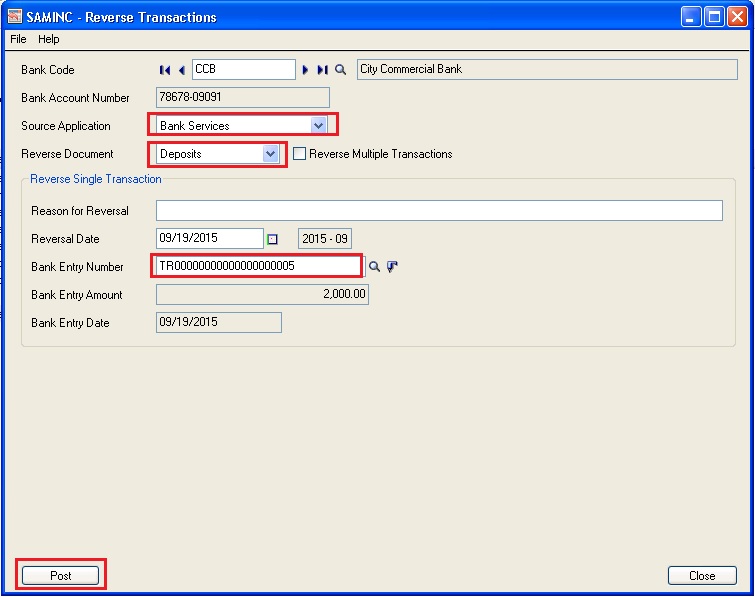

Now we can do the reverse transactions against bank services, select bank=CCB, select source application as Bank Services, reverse document=Deposits, select bank entry no= TR00000000000000000005, Click on post button, to navigate reverse transactions, go to Common Services–>Bank Services–>Bank Transactions–>Reverse Transactions, refer below screenshot:-

After clicking on Post button, a screen pops-up with the message “Reverse transaction completed successfully”. It will also create a GL transaction in un-posted status under General Ledger module. Then go to General Ledger module and post the GL transaction of the Reverse Transaction.

Now we can verify the bank book balance after reverse transactions for a deposited amount in bank entry.

Bank Balance Status after Bank services Reverse Transaction, refer below screenshot:-

In the above screen, we can review the Deposits is decreased by 2000 and Current Balance is increased by 2000 after reverse transactions of bank entry.