In our previous blog, we discussed the GL Voucher Report, which is part of our India Pack Report. In today’s blog, we will provide a detailed discussion on the GSTR2 Report in Sage Intacct ERP.

The GSTR-2 is a tax return under India’s Goods and Services Tax (GST) system, focusing on purchase-related transactions. It captures details of all inward supplies (purchases) made during a specific tax period. Filed by the recipient of goods or services, this return facilitates the claiming of input tax credit (ITC) by reconciling the reported purchases with the suppliers.

New Stuff: – Sage Intacct for SaaS Firms – A Subscription Billing & Accounting Solution

In this blog, we are going to discuss about the GSTR-2 Report in the sage intacct.

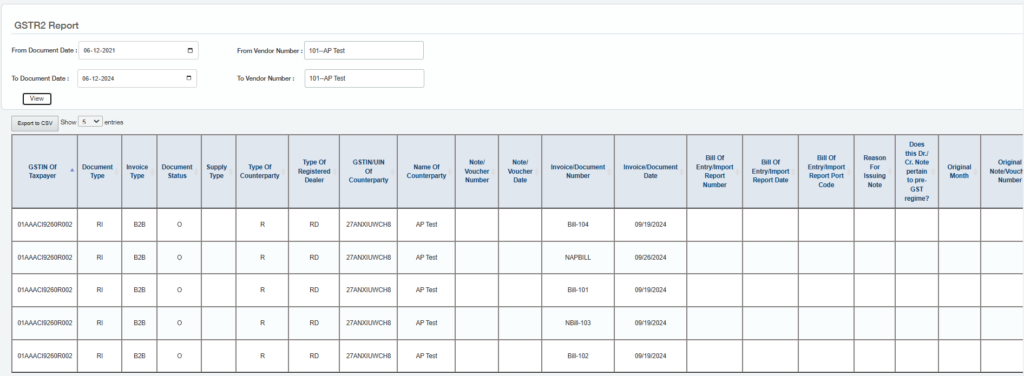

When you click the “View” button, all data for the specified time period and the selected “From” and “To” vendor numbers will be displayed in a table format.

In the top-right corner, a search feature enables users to search within any column values. Additionally, users can select to display table entries in groups of 5, 10, 25, 50, or view all entries at once.

The “Export to Excel” button allows users to download the report as an Excel file.

This report includes following fields from PO and AP Transaction screen and can be modified according to your requirement.

- GSTIN Of Taxpayer.

- Document Type.

- Invoice Type.

- Document Status.

- Supply Type.

- Type Of Counterparty.

- Type Of Registered Dealer.

- GSTIN/UIN Of Counterparty.

- Name Of Counterparty.

- Note/ Voucher Number.

- Note/ Voucher Date.

- Invoice/Document Number.

- Invoice/Document Date.

- Bill Of Entry/Import Report Number.

- Bill Of Entry/Import Report Date.

- Bill Of Entry/Import Report Port Code.

- Reason For Issuing Note.

- Does this Dr./ Cr. Note pertain to pre-GST regime?.

- Original Month.

- Original Note/Voucher Number.

- Original Note/Voucher Date.

- Original Invoice Number.

- Original Invoice Date.

- Original GSTIN/UIN Number.

- Total Invoice Value/Note Value.

- Place of supply.

- Whether reverse charge is applicable.

- Sr.No.

- Gross Value.

- Discount.

- Additions to invoice value.

- Goods/Services.

- HSN/ SAC.

- Description.

- Unit.

- Quantity.

- Taxable value.

- Tax rate.

- IGST Rate.

- IGST Amt.

- CGST Rate.

- CGST Amt.

- SGST/UTGST Rate.

- SGST/UTGST Amt.

- CESS Rate.

- CESS Amt.

- Whether input or input service/Capital goods (incl. plant and machinery)/Ineligible for ITC.

- Total Tax available as ITC IGST Amount.

- Total Tax available as ITC CGST Amount.

- Total Tax available as ITC SGST/UTGST Amount.

- Total Tax available as ITC CESS Amount.

- Tax applicability.

- Fiscal Year.

- Internal Reference Document number.

- Posting date.

- Invoice status.

- Internal Counterparty Code.

- Area code.

- Plant code.

- Project code.

- Department Code.

- Division Code.

- Cost Center.

- Branch Code.

- User Name.

- Transaction Category.

- GL Code.

About Us

Greytrix – a globally recognized and one of the oldest Sage Development Partner is a one-stop solution provider for Sage ERP and Sage CRM organizational needs. Being acknowledged and rewarded for multi-man years of experience and expertise, we bring complete end-to-end assistance for your technical consultations, product customizations, data migration, system integrations, third party add-on development and implementation competence.

Greytrix has a wide product range for Sage Intacct- a Cloud ERP. This includes migrations from QuickBooks | Sage 50 | Sage 100 | Sage 300 to Sage Intacct. Our unique GUMU™ integrations include Sage Intacct for Sage CRM | Salesforce | FTP/SFTP | Rev.io | Checkbook | Dynamics 365 CRM | Magento | Rent Manager | Treez | Avalara Avatax | Blackline SFTP. We also offer best-in-class Sage Intacct Development Services, Consulting services, integrated apps like POS | WMS | Payroll | Shipping System | Business Intelligence | eCommerce for Sage Intacct to Sage business partners, resellers, and Sage PSG worldwide. Greytrix constantly develops apps, products, and add-ons to enhance user experience. Sage Intacct add-ons include AR Lockbox File Processing.

Greytrix GUMU™ integration for Sage CRM – Sage Intacct, Sales Commission App for Sage Intacct, and Checkbook.io ACH/Digital Check Payments for Sage powered by GUMU™ are listed on Sage Intacct Marketplace.

The GUMU™ Cloud framework by Greytrix forms the backbone of cloud integrations that are managed in real-time for the processing and execution of application programs at the click of a button.

For more information on Sage Business Cloud Services, please contact us at sagecloud@greytrix.com. We will like to hear from you.