TAX CALCULATION

The integration will be established which will sync sales transactions from Sage Intacct to Avalara. Tax will be calculated in Avalara; summarized tax will be updated back into Sage Intacct.

Native integration works on a post of sales transactions in Sage Intacct. After-tax calculation; tax amounts and rates are updated at line level. Upon posting of sales invoice in Sage Intacct; integration will sync sales transaction with Avalara.

Avalara will calculate tax and will be returned the calculated tax amounts. This amount will be updated back into Sage Intacct.

Avalara doesn’t support inline locations; it maps a company/entity as a company in Avalara. To resolve this; integration will post one or multiple transactions in Avalara by Locations/Company codes.

Assuming the sale invoice mentions 3 different inline locations; each line item will be posted under the appropriate company in Avalara. In Avalara; transaction Document no. will be the same as Sage Intacct Invoice/Document no. There will be 3 transactions posted in Sage Intacct under separate companies.

Appropriate tax will be added depending on whether a customer is generated through Point of sale, E-commerce, or direct sale. In the case of a multi-entity in Sage Intacct, they are handled as different companies for multi-entity taxation. The GUMUTM for Sage Intacct-Avalara is your business’s perfect tax compliance partner!

Integration Touch-points

Sales Invoice

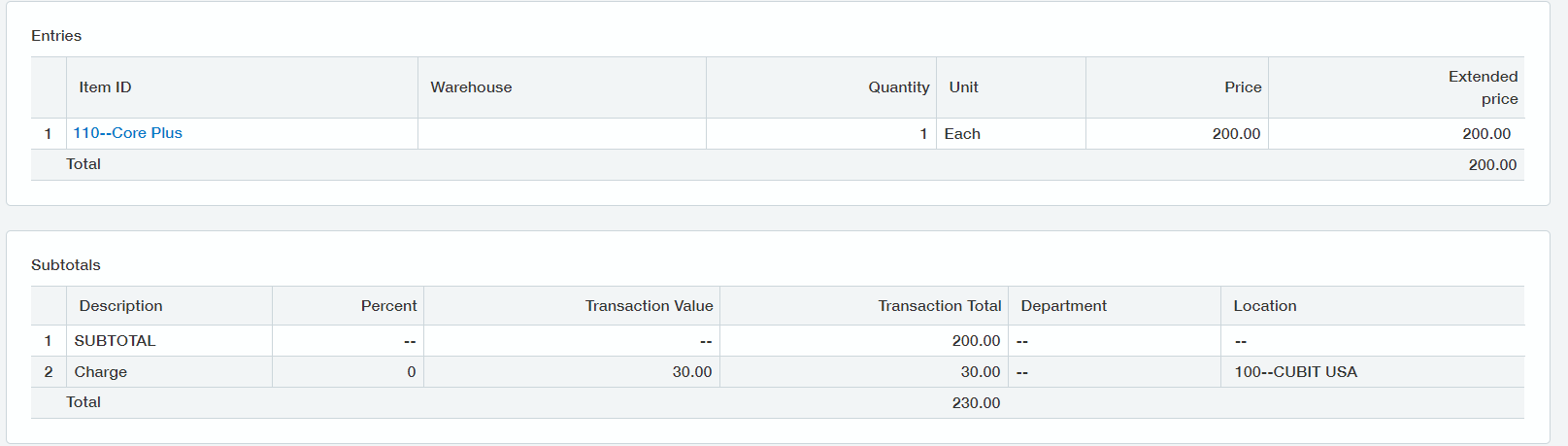

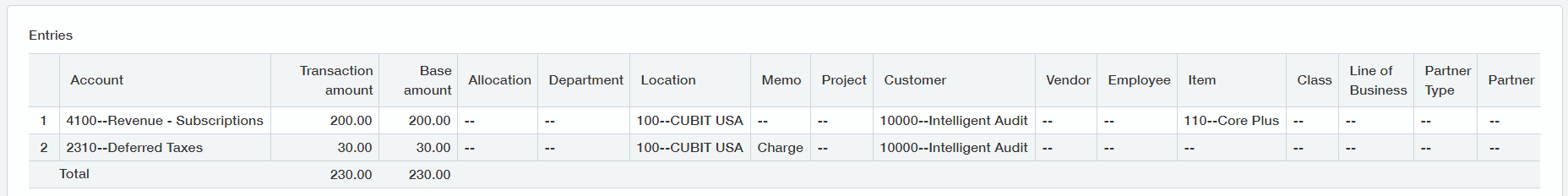

All sales invoices created in Sage Intacct will be integrated into Avalara. Then, Avalara will calculate the respective sales invoice’s tax based on its subtotal. This tax amount will be updated on Sales Invoice as a charge or tax.

The updated transaction amount will also be reflected in AR Invoice. It will show the calculated tax amount corresponding to the mapped GL account (charge type). Credit Memo

Credit Memo

Sales Credit Memo posted in Sage Intacct will integrate into Avalara as Return Invoice. Then, Avalara will calculate the tax on respective Sales Credit Memo transaction.

In Avalara; transaction will be created in appropriate Company; determined on the basis of mapped Location (Sage Intacct). Transaction no. will be same as in Sage Intacct.

This blog gives you a brief understanding of how using Avalara Integration, tax calculations can be managed in Sage Intacct.

About Us

Greytrix – a globally recognized and one of the oldest Sage Development Partner is a one-stop solution provider for Sage ERP and Sage CRM organizational needs. Being acknowledged and rewarded for multi-man years of experience and expertise, we bring complete end-to-end assistance for your technical consultations, product customizations, data migration, system integrations, third party add-on development and implementation competence.

Greytrix has a wide product range for Sage Intacct- a Cloud ERP. This includes migrations from QuickBooks | Sage 50 | Sage 100 | Sage 300 to Sage Intacct. Our unique GUMU™ integrations include Sage Intacct for Sage CRM | Salesforce | FTP/SFTP | Rev.io | Checkbook | Dynamics 365 CRM | Magento | Rent Manager | Treez | Avalara Avatax | Blackline SFTP. We also offer best-in-class Sage Intacct Development Services, Consulting services, integrated apps like POS | WMS | Payroll | Shipping System | Business Intelligence | eCommerce for Sage Intacct to Sage business partners, resellers, and Sage PSG worldwide. Greytrix constantly develops apps, products, and add-ons to enhance user experience. Sage Intacct add-ons include AR Lockbox File Processing.

Greytrix GUMU™ integration for Sage CRM – Sage Intacct, Sales Commission App for Sage Intacct, and Checkbook.io ACH/Digital Check Payments for Sage powered by GUMU™ are listed on Sage Intacct Marketplace.

The GUMU™ Cloud framework by Greytrix forms the backbone of cloud integrations that are managed in real-time for the processing and execution of application programs at the click of a button.

For more information on Sage Business Cloud Services, please contact us at sagecloud@greytrix.com. We will like to hear from you.