You may have often come across a scenario wherein you have received some payment from the customer after the due date or late and at that particular moment you are not aware for what the reason the payment is received. You may get into confusion as to how to record such transaction into your accounting system.

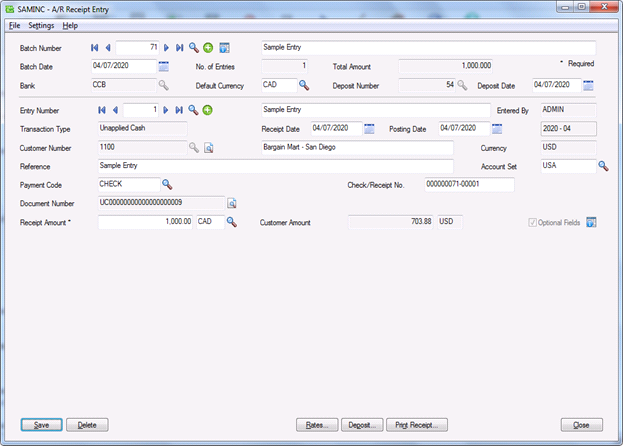

Sage 300 ERP is the ultimate solution for handling such transactions. It allows you to record transactions under the ‘receipt form’ using transitions type as unapplied cash. You too may have received cash from your customer, with no indication of the transaction they are paying for. Sage 300 ERP allows you to record such transactions and resolve this problem efficiently.

In simple terms, unapplied cash is the receipt which does not have any specific customer transaction related to it

New Stuff: How Deposit date in AR receipt entry plays important role in Bank Reconciliation

The journal entry passed during such transaction is

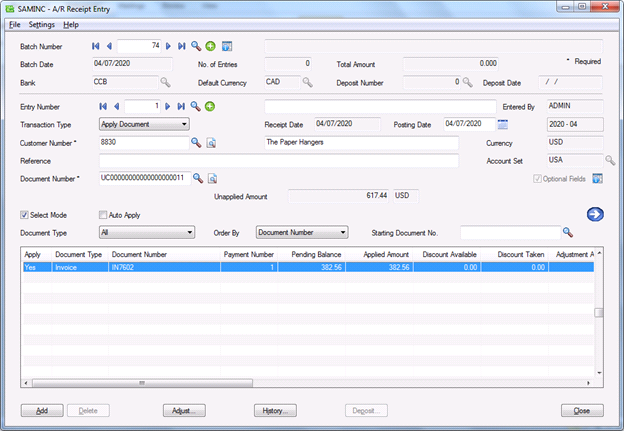

Processing Unapplied Cash Transactions When you receive payments from your customers with no indication of what they are paying, you enter the receipt as an Unapplied Cash transaction type in a receipt entry form. This step lets you record the receipt in your Accounts Receivable system and post it to the customer’s account so you can apply it to the appropriate document later.

Then we need to post the batch from the receipt batch list.

Then we need to post the batch from the receipt batch list.

Now let us invoice that customer.

Now, in this case, the customer had already made the payment of 1000 INR by means of unapplied cash.

So now we will adjust that amount of the unapplied cash. The amount of unapplied cash is adjusted against the invoice which was raised.

You might feel that the unapplied cash transition works similarly as the pre-payment transaction, but I would like to bring to your notice the only difference between the two:

In case of pre-payment the account which gets credited in the accounts receivable is the ”Prepayment liability” and in case of the payment received in the form of unapplied cash the “Receivable control “ account gets credited.

This is how we can solve the issue of posting the transactions which are related to the payments received from the customers without any reference provided by him.

About Us

Greytrix a globally recognized Premier Sage Gold Development Partner is a one stop solution provider for Sage ERP and Sage CRM needs. Being recognized and rewarded for multi-man years of experience, we bring complete end-to-end assistance for your technical consultations, product customizations, data migration, system integrations, third party add-on development and implementation expertise.

Greytrix offers unique GUMU™ integrated solutions of Sage 300 with Sage CRM, Salesforce.com and Magento eCommerce along with Sage 300 Migration from Sage 50 US, Sage 50 CA, Sage PRO, QuickBooks, Sage Business Vision and Sage Business Works. We also offer best-in-class Sage 300 customization and development services and integration service for applications such as POS | WMS | Payroll | Shipping System | Business Intelligence | eCommerce for Sage 300 ERP and in Sage 300c development services we offer services such as upgrades of older codes and screens to new web screens, newer integrations using sdata and web services to Sage business partners, end users and Sage PSG worldwide. Greytrix offers over 20+ Sage 300 productivity enhancing utilities that we can help you with such as GreyMatrix, Document Attachment, Document Numbering, Auto-Bank Reconciliation, Purchase Approval System, Three way PO matching, Bill of Lading and VAT for Middle East.

For more details on Sage 300 and 300c Services, please contact us at accpac@greytrix.com. We will be glad to assist you.