In Sage Intacct, the OE Tax Invoice Report plays a vital role in documenting taxable sales transactions under the Singapore GST regime. This report ensures that every sale made to a customer is accurately represented in a GST-compliant format, aligning with local tax laws while maintaining accounting precision and transparency.

The OE Tax Invoice is generated when goods or services are sold to a customer. It includes key details such as seller and buyer information, GST registration numbers, taxable values, and total amounts. Through the Singapore Localization Suite, Sage Intacct provides a structured, compliant OE Tax Invoice Report that guarantees both financial accuracy and adherence to statutory regulations.

New Stuff : Faster Vendor Payments Just Got Easier in Sage Intacct

In this blog, we are going to discuss about the OE tax Invoice Report in Singapore Localization.

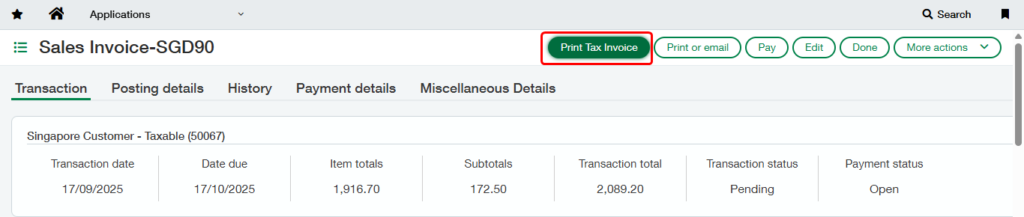

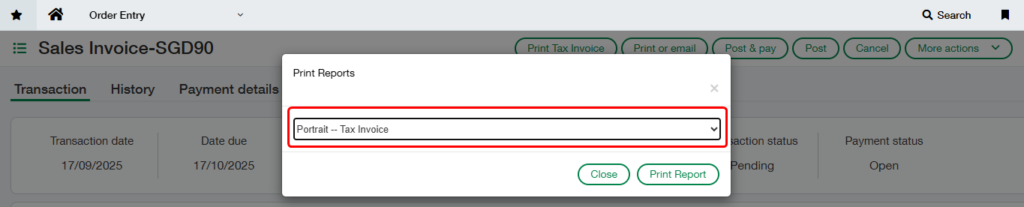

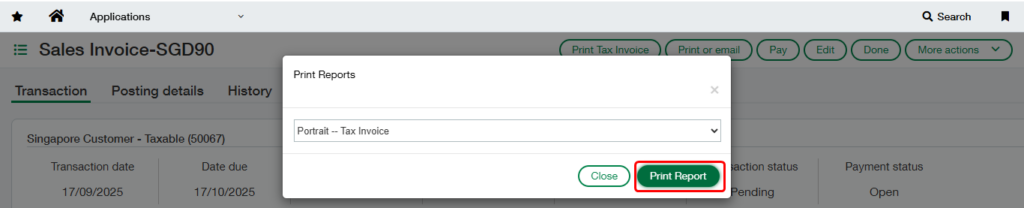

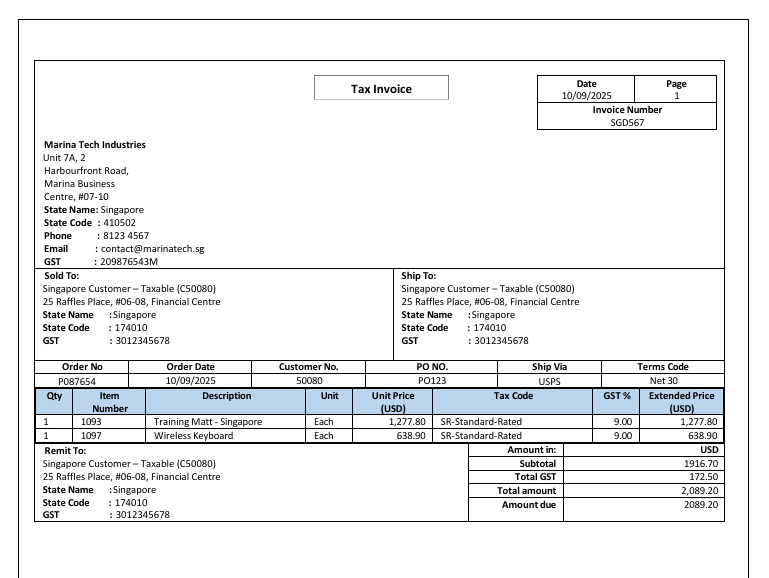

In the OE module, users can generate the Singapore Tax Invoice Report in just a few simple steps. Select the required transaction and click the “Print Invoice” button (Refer Fig. 1). A dropdown will appear showing the list of available report (Refer Fig. 2). From the list, choose “Portrait – Tax Invoice” format. Then click the “Print Report” button (Refer Fig. 3). The system will generate the Singapore OE Tax Invoice Report in the desired layout (Refer Fig. 4).

The Sales Invoice screen of the Order Entry module provides all the necessary data for the Singapore OE Tax Invoice Report, which can be tailored to meet specific business needs. The following crucial sections are included in it:

- Purpose of the Document :

The Tax Invoice serves as an official record of a sale made to a GST-registered customer in Singapore. It confirms the value of goods or services supplied, along with applicable GST. This report helps ensure compliance with the Inland Revenue Authority of Singapore (IRAS) requirements and provides transparency for both supplier and customer.

- Company Details :

Capturers essential company details such as Company name ,address ,GST ,Phone and Email.

- Billing Details :

“Bill To” includes recipient’s address , GST Details , Stare name and Code .

- Shipping Details :

“Ship To” includes recipient’s address , GST Details , Stare name and Code.

- Transaction Details :

Transaction table provides an itemized breakdown, including:

- Item Number and Description

- Quantity and Unit

- Unit and Quantity

- Unit Price and Extended Price

- Tax Code

- GST Information

- Total

- Additional Information :

The report also includes:

- Remit To details for payment reference

- Invoice Number and Date

About Us: –

Greytrix – a globally recognized and one of the oldest Sage Gold Development Partner is a one-stop solution provider for Sage ERP and Sage CRM organizational needs. Being acknowledged and rewarded for multi-man years of experience, we bring complete end-to-end assistance for your technical consultations, product customizations, data migration, system integrations, third party add-on development and implementation competence.

Greytrix offers unique GUMU™ integrated solutions of Sage 300 with Sage CRM, Salesforce.com, Dynamics 365 CRM and MagentoeCommerce along with Sage 300 Migration from Sage 50 US, Sage 50 CA, Sage PRO, QuickBooks, Sage Business Vision and Sage Business Works. We also offer best-in-class Sage 300 customization and development services and integration services for applications such as POS | WMS | Payroll | Shipping System | Business Intelligence | eCommerce for Sage 300 ERP and for Sage 300c development services we offer, upgrades of older codes and screens to new web screens, latest integrations using Data and web services to Sage business partners, end users and Sage PSG worldwide.Greytrix offers 20+ addons for Sage 300 to enhance productivity such as GreyMatrix, Document Attachment, Document Numbering, Auto-Bank Reconciliation, Purchase Approval System, Three way PO matching, Bill of Lading and VAT for Middle East. The GUMU™ integration for Dynamics 365 CRM – Sage ERP is listed on Microsoft Appsource with easy implementation package.

For more details on Sage 300 and Sage 300c Services, please contact us at accpac@greytrix.com, We will like to hear from you.