E Invoicing is a process of validating invoices electronically through GST Network (GSTN) for further use on common GST portal.

Benefits of E-Invoicing:

1. Reduces time, cost and effort of filing invoices manually.

2. Prevents user from errors, frauds and losses.

3. Improvement in account reconciliation.

In this blog, we are going to know E-Invoice filing from Sage 300 ERP.

E-Invoice in Sage 300 ERP:

Sage 300 ERP provides solution for filing E-Invoice/s on a single button click which reduces efforts of the user on a larger scale in filing invoices manually.

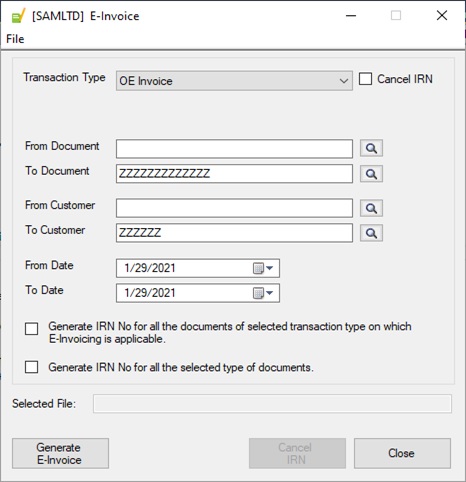

Below screen shot is the glimpse of E-Invoice UI which will be added under GST Module in the Sage 300 ERP.

New Stuff: Advantage of specifying Customer Account Set in OE Templates

Functionalities in E-Invoice

Following are the major functionalities of E-Invoice UI.

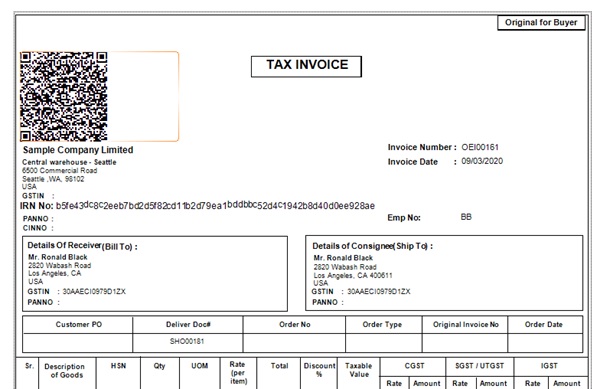

- Filing E-Invoice on a button click: This functionality user\module user can select & file desired invoice using the filters Transaction Type, Document, Customer and Date. On clicking Generate E-Invoice button, selected invoices will sent to E-Invoice System and in response to that IRN (Invoice Reference Number) along with digitally Signed Invoice & Signed QR code will be received from E-Invoice system and same will be stored in the Sage 300 ERP database and the same will get printed in respective report forms over the time.

- Filing E-Invoice using CSV: This feature enables user to export the desired invoices from file menu in a CSV format using all the filters mentioned above. Later on user can upload the exported file on their respective GSP portal or NIC portal.

- Cancel filed Invoice: By checking Cancel IRN checkbox user can cancel the invoices which are already filed. This feature can be used by selecting desired filters and clicking Cancel IRN button.

Below screen shots shows sample TAX INVOICE form where IRN and Signed QR Code which is received from E-invoice system is stored and printed:

About Us

Greytrix – a globally recognized and one of the oldest Sage Development Partners is a one-stop solution provider for Sage ERP and Sage CRM organizational needs. Being acknowledged and rewarded for multi-man years of experience, we bring complete end-to-end assistance for your technical consultations, product customizations, data migration, system integrations, third-party add-on development, and implementation competence.

Greytrix offers unique GUMU™ integrated solutions of Sage 300 with Sage CRM, Salesforce(listed on Salesforce Appexchange), Dynamics 365 CRM, and Magento eCommerce, along with Sage 300 Migration from Sage 50 US, Sage 50 CA, Sage PRO, QuickBooks, Sage Business Vision and Sage Business Works. We also offer best-in-class Sage 300 customization and development services and integration services for applications such as POS | WMS | Payroll | Shipping System | Business Intelligence | eCommerce for Sage 300 ERP and for Sage 300c development services we offer, upgrades of older codes and screens to new web screens, latest integrations using Data and web services to Sage business partners, end users and Sage PSG worldwide.

Greytrix offers 20+ add-ons for Sage 300 to enhance productivity such as GreyMatrix, Document Attachment, Document Numbering, Auto-Bank Reconciliation, Purchase Approval System, Three-way PO matching, Bill of Lading, and VAT for the Middle East. The GUMU™ integration for Dynamics 365 CRM – Sage ERP is listed on Microsoft Appsource with an easy implementation package.

The GUMU™ Cloud framework by Greytrix forms the backbone of cloud integrations that are managed in real-time for processing and execution of application programs at the click of a button.

For more details on Sage 300 and Sage 300c Services, please contact us at accpac@greytrix.com, We will like to hear from you.