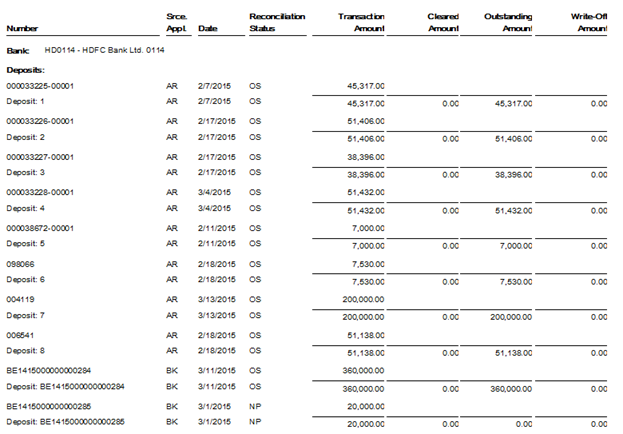

The Bank Reconciliation Status of SAGE 300 ERP lists the status of all transactions for bank accounts, with the amount stated in the bank’s statement currency. The report includes:

For each bank:

- Lists of transactions and subtotals for all transactions that appear on the Reconcile Statements form.

- The bank total (the sum of all transactions that increase the bank balance, less the transactions that decrease it).

For each transaction:

- The reconciliation status (for deposits, checks, or returned customer checks), or the transaction type description (for bank statement entries).

- The documented amount (that is, the item amount recorded in Sage 300 ERP), the cleared amount (entered when you reconciled the bank account), and the amount of the clearing difference. If the item has not been reconciled, the cleared amount is zero.

- If you did not use the Print Deposit Details option, any deleted deposits appear as empty deposits on the report, showing “Deleted” in the status column and zeroes in the other columns. (If you used the Print Deposit Details option, deleted deposits do not appear on the report.)

- A summary by a bank for all selected banks appears at the end of the report.

So we have come up with the “Auto Bank Reconciliation module in Sage 300 ERP” which lists the status of all transactions for bank accounts.

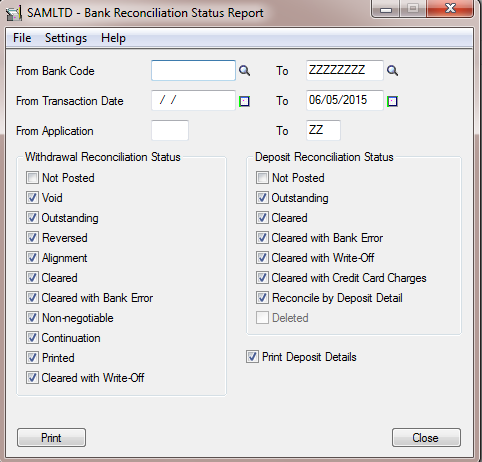

To print this report follow the steps mentioned below:

- Open Common Services → Bank Services → Bank Transactions Reports → Bank Reconciliation Status Report.

- Specify the bank or a range of banks to include in the report.

- Specify criteria for selecting transactions to include in the report, including:

- The range of dates to which transactions were posted.

- The source application (or a range of applications) that sent the transactions to Bank Services.

- Select Reconciliation statuses for withdrawals.

- Select Reconciliation statuses for deposits.

- Select the Print Deposit Details option to print details of individual receipts in a deposit.

- Click Print.

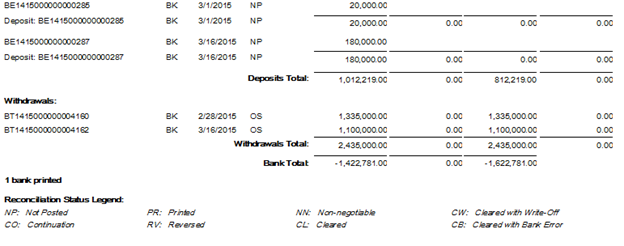

Below is the screen Shot of the report, it is printed as including the withdrawal & deposit reconciliation status as Not Posted & Outstanding.

This report will help you determine why the reconciliation does not balance & also help you to identify the cleared and outstanding amount in a bank account.

About Us

Greytrix is a one-stop solution provider for Sage ERP and Sage CRM needs. We provide complete end-to-end assistance for your technical consultations, product customizations, data migration, system integrations, third-party add-on development and implementation expertise.

Greytrix has some unique solutions of Sage 100 integration with Sage CRM, and Salesforce.com along with Sage 100 Migration from Sage 50 US, QuickBooks, Sage Business Vision and Sage Business Works. We also offer best-in-class Sage 100 customization and development services to Sage business partners, end users, and Sage PSG worldwide.

For more details on Sage 100 Services, please contact us at sage@greytrix.com. We will be glad to assist you.