There are situations when one would need to include taxes in the Cost itself, especially when one is in the Retail industry where most of the cost and prices of the commodities are inclusive of taxes. Now there arises a situation when one needs to have to have this functionality by default for all the items in the masters as well as transactions. To achieve this, one needs to follow the steps listed below:

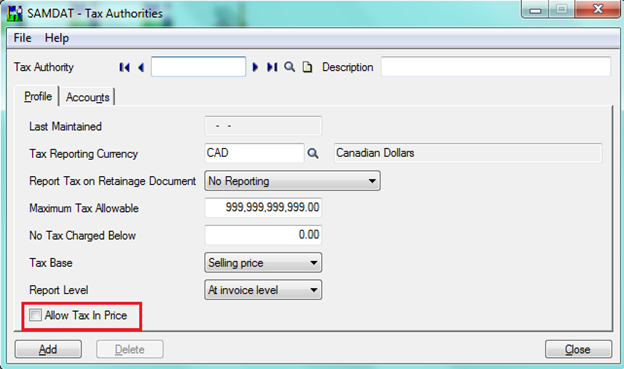

First of all, one has to define in the Tax Masters whether the tax authority is included in the price itself or not. To do so, one has to navigate through

New Stuff : Salesperson Commission Report in Sage 300 ERP

Common Services => Tax Services => Tax Authority

Below is the screenshot of the same, where the check box which says “Allow Tax in Price” has to be ticked.

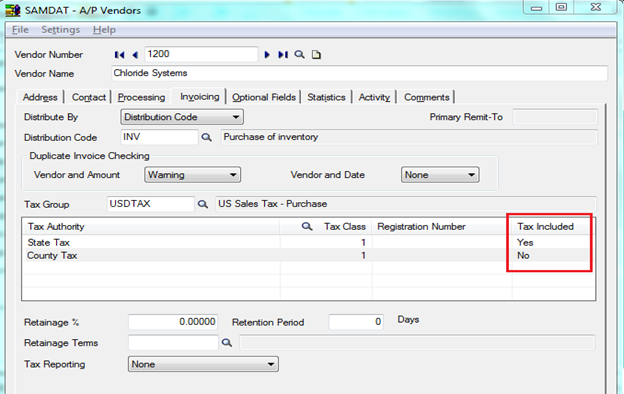

Second step would be to define the same in the Vendor Masters, so that whenever the Vendor is selected the tax included option is by default set to “YES”. Below is the screenshot where the setting changes have to be done in the Vendor Master. One just needs to set the highlighted fields to YES. To do so one need to navigate to Vendor Masters through

Accounts Payable => A/P Vendors => Vendors => Invoicing Tab

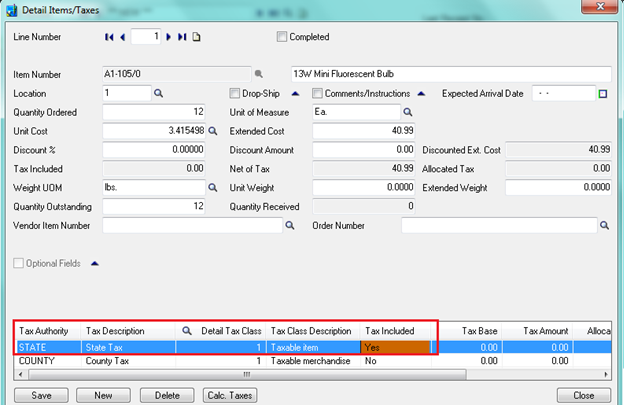

The third step would be to select the Vendor in the PO transactions and then the selected Tax authority will automatically be assigned to the transactions as shown in the below screenshot.

By following these few simple steps one would be able to configure the Tax included option by default to YES in the transactions.

Also Read: 1. Configure Reverse Charge Mechanism for Service Tax in Sage 300 ERP 2. Tax Setting – Allow Tax In Price 3. Taxes in Sage 300 ERP 4. Tax Tracking Report in Sage 300 ERP 5. Tax Recovery Set-up in Sage 300 ERP