Sage 300 (formerly Sage Accpac ) ERP has the flexibility to support the unique needs of multi-site and global organizations. For global organizations with offices in India we have developed a must-need Tax Solution “Greytrix TDS (Tax Deducted at Source) for Sage 300 ERP”

Get ready for a First Look of our Greytrix TDS for Sage 300 (Accpac) ERP with enhanced features. In this version Greytrix TDS modules will be available in portal with all these features.

Tax deducted at Source is an add-on for Sage Accpac ERP enabling organizations to maintain complex requirements on Tax Deducted at Source and generates reports and forms required by the Central Government including eTDS file. Tax deducted at Source automates your tax deduction calculations under various sections and slabs and provides you comprehensive, accurate and detailed reporting.

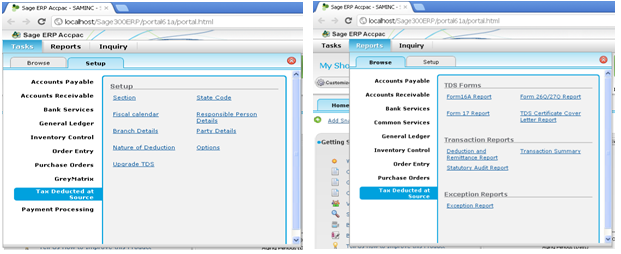

Overview of the new Greytrix TDS on portal: We will first see user interface links of Greytrix TDS provided in the Sage 300 Portal.

You can easily Generate TDS related Reports like:

You can easily Generate TDS related Reports like:

- Form 16A

- Form 26Q/27Q

- Deduction and remittance

- TDS challan

- E-TDS quarterly return

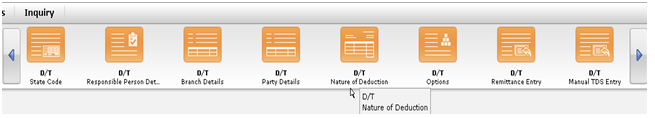

Lets now see the shortcut navigation tab of Greytrix TDS for Easy access of User Interface in Sage 300 ERP Portal

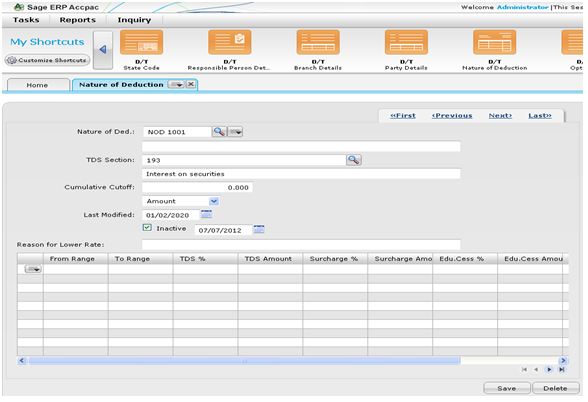

Now lets look at user interface of “Nature of deduction” from portal. User can easily access the entire screen same like earlier version of TDS but with new advanced look.

Now lets look at user interface of “Nature of deduction” from portal. User can easily access the entire screen same like earlier version of TDS but with new advanced look.

Do provide us with you feedback/suggestion on sage@greytrix.com . We would be glad to make additions to our existing list.

Do provide us with you feedback/suggestion on sage@greytrix.com . We would be glad to make additions to our existing list.