In the last blog, we introduced the features related with Integration settings. In this blog, we are discussing the Checkbook Draft Payment feature.

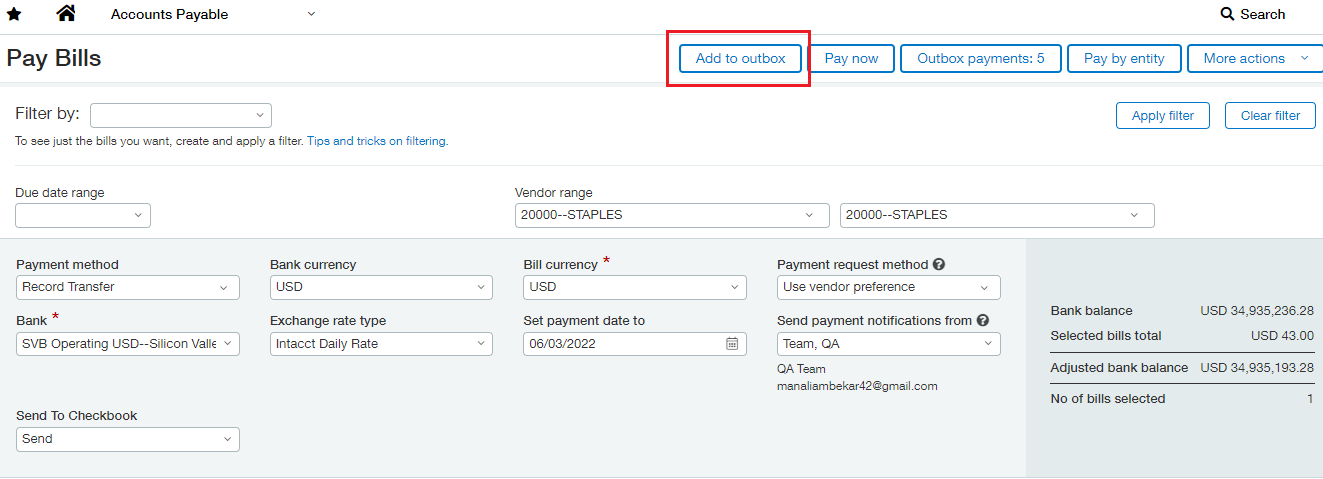

Checkbook Draft Payment is a feature where Bill payment can be saved and paid later when needed. Setting a Bill Payment as Draft is an easy process where User needs to click on “Add to Outbox” button which is in the Accounts Payable Module in Pay Bills Tab.

Advantage

- User can Draft the Bill Payment with All the Payment types that was discussed in the previous Blog i.e. Paper check payment, Digital Transaction, and ACH Direct Deposits.

- The Users can pay the Draft Payments later, which were added to the Draft.

- The Checkbook Draft Payment feature is operates on just click of a button.

How to Draft the Bill Payment in Checkbook?

This feature is in the Account Payable Module.

To see this feature, Go to Account Payable >Pay Bills >Select the Vendor and the other Mandatory Details and Select the Bill >Click on Add to Outbox. By Clicking on this feature, the Bill payment will be added to the Draft.

How to View the Bill Payments which is added to the Draft?

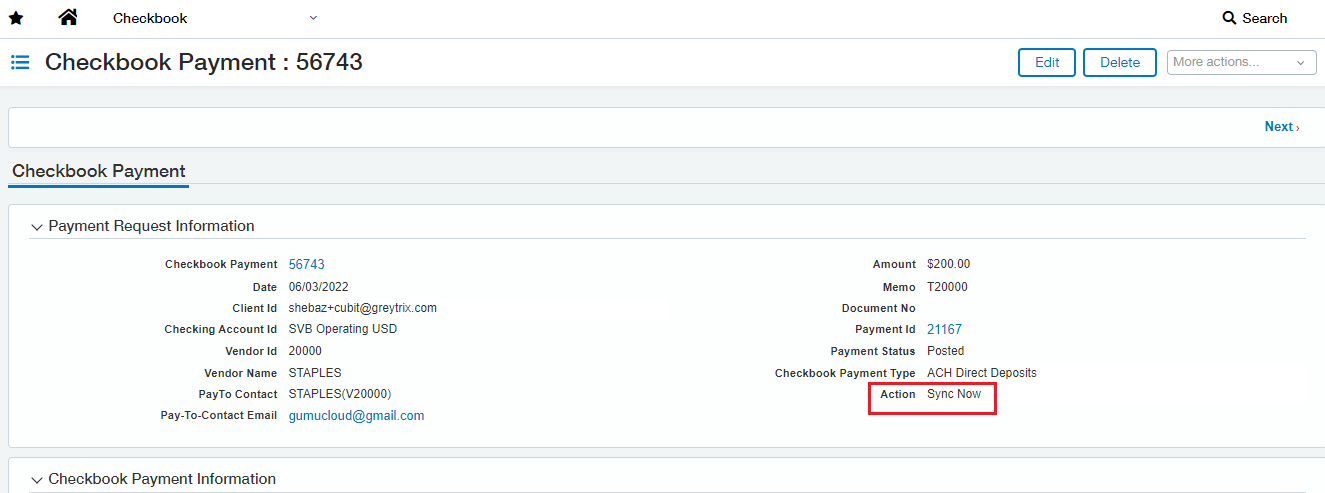

To view the Bill Payments which was added to the Draft is in the Customized application i.e. Checkbook > Checkbook Draft Payments. Users can view all the Drafted Bill payment Which was Added to the Draft. but the Drafted Bill Payment cannot be modified, once it is added to the Draft.

Can Users pay the Bill Payments which were added to the Draft?

Yes, The Users can pay the Draft Bill Payments which were added to the Draft by Clicking on “Confirm Payment” button. So here are the Steps to pay the Draft Payment are

Go to Customized application i.e. Checkbook >checkbook Draft Payments >Select the bill click on Confirm Payments >Yes >The Payment will successfully added to the payment list.

The Draft Payment will be added to the Payment list and can be synced and Sent to Checkbook. The Payment Status will be Draft because it was added to the Draft. So, the Checkbook Draft Payment is the feature in the Checkbook which provide the flexibility to the Users to pay the Bills Payment according to the Business Requirements.

About Us

Greytrix has a wide product range for Sage Intacct- a Cloud ERP. This includes migrations from QuickBooks | Sage 50 | Sage 100 | Sage 300 to Sage Intacct. Our unique GUMU™ integrations include Sage Intacct for Sage CRM | Salesforce | FTP/SFTP | Rev.io | Checkbook | Dynamics 365 CRM | Magento | Rent Manager | Treez | Avalara Avatax | Blackline SFTP. We also offer best-in-class Sage Intacct Development Services, Consulting services, integrated apps like POS | WMS | Payroll | Shipping System | Business Intelligence | eCommerce for Sage Intacct to Sage business partners, resellers, and Sage PSG worldwide. Greytrix constantly develops apps, products, and add-ons to enhance user experience. Sage Intacct add-ons include AR Lockbox File Processing.

Greytrix GUMU™ integration for Sage CRM – Sage Intacct, Sales Commission App for Sage Intacct, and Checkbook.io ACH/Digital Check Payments for Sage powered by GUMU™ are listed on Sage Intacct Marketplace.

The GUMU™ Cloud framework by Greytrix forms the backbone of cloud integrations that are managed in real-time for the processing and execution of application programs at the click of a button.

For more information on Sage Business Cloud Services, please contact us at sagecloud@greytrix.com. We will like to hear from you.