Trading Excise is Greytrix Add-On, seamlessly, integrated with Sage 300 ERP, which makes easy for the users to make the automated duty calculation and also helps users to get the required statutory report to track the excisable inventory and duty levied on goods. Also it is important for the users to get their excise return automatically without doing the manual work. Main crucial task is to create XML file to upload E-return on www. ACES.com

New stuff: Rent Receipt Report for Rental industries

In case of online return filing of Central Excise and Service Tax returns, two options are available

1. Feeding the data online in return forms or filling the data offline. Uploading the XML files later.

2. All returns are converted in to XML files either with the use of third party software or by using the government excel utilities.

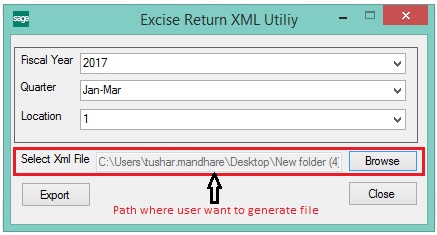

Trading Excise module contains utility that generate xml file with help of data in Trading Excise module of SAGE 300 ERP. It just one way process no need extra hectic user need to just generate that using below screen.

Fields to provide to screen.

1. Fiscal Year: here user need to enter current fiscal year.

2. Quarter: here user need to enter current fiscal year.

3. Location: location on which duty need to calculate.

4. Path: path to generate XML file.

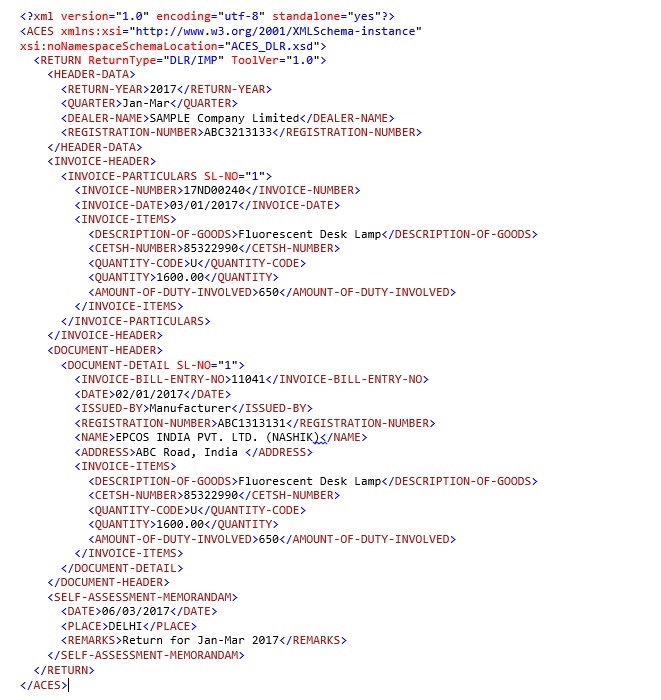

It will create File structure as below

1. Header Data: Contains Return Year, Quarter, Company Name, and Registration Number.

2. Shipment Data: All the information related Shipment and levied duty on that goods.

3. Receipt Data: All the information related Receipt and levied duty on that goods.

With the help of this utility user can easily extract the XML file for all the sales and purchases done for particular quarter and upload on the government site for e-Return.