In the complex structure of the Goods and Services Tax (GST) in India, businesses with multiple branches or units often face challenges in distributing input tax credits efficiently. This is where the Input Service Distributor (ISD) mechanism plays a crucial role. Designed to streamline the allocation of input tax credit (ITC) across different branches of an organization, ISD helps ensure compliance and effective utilization of tax credits.

New Stuff :- Customization of Default commits quantity on greymatrix order entry screen.

What is an Input Service Distributor (ISD)?

An Input Service Distributor (ISD) is a registered GST Tax Payer who receives Input Services Invoices and then distributes the eligible Input Tax Credit (ITC) to its units or branches. The recipients of this ITC must be registered under the same PAN, and can be located in different states with different GST Numbers across India.

Key Features of ISD

- Centralized Billing: Services are invoiced to the ISD unit, even though the benefits are shared across multiple branches.

- Credit Distribution: ITC is distributed to respective branches as per their Turnover of the year.

- Separate Registration: The ISD obtains a separate GST registration, different from the normal taxpayer GST registration.

- Applicable Only to Services: The ISD mechanism applies only to input services, not goods or capital goods.

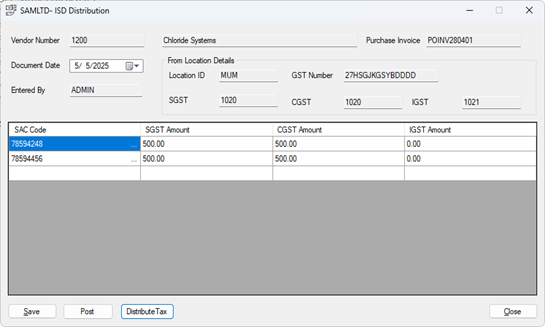

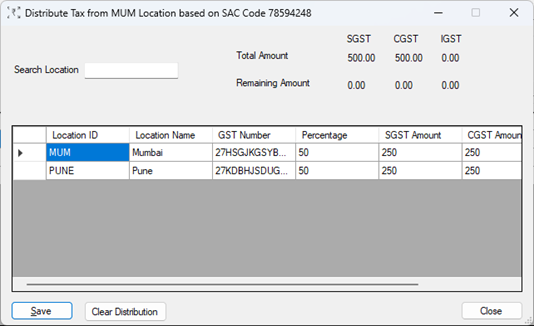

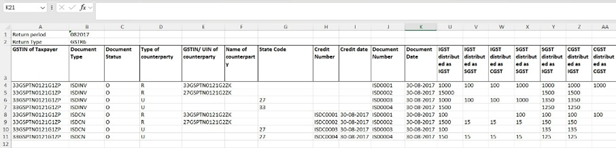

To handle this concept in our Sage 300 ERP, we have introduced this provision in our Goods & Service Tax Addon. With this feature, user will be able to easily distribute the ITC to its various branches based on the ISD Registration and GST number. We have introduced a distribution screen that will have help user identify the total taxes paid and distribute the same based on Turnover and required percentage. Below is the screen that helps distribute the taxes.

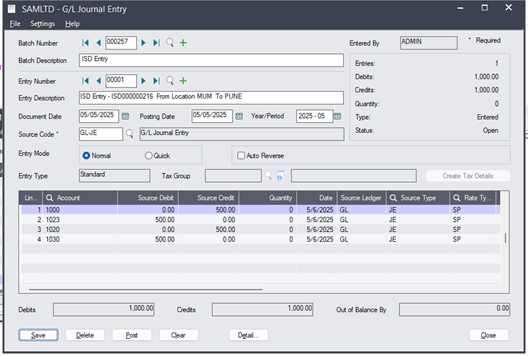

Further to this, an ISD Invoice will be generated on the click of Post button, a GL-JE will be created that will allocate taxes to the accounts that will be mapped in the Setup screens.

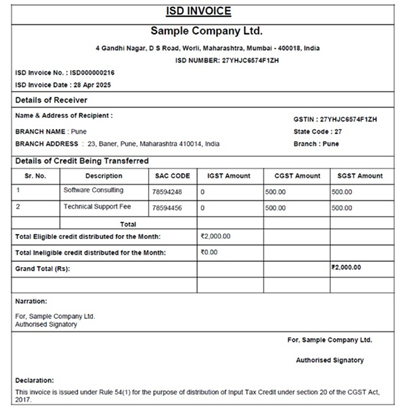

These ISD Invoices will also be available in report format which are in compliance with Rule 54(1) along with readiness of data required for filing GSTR-6 (Return for ISD).

The Input Service Distributor mechanism is a powerful tool for businesses operating across multiple locations. It not only facilitates the appropriate use of input tax credits but also contributes to smoother GST compliance. However, accurate implementation, proper documentation, and a clear understanding of the rules are essential to avoid penalties and optimize benefits.

About Us:-

Greytrix – a globally recognized and one of the oldest Sage Gold Development Partner is a one-stop solution provider for Sage ERP and Sage CRM organizational needs. Being acknowledged and rewarded for multi-man years of experience, we bring complete end-to-end assistance for your technical consultations, product customization, data migration, system integration’s, third party add-on development and implementation competence.

Greytrix offers unique GUMU™ integrated solutions of Sage 300 with Sage CRM, Salesforce.com, Dynamics 365 CRM and MagentoeCommerce along with Sage 300 Migration from Sage 50 US, Sage 50 CA, Sage PRO, QuickBooks, Sage Business Vision and Sage Business Works. We also offer best-in-class Sage 300 customization and development services and integration services for applications such as POS | WMS | Payroll | Shipping System | Business Intelligence | eCommerce for Sage 300 ERP and for Sage 300c development services we offer, upgrades of older codes and screens to new web screens, latest integration’s using Data and web services to Sage business partners, end users and Sage PSG worldwide. Greytrix offers 20+ addons for Sage 300 to enhance productivity such as GreyMatrix, Document Attachment, Document Numbering, Auto-Bank Reconciliation, Purchase Approval System, Three way PO matching, Bill of Lading and VAT for Middle East. The GUMU™ integration for Dynamics 365 CRM – Sage ERP is listed on Microsoft Appsource with easy implementation package.

For more details on Sage 300 and Sage 300c Services, please contact us at accpac@greytrix.com, We will like to hear from you.