In our last blog, we had discussed about Statutory and Excise Module-Configuration-I in that we discussed about the configuration of Company profile and Location profile. We also learnt to calculate Additional duties .In this blog we will learn how to maintain Vendor, Customer and Item information the trading excise module.

When we are dealing with Central Excise it’s very Crucial task to maintain all information so Sage Accpac provide optional fields to maintain the data.

New Stuff: Vendor item cost and rating

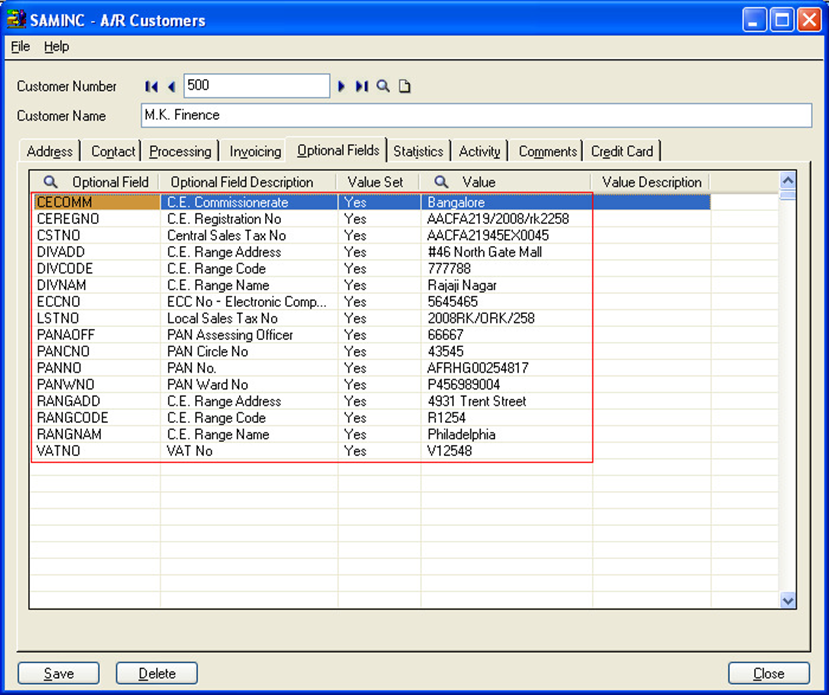

• Maintaining Customer information

Following are optional fields where we store statutory data for Customer like PAN no., Commissionerate, etc . These optional fields are regarding to Excise and trading.

On this screen, you enter Following Details, which are used for various forms of correspondence and reports:

• Excise registration number ( range, division in which this is located)

• Central sales tax (CST) number

• Local sales tax (LST) registration number

• Permanent account number (PAN)

• customers’ tax registration numbers

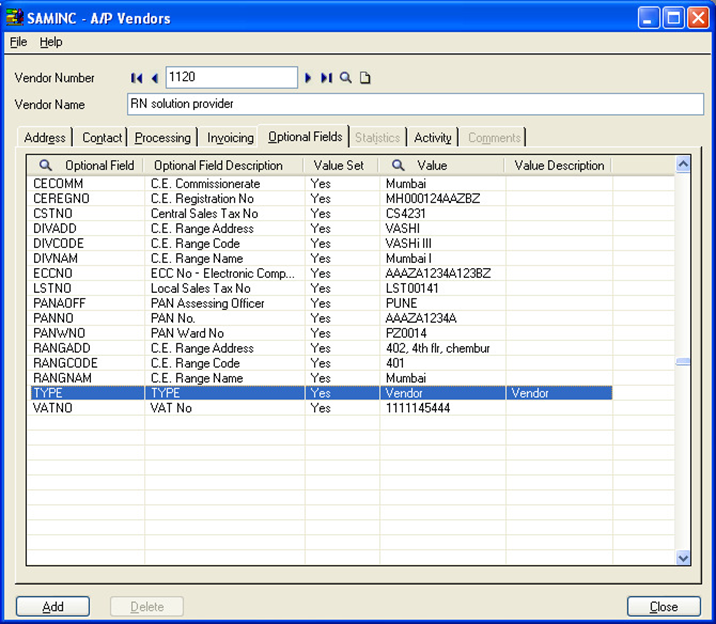

• Maintaining Vendor information

• Maintaining Vendor information

Here also we maintain the information for Vendor like Customer as shown in the below screen shot

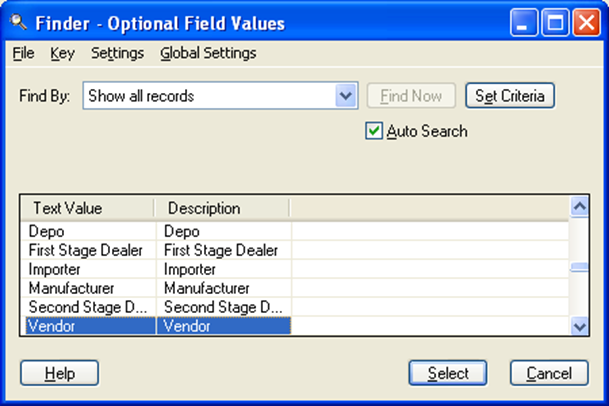

There is one Extra field for Vendor i.e. TYPE.

There can be various following Types of Vendor. Types are as follows.

1. Agent of Manufacturer.

2. Depo

3. First Stage Dealer.

4. Importer.

5. Manufacturer.

6. Second Stage Dealer.

7.Vendor.

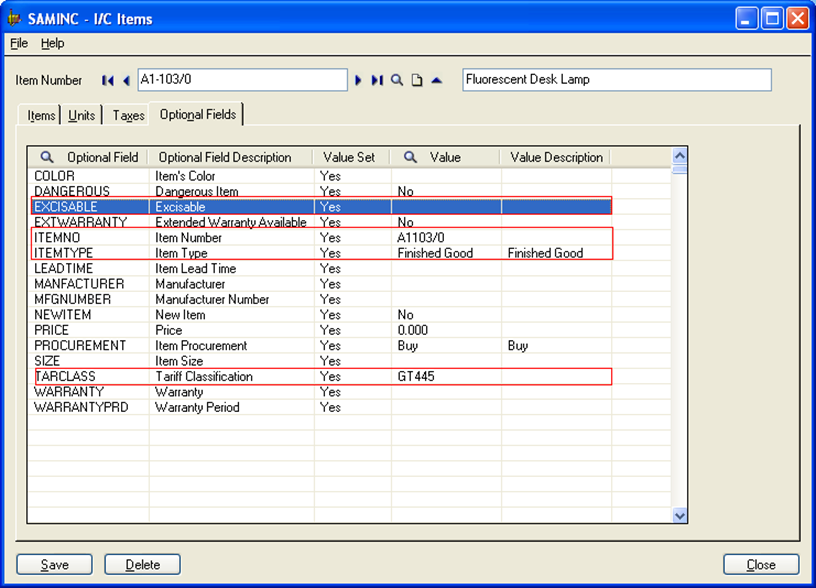

• Maintaining Item information.

This Item Optional Fields are used to Capture Additional information for Item such as Color, Dangerous, Excisable, Warranty, Item no, Item type, Price etc.

Here important optional field is Item type. Following are Item Type which we have to Choose.

1. Capital Goods.

2. Component Item.

3. Finished Good.

4. Finished Goods.

5. Kit.

6. Master Item.

7. Raw Material.

8. SCRAP

In this way we are done with the maintaining the statutory info for vendor and customer in the excise module. In our next blog we will discuss about how we will configure the additional duties as taxes in case of import purchase

Also Read:

1. Taxes in Sage 300 ERP

2. Transfer of Excise duties along with Inventory Transfer in Sage 300 ERP

3. Tax Calculation on the basis of Quantity in Sage 300 ERP

4. Statutory and Excise Module-Configuration-I