Many a times it so happens that, we post a payment without knowing that we are applying payment against the wrong Invoice number of customer. Say for an Instance, a payment of $117 has been posted against the Customer Invoice in Sage 300 ERP (earlier known as Sage Accpac ERP) instead for an Invoice which was supposed to be paid. Thus, for this kind of situations, Sage has provided a Reverse transaction feature, that Users can use to reverse wrong payment transaction posted against an Invoice.

In this blog, we would see how users can use this feature and would explain its steps in detail;

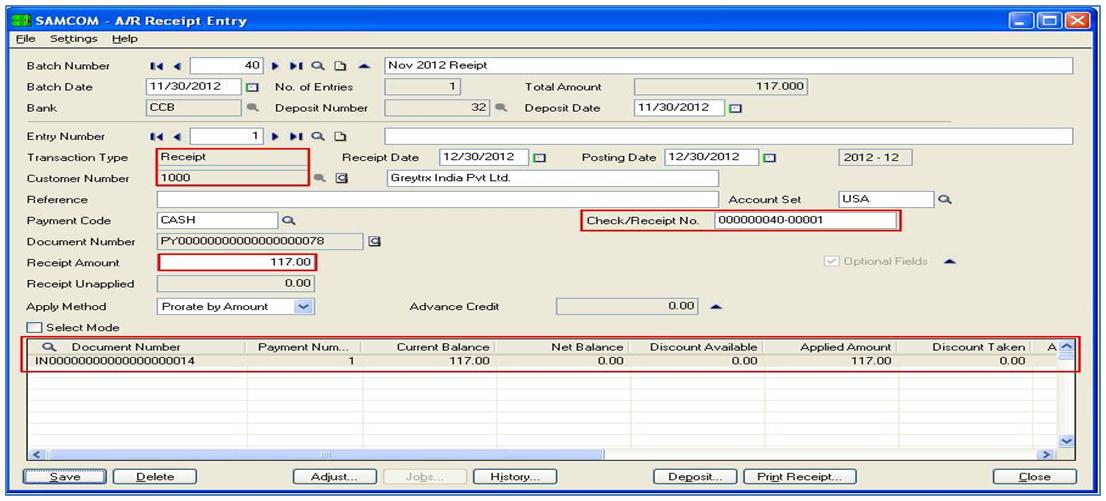

1. Say, we applied a check payment against an existing Invoice of customer.

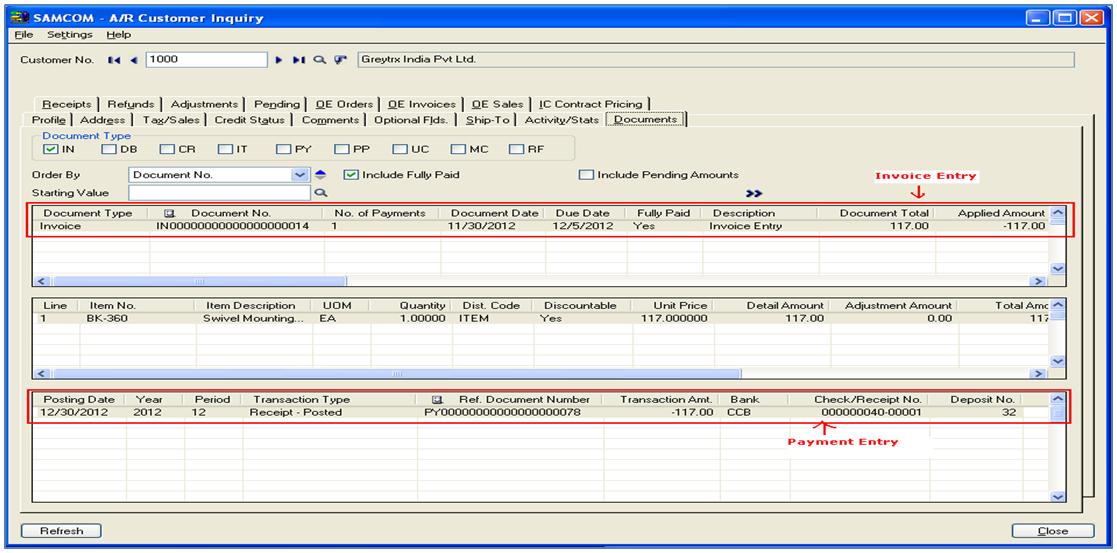

2. After posting this Payment transaction, we would be able to see this transaction in the Customer Inquiry Screen of this customer.

3. Thus, navigate to Accounts receivable -> A/R Customers -> Customer Inquiry. Enter Customer no. users would be able to see Invoice entry transaction and its payment entry transaction.

Now, let us see how Users can reverse this transaction ( the above transaction) by using Reverse Transaction Feature.

To create Reverse Transaction Entry in Sage 300 ERP, follow below mentioned steps:

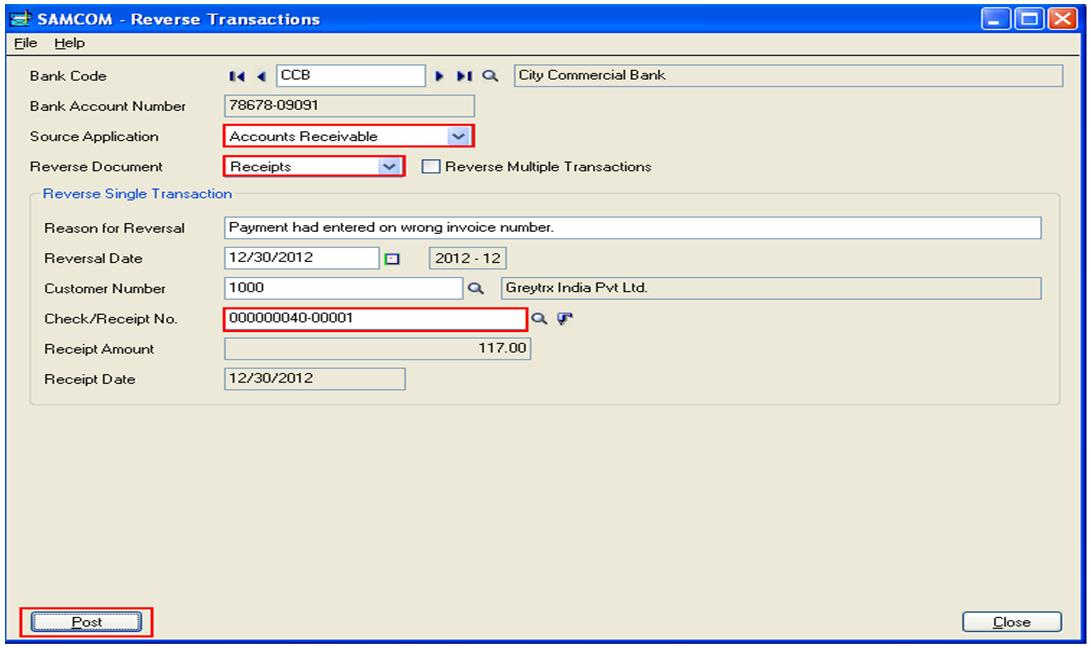

1. Navigate to Common Services -> Bank Services -> Bank Transactions -> Reverse Transactions.

2. Enter header information for the reversal:

* Bank Code: Select Bank code for processed transaction that user want to reverse.

* Source Application: Use this field to specify program from where the transaction originated. You can select Accounts Receivable, Accounts Payable, Payroll, Bank Services etc.

* Reverse Document: This field is available to user for selected Accounts Receivable or Bank Services as the source application. Depending on the type of transaction user want to reverse, select Payments or Receipts.

3. Reverse single transaction, identify it by filling in the following fields:

* Reason for Reversal: Use this field to explain why you are reversing transaction.

* Reversal Date: Reversal date determines the year and period for which the reversal is posted.

4. Enter or select customer number.

5. Use Finder to select the Check/Receipt No.

6. Once you specify a payment, receipt, or bank entry, program displays the date and amount of transaction.

7. After click on Post button a screens pops-up with the message “Reverse transaction completed successfully”.

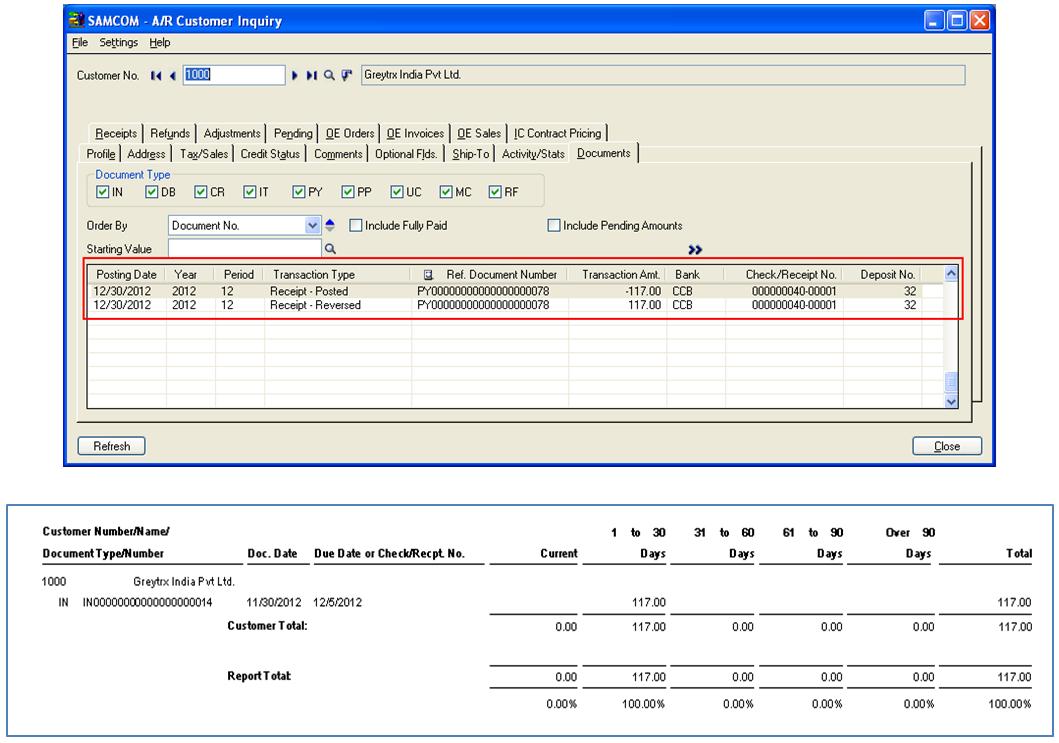

Now, navigate to Accounts receivable -> A/R Customers -> Customer Inquiry, users can view the receipt entry is reversed and closed Invoice was reopened.

Hope now you would be able to Reverse transactions that were mistakenly posted in Sage 300 ERP with wrong amounts.