Till now we are very much familiar with our product GST in Sage 300 ERP. There is one more feature added in our module GST i.e. E-Way Bill (Electronic Way Bill). Before proceeding with the functionality of the feature in GST, let us get some simple aspects cleared that will help in understanding e-Way Bill in more detail.

What is e-Way Bill?

E-Way bill is a unique bill number, which is electronically generated by government for the transportation of goods from one place to another (inter-state or intra-state) and value of that goods should be more than INR 50,000.

From when e-Way Bill came into picture?

Generation of the e-Way Bill has been made compulsory from 1st April 2018.

Who will generate e-Way Bill?

- GST Registered Person

- Unregistered Person

- Transporter

When to use e-Way Bill?

E-Way Bill should be generated before the movement of goods begins and the value of goods should be above INR 50.

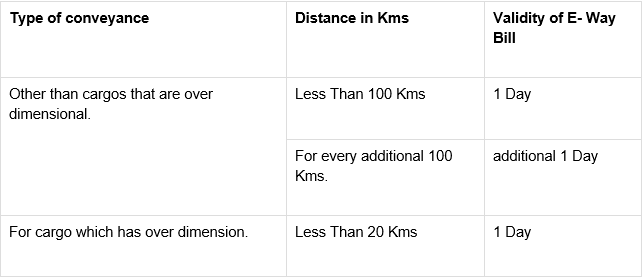

Validity of E-way bill can be extended.

Cases when e-Way bill is not required

- The mode of transport is non-motor vehicle.

- If transit cargo is transported to or from Nepal or Bhutan.

- Goods transported from Customs port, airport, air cargo, etc.

- E-Way Bill is not required to be filled where the distance between the consigner/consignee and the transporter is less than 50 Kms and transport is within the same state.

- Goods transported under Customs supervision/under customs seal.

- Goods transported under Customs Bond from ICD to Customs port or from one custom station to another.

- Movement of goods caused by defense formation under Ministry of defense as a consignor or consignee

- Empty containers are being transported.

- Shipper transporting goods to or from place of business and a weighbridge for weighment within a distance of 20 kilometers, along with Delivery challan.

- Goods being transported by rail where the Consignor of goods is the Central Government, State Governments or a local authority.

- Goods specified as exempt from E-Way bill requirements in the respective State/Union territory GST Rules.

- Goods that comes under list of exempt supply of goods, Annexure to Rule 138(14), goods treated as no supply as per Schedule III, and Certain schedule to Central tax Rate notifications.

Documents or Details required to generate e-Way Bill

- By road transport – Transporter ID or Vehicle number.

- Transport by rail, air, or ship – Transporter ID, Transport document number, and date on the document.

- Invoice/ Bill of Supply/Challan related to the consignment of goods.

Working of e-Way Bill in GST

- Electronically generated e-Way bill number for each transaction will be stored in the database and can be printed in the form of e-Way bill register over the time.

Note: In future blog we will post about working of E-Way Bill functionality along with E-Way Bill register in Sage 300 ERP.

About Us:-

Greytrix – a globally recognized and one of the oldest Sage Gold Development Partner is a one-stop solution provider for Sage ERP and Sage CRM organizational needs. Being acknowledged and rewarded for multi-man years of experience, we bring complete end-to-end assistance for your technical consultations, product customizations, data migration, system integrations, third party add-on development and implementation competence.

Greytrix offers unique GUMU™ integrated solutions of Sage 300 with Sage CRM, Salesforce.com, Dynamics 365 CRM and Magento eCommerce along with Sage 300 Migration from Sage 50 US, Sage 50 CA, Sage PRO, QuickBooks, Sage Business Vision and Sage Business Works. We also offer best-in-class Sage 300 customization and development services and integration services for applications such as POS | WMS | Payroll | Shipping System | Business Intelligence | eCommerce for Sage 300 ERP and for Sage 300c development services we offer, upgrades of older codes and screens to new web screens, latest integrations using Data and web services to Sage business partners, end users and Sage PSG worldwide. Greytrix offers 20+ addons for Sage 300 to enhance productivity such as GreyMatrix, Document Attachment, Document Numbering, Auto-Bank Reconciliation, Purchase Approval System, Three way PO matching, Bill of Lading and VAT for Middle East. The GUMU™ integration for Dynamics 365 CRM – Sage ERP is listed on Microsoft Appsource with easy implementation package.

For more details on Sage 300 and Sage 300c Services, please contact us at accpac@greytrix.com, We will like to hear from you.