During audits your auditor may ask you to reconcile the TDS amount with the general ledger accounts. The general accounts are used in the respective transactions where TDS is being deducted; also this account can be used to calculate balance sheet or income statement.

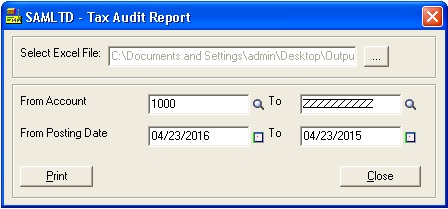

In Sage 300 ERP we have customized such kind of reports for one of our clients that can help us reconcile the TDS amounts with the corresponding general ledger accounts. Purpose of the report is to display the general ledger accounts and the TDS amounts deducted in front of each of them along with the debit and credit amount. The Report UI will look as shown below.

New Stuff:Migrate Item Pricing from Sage 50 US (Peachtree) to Sage 300 ERP

The UI has a filter criteria of “from” and “to” Account Number along with the Posting Date.

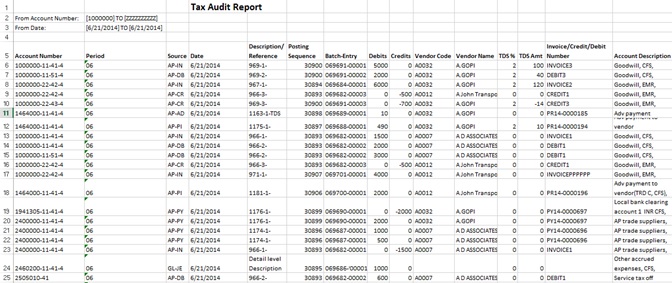

The report has the below columns:

Account number and its description

Source Type

Date

GL Batch- Entry Number

Vendor and its Name

Debit Credit Amount

Document Number

TDS Percentage

TDS Amount

Also this report gives us the detailed list of all the transaction of AP, GL-Journal Entry and PO with and without TDS. This report also displays tax accounts along with the corresponding TDS and gives us the detailed line wise proration of TDS amount.

The report will be generated in excel format. Output of the report will look like the following:

Thus this report can turn out to be critical when it comes to reconciling the TDS returns before you file it.

Also Read:

1. Greytrix TDS with PJC Integration

2. Multicurrency in Greytrix TDS

3. Configuring Greytrix TDS in Sage 300 ERP – II

4. Manual TDS Posting in Greytrix TDS Module for Sage 300 ERP

5. Configuring Greytrix TDS in Sage 300 ERP – III

Sage 300 ERP – Tips, Tricks and Components

Explore the world of Sage 300 with our insightful blogs, expert tips, and the latest updates. We’ll empower you to leverage Sage 300 to its fullest potential. As your one-stop partner, Greytrix delivers exceptional solutions and integrations for Sage 300. Our blogs extend our support to businesses, covering the latest insights and trends. Dive in and transform your Sage 300 experience with us!