Today, we are going to discuss a new topic which is a part of Indian excise & the same is called as 57F4 & Subcontracting process. For example when we issue a material to any subcontractor we need to keep a track on what type of material is being issued, How much of quantity is being utilize, Pending balance of Quantity & when we are going to receive the material after the processing is completed by subcontractor & in order to keep close monitoring on this process, 57F4 process was implemented.

When we send a material to subcontractors for processing we are not required to pay any excise duty because while purchasing of this material we have already taken credit of it & when we send a material outside a factory premises for processing we need to send it with 57F4 Challan

New Stuff: Migrate Sales Invoice from Sage Business Vision to Sage 300 ERP

Now let’s see how the same can be configure in Sage 300 ERP

Example: – Here, we are subcontractor & we receive material From X Company for further processing with a tracking Challan number which we consider as 57F4 Challan.

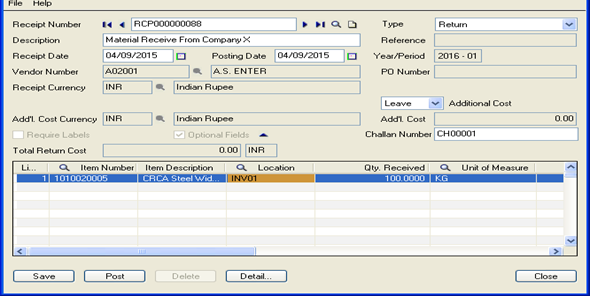

To define this process lets navigate to Excise Module –> M/E Transaction –> 57F4 Process –> Excise Receipt.

As shown in above screen, this is an inward transaction with Challan number against the materials that we have received from X company, wherein we have to update information in fields like description, Vendor, Challan number, item number, location, Qty.

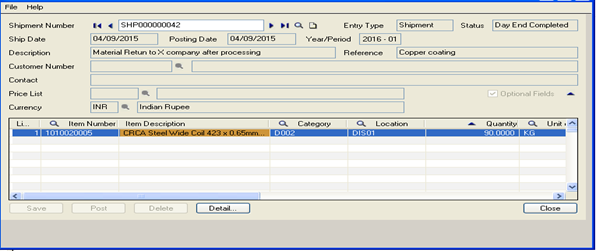

Now we have already receive “100” Kg of material against Challan number “CH00001” & after processing that material we are going to send it back to X company & we have to close the Challan as well against which we have shown the inward transaction so let’s navigate to Excise Module –> M/E Transaction –> 57F4 Process –> Excise Shipment

As shown above after processing we are ready to send the material back to X Company so we will update the same from excise shipment screen & will enter some details like item number, Location, Quantity & as we can see out of 100 Kg we are sending back 90 Kg after processing. But here the most important is closing of Challan & the same is shown below.

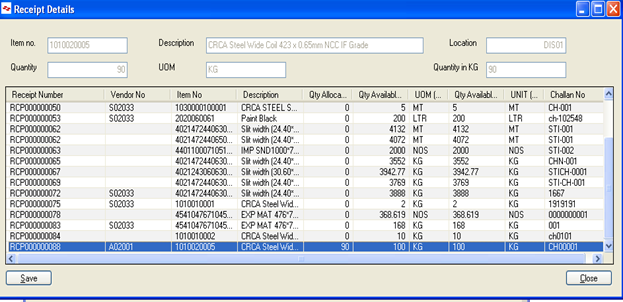

After updating details in the Excise shipment, the user will click on F6 button which will show all Challan against which we have received the material from X company & at the end we can see the Challan number “CH00001”with Quantity Available (Basic) which is 100 Kg & the allocated quantity is 90 kg.

After updating details in the Excise shipment, the user will click on F6 button which will show all Challan against which we have received the material from X company & at the end we can see the Challan number “CH00001”with Quantity Available (Basic) which is 100 Kg & the allocated quantity is 90 kg.

And for processing of material we can book an invoice from Accounts Payable –> AP Transaction–>Invoice Entry

Also Read:

1. Excise Module- Tax Configuration

2. Statutory & Excise Module-Configuration-2

3. Statutory and Excise Module-Configuration-I

4. Transfer of Excise duties along with Inventory Transfer in Sage 300 ERP