We have learned in our earlier blog how to add additional costs like freight, handling charges in case of material vendor & Additional cost vendor

As we all know that there are 2 types of additional costs; which we are going to learn in detail in this blog

A) Material Vendor: – While doing PO, we select a vendor which will be our material vendor from whom we purchase the material.

B) Additional cost vendor: – In case of additional cost there are 2 scenarios.

- Material vendor & additional cost vendor will be different.

- One is material vendor and additional cost vendor will be same.

New Stuff: Migrate Item On Hand Quantity from Business Vision to Sage 300 ERP

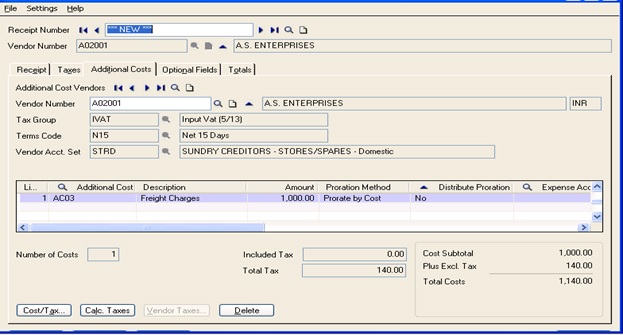

Today we are going to focus on point number “b” in which material vendor and additional cost vendor are same as shown below.

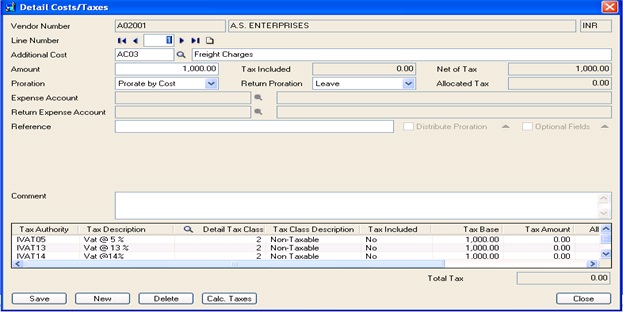

As we can see above, the additional cost of the vendor & material vendor is same because of which, when we enter additional cost, the material tax will apply on that additional cost as highlighted above which actually is not require and it should be non taxable. So with the help of “cost/tax” option we can set the tax as non-taxable for the additional cost as shown below.

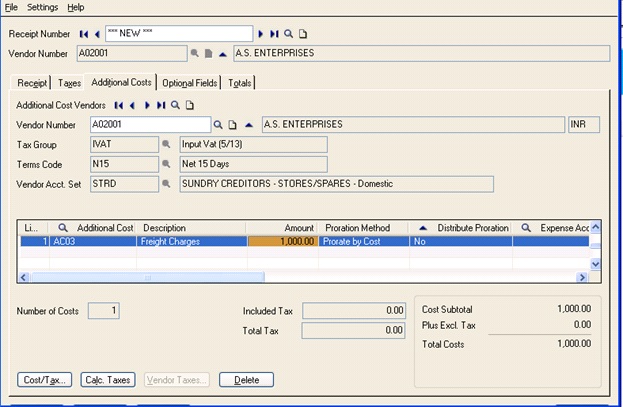

Now before posting the GRN we can see tax amount on additional cost is zero as shown below.

In this way the feature will help for additional cost.

Also Read:

1) GL Handling of Expensed Additional Cost – I

2) GL Handling of Expensed Additional Cost – II

3) Handling Additional Costs and its Variations in Sage 300 ERP

4) Adding Additional Costs to Inventory When They Are Not Know At Time of Receipt in Accpac

5) Landed cost in Sage 300 ERP