Import Bank Reconciliation is used to accelerate the matching of bank transactions from bank statements to the Sage 500 ERP system. This feature is used in Sage 500 ERP to import and reconcile those bank transactions with outstanding transactions in Sage 500 ERP Cash Management.

It is only available if Cash Management is installed in Sage 500 ERP.

New Stuff: Maintain Contract pricing in Sage 500

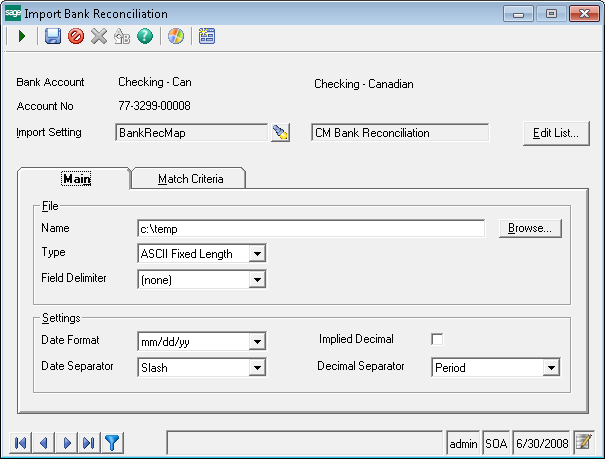

Many banks will send their customer an electronic file or hard copy statement which include account number, statement date, ending balance, cheque number, transaction date and type. This reconciliation process will allow for import bank transaction from a data file to reconcile the transaction of Sage 500 System.

Sage 500 ERP will only support ASCII text files either of fixed length, or variable length using field delimiters to separate the data fields.

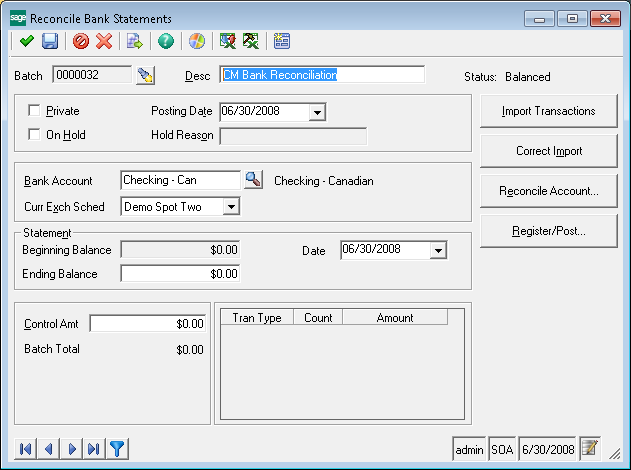

In order to perform the CM import Bank reconciliation process, the user need to create a reconciliation batch and select a bank account for import the data files. Once click on the “Import transaction” button the batch form will initiate the process of CM import bank reconciliation.

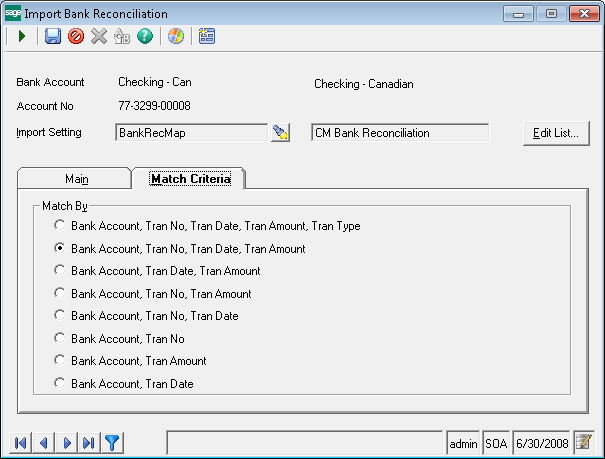

- Matching process

Since not all transaction fields are required into the Import data field, depending on the above selection which transaction data field are present, Import Bank reconciliation automatically match bank transactions from the import data file.

- Bank Account Number, Transaction Number, Transaction Date, Transaction Amount, Transaction Type (check, deposit, withdrawal, etc.)

- Bank Account Number, Transaction Number, Transaction Date, Transaction Amount (Default)

- Bank Account Number, Transaction Date, Transaction Amount

- Bank Account Number, Transaction Number, Transaction Amount

- Bank Account Number, Transaction Number, Transaction Date

- Bank Account Number, Transaction Number

- Bank Account Number, Transaction Amount

- Bank Account Number, Transaction Date

Total 8 selected criteria available on the basis of which user can import Bank data file by using Sage 500, system automatically processes the bank data file to match and unmatched the bank transaction.

About Us:

Greytrix – a globally recognized and one of the oldest Sage Gold Development Partner is a one-stop solution provider for Sage ERP and Sage CRM organizational needs. Being acknowledged and rewarded for multi-man years of experience, we bring complete end-to-end assistance for your technical consultations, product customizations, data migration, system integrations, third party add-on development and implementation competence.

Greytrix offers unique GUMU™ integrated solutions of Sage 300 with Sage CRM, Salesforce.com, Dynamics 365 CRM and Magento eCommerce along with Sage 300 Migration from Sage 50 US, Sage 50 CA, Sage PRO, QuickBooks, Sage Business Vision and Sage Business Works. We also offer best-in-class Sage 300 customization and development services and integration services for applications such as POS | WMS | Payroll | Shipping System | Business Intelligence | eCommerce for Sage 300 ERP and for Sage 300c development services we offer, upgrades of older codes and screens to new web screens, latest integrations using sData and web services to Sage business partners, end users and Sage PSG worldwide. Greytrix offers 20+ addons for Sage 300 to enhance productivity such as GreyMatrix, Document Attachment, Document Numbering, Auto-Bank Reconciliation, Purchase Approval System, Three way PO matching, Bill of Lading and VAT for Middle East. The GUMU™ integration for Dynamics 365 CRM – Sage ERP is listed on Microsoft Appsource with easy implementation package.

For more details on Sage 300 and Sage 300c Services, please contact us at accpac@greytrix.com, We will like to hear from you.