In our previous blog, we had discussed about “Default settings for Deposit slip, Receipt & adjustments options in Account Receivable”. In this blog post we will discuss about Default settings for invoices in Accounts Payable module. Using this option we can set the default posting dates & tax related settings which we will maintain at the time of AP invoice transactions.

Sage 300 provides various options which we can set up to get the process of all transactions easier. Once you set up this default option, it will appear while generating AP invoice entry.

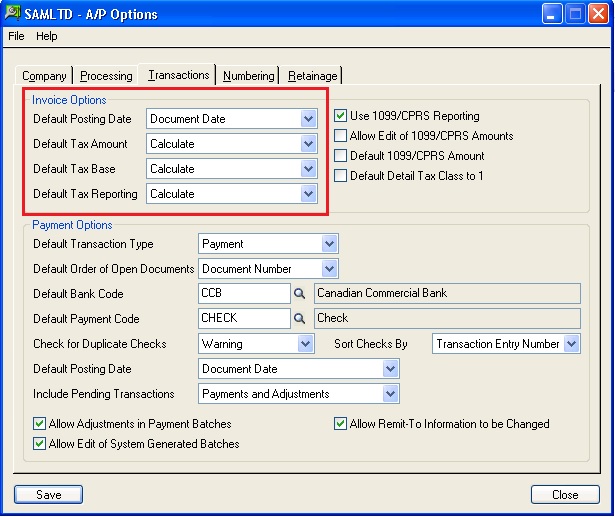

For setting the default options for receipts, navigate to Accounts Payable –>A/P Setup Options–>Transaction Tab–>Invoice Options, refer below screenshot:-

New Stuff: Creating Purchase Order By Using Sales Order details in Sage 300.

• Default Posting Date:-

There are three options to set the default posting date are Document date, Batch date & Session date. Posting date is the date on which the batch is posted to General Ledger. Posting date can be different from the document date.

If you set the default posting date as document date then while creating invoice document posting date will be automatically get as per document date. If select default date as batch date them posting date will be automatically get as per batch date. If select default date set as session date then date will be automatically set as per accpac session date.

You can change the posting date any time of creating AP invoice entry.

• Default Tax amount:-There are three options for default tax amount-

-Calculate

-Enter

-Distribute

If you select ‘calculate’, then the tax amount will be calculated automatically & you cannot change the tax amount. If you select the option as ‘distribute’ & you enter tax amount manually then you need to process from distribute button to calculate taxes as per distribution lines, If you select ‘Enter’ & enter all tax amount manually then you can change total tax amount manually.

• Default Tax Base:-There are three options for default tax amount-

-Calculate

-Enter

-Distribute

If you select calculate then tax base will be calculated automatically & you cannot change the tax amount. If you select as distribute & you enter tax base manually then you need to process from distribute button to calculate taxes as per distribution lines, If you select as Enter & enter all tax base manually then you can change total tax base manually.

If you select calculate, distribute or enter then the tax amount is calculated automatically based on the tax base.

• Default Tax Reporting:- There are three options for default tax amount-

-Calculate

-Enter

-Distribute

If you select calculate option then Accounts Payable will convert all taxes to the tax reporting currency for created documents and their details. If you select as distribute then the total tax reporting amounts converts for each tax authority, then distribute the tax reporting amounts automatically to document details using the Distribute Taxes button. If you select enter then tax reporting amount convert manually for documents and their details.

This will be useful when you have a multi-currency database.

Also Read:

1.Default settings for Invoices in Account Receivable

2.Default Settings for Accounts Payable Payments in Sage 300 ERP

3.G/L Integration in A/P module with options for creating G/L transaction by (Creating and Posting a New Batch)

4.Defaulting Detail Tax class to 1 in Account Payable in Sage 300 ERP

5.Default settings for Receipts in Account Receivable in Sage 300 ERP

Sage 300 ERP – Tips, Tricks and Components

Explore the world of Sage 300 with our insightful blogs, expert tips, and the latest updates. We’ll empower you to leverage Sage 300 to its fullest potential. As your one-stop partner, Greytrix delivers exceptional solutions and integrations for Sage 300. Our blogs extend our support to businesses, covering the latest insights and trends. Dive in and transform your Sage 300 experience with us!