In Sage Intacct, companies that are registered for Goods and Services Tax (GST) must submit GST returns to the Inland Revenue Authority of Singapore (IRAS). These returns, filed using Forms F5 to F8, allow businesses to report the GST they charge on sales (output tax) and the GST they pay on business purchases (input tax).

Form F5 – The standard GST return, usually filed every quarter.

Form F8 – The final return, filed when a GST registration is cancelled.

Most businesses file these returns through myTax Portal, and strict deadlines apply. Timely and accurate filing helps businesses stay compliant and avoid late filing penalties.

New Stuff: – GST IRAS Audit File Generator in Singapore Localization Suite

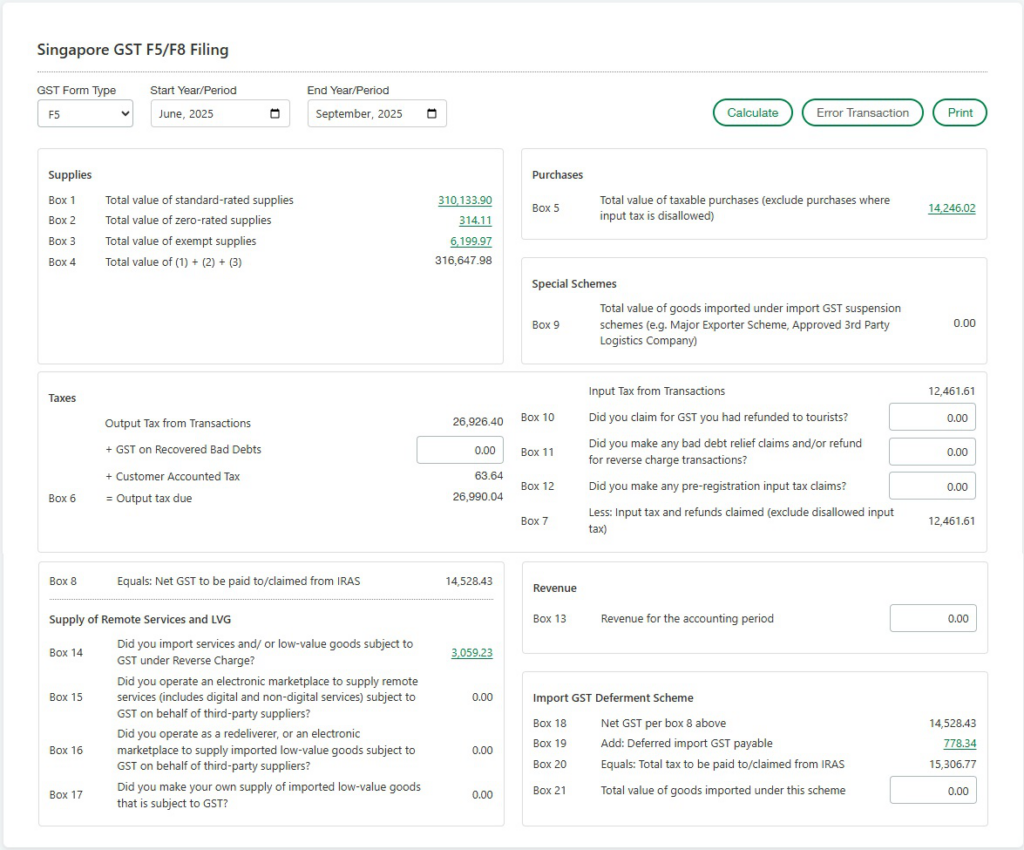

In this blog, we are going to discuss working of GST F5-F8 Filing. The GST F5 return is the standard form that GST-registered businesses in Singapore must file, usually on a quarterly basis. In this report, a business declares: Output tax – GST collected from customers on sales. Input tax – GST paid on eligible business purchases and expenses. The difference between output tax and input tax determines whether the business must pay GST to IRAS (if output tax > input tax) or will receive a GST refund (if input tax > output tax).

Please refer below screenshot of the user interfaces for the “GST F5-F8 Filing”.

The GST F8 return is filed when a business cancels its GST registration in Singapore. This final report ensures that all GST matters are settled before deregistration. In the F8 return, a business must:

- Declare all outstanding sales and purchases up to the cancellation date.

- Account for GST on business assets (like stock or fixed assets) that are still held at the point of deregistration, if input tax was previously claimed on them.

- Calculate the final net GST payable or refundable.

Submission is done online via myTax Portal, and once processed, the business’s GST obligations with IRAS are considered closed.

Together, the GST F5 and F8 reports play a vital role in Singapore’s GST compliance framework. While the F5 return supports ongoing tax reporting during business operations, the F8 return ensures a proper closure of GST obligations when registration ends. Filing them accurately and on time helps businesses remain compliant, avoid penalties, and maintain good standing with IRAS.

About Us: –

Greytrix – a globally recognized and one of the oldest Sage Gold Development Partner is a one-stop solution provider for Sage ERP and Sage CRM organizational needs. Being acknowledged and rewarded for multi-man years of experience, we bring complete end-to-end assistance for your technical consultations, product customizations, data migration, system integrations, third party add-on development and implementation competence.

Greytrix offers unique GUMU™ integrated solutions of Sage 300 with Sage CRM, Salesforce.com, Dynamics 365 CRM and MagentoeCommerce along with Sage 300 Migration from Sage 50 US, Sage 50 CA, Sage PRO, QuickBooks, Sage Business Vision and Sage Business Works. We also offer best-in-class Sage 300 customization and development services and integration services for applications such as POS | WMS | Payroll | Shipping System | Business Intelligence | eCommerce for Sage 300 ERP and for Sage 300c development services we offer, upgrades of older codes and screens to new web screens, latest integrations using Data and web services to Sage business partners, end users and Sage PSG worldwide.Greytrix offers 20+ addons for Sage 300 to enhance productivity such as GreyMatrix, Document Attachment, Document Numbering, Auto-Bank Reconciliation, Purchase Approval System, Three way PO matching, Bill of Lading and VAT for Middle East. The GUMU™ integration for Dynamics 365 CRM – Sage ERP is listed on Microsoft Appsource with easy implementation package.

For more details on Sage 300 and Sage 300c Services, please contact us at accpac@greytrix.com, We will like to hear from you.