Indian localization in the context of Tax Deducted at Source (TDS) and Goods and Services Tax (GST) involves altering financial and taxation processes to comply with Indian tax laws and regulations. This localization ensures that businesses adhere to the specific requirements of TDS and GST as they operate within India. In Sage Intacct, we have come up with new add-ons namely Tax Deducted at Source (TDS), Goods and Services Tax (GST) and India Pack Reports to help users with the taxation process.

In this blog we will see the introduction of Tax Deducted at Source (TDS), Goods and Services Tax (GST), and India Pack Reports add-ons.

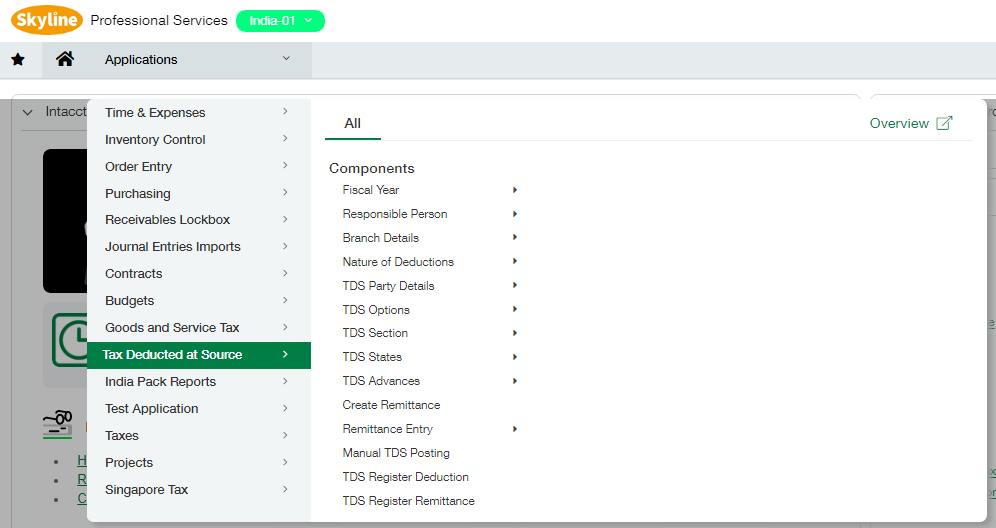

Tax deducted at source (TDS)

In India, Tax deducted at source (TDS) is one of the most frequent methods of collecting income tax from assesses. It is a mandatory requirement under Indian income tax laws for individuals, firms, and organizations.

Payments will only be deducted if they exceed the minimum limit for the TDS category for the specified financial period. Individuals liable to TDS may have income from various sources, including interest, dividends, securities, lottery, horse racing, commissions, brokerage, rent, fees for professional and technical services, and payments to nonresidents.

The percentages will fluctuate between services. Sage has created “Tax Deducted at Source,” an addon for Sage Intacct that simplifies the TDS procedure and allows users to deduct TDS with a few clicks. Sage Intacct also provides reports and forms that comply with the Central Government of India.

The TDS addon automates tax deduction computations across sections and slabs, resulting in complete and accurate reporting.

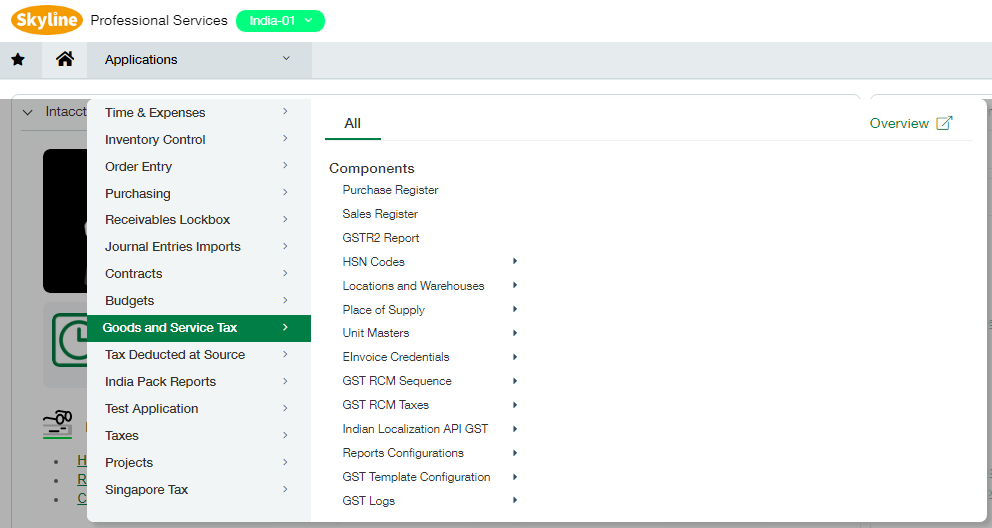

Goods and Service Tax (GST)

The Goods and Services Tax (GST) is a comprehensive, single tax system that replaces multiple indirect taxes levied by central and state governments in India. It aims to simplify the taxation process, create a unified market, and enhance compliance and efficiency. In Sage Intacct, we have introduced the add-on “Goods and Service Tax” that helps users with the taxation details in various reports.

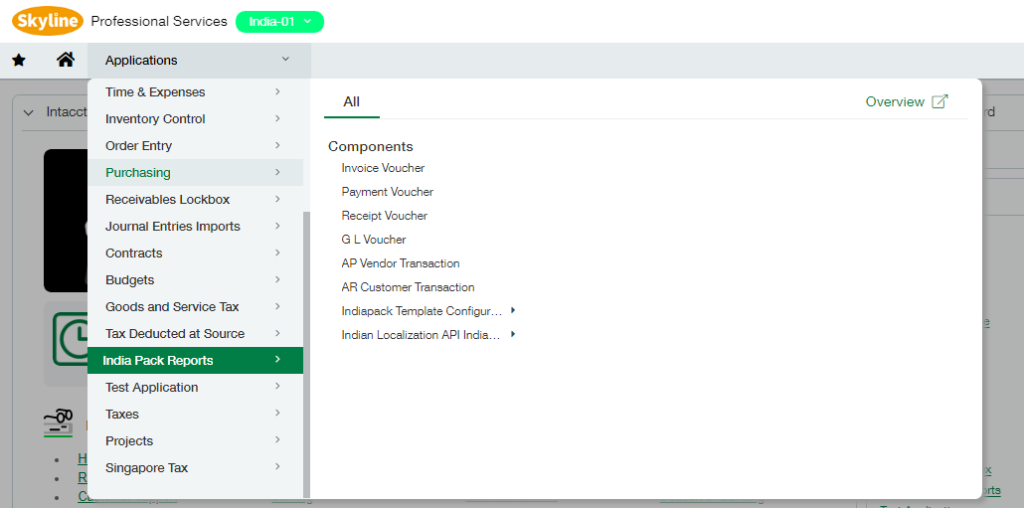

India Pack Reports

India Pack Reports consists of essential registers and vouchers specifically designed to align with the Indian business working style. This package includes a variety of form formats supported by Sage Intacct to enhance business reporting for Indian clients. These forms integrate smoothly into your Intacct system, providing local reporting that meets international standards. The product reports are easy to analyze, and all are accessible under a single entity, saving users time by eliminating the need to navigate through different modules to print them.

About Us

Greytrix – a globally recognized and one of the oldest Sage Development Partner is a one-stop solution provider for Sage ERP and Sage CRM organizational needs. Being acknowledged and rewarded for multi-man years of experience and expertise, we bring complete end-to-end assistance for your technical consultations, product customizations, data migration, system integrations, third party add-on development and implementation competence.

Greytrix has a wide product range for Sage Intacct- a Cloud ERP. This includes migrations from QuickBooks | Sage 50 | Sage 100 | Sage 300 to Sage Intacct. Our unique GUMU™ integrations include Sage Intacct for Sage CRM | Salesforce | FTP/SFTP | Rev.io | Checkbook | Dynamics 365 CRM | Magento | Rent Manager | Treez | Avalara Avatax | Blackline SFTP. We also offer best-in-class Sage Intacct Development Services, Consulting services, integrated apps like POS | WMS | Payroll | Shipping System | Business Intelligence | eCommerce for Sage Intacct to Sage business partners, resellers, and Sage PSG worldwide. Greytrix constantly develops apps, products, and add-ons to enhance user experience. Sage Intacct add-ons include AR Lockbox File Processing.

Greytrix GUMU™ integration for Sage CRM – Sage Intacct, Sales Commission App for Sage Intacct, and Checkbook.io ACH/Digital Check Payments for Sage powered by GUMU™ are listed on Sage Intacct Marketplace.

The GUMU™ Cloud framework by Greytrix forms the backbone of cloud integrations that are managed in real-time for the processing and execution of application programs at the click of a button.

For more information on Sage Business Cloud Services, please contact us at sagecloud@greytrix.com. We will like to hear from you.