Tax deducted at Source (TDS) is one of the modes for collecting income tax from assesses. Such collection of tax is effected at the source when income arises.

Greytrix TDS module can be used by both Government and Non-Government organization.

In this blog we will go through the configuration of Greytrix TDS module.

1. After installing Greytrix TDS, user has to activate TDS module in Sage 300 ERP.

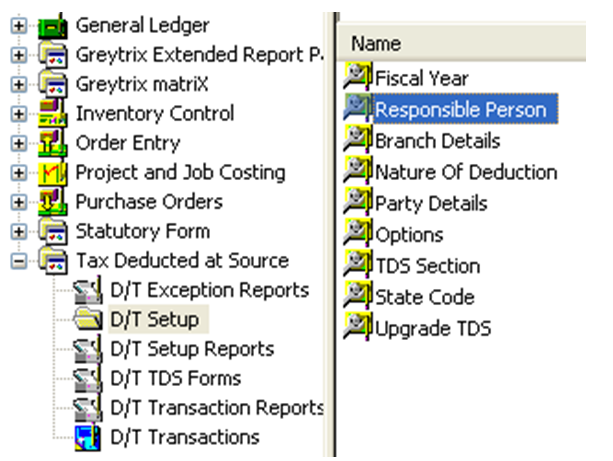

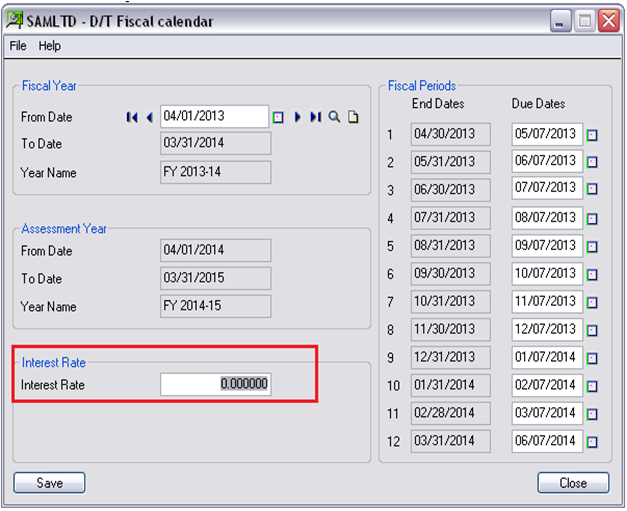

2. Once, activated successfully, navigate to Sage 300 ERP >> Tax Deducted at Source >> DT Setup

3. Setting up TDS information is mandatory for smooth functioning of Greytrix TDS.

New Stuff: Greytrix TDS with PJC Integration

To configure TDS following things has to be taken care;

Fiscal Year: User can maintain Fiscal year information by clicking on TDS >> DT setup >> Fiscal year. Fiscal year allow user to enter from Date and would calculate the rest of the dates based on from Date.

NOTE: Only 1 Fiscal Year Name is allowed i.e. there will always be a single record of a Particular Year.

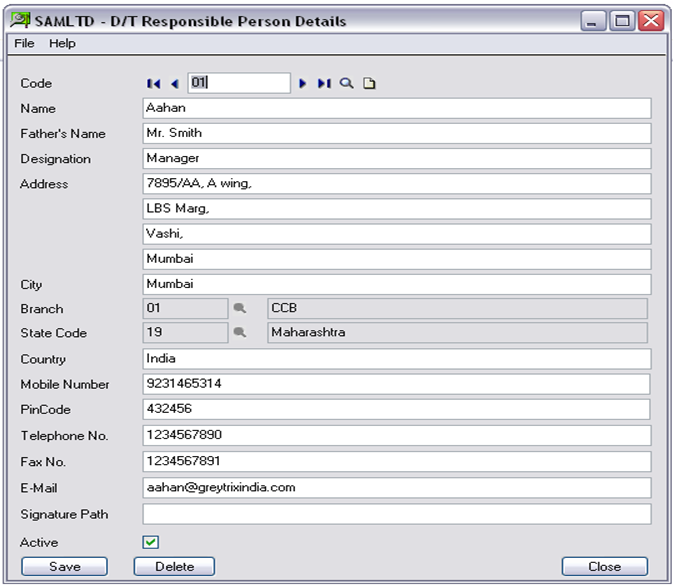

Responsible Person: You need to display Responsible person name and designation on Form Return reports. This person is responsible to deduct the tax from service provider. “Responsible person” information can be maintained by clicking on TDS >> setup >> Responsible person.

Here user can create as many Responsible people as per their need. But it is mandatory to define at least one Responsible person for a company on which TDS is deducted. Responsible persons are created here but need to be defined for that company in DT Option.

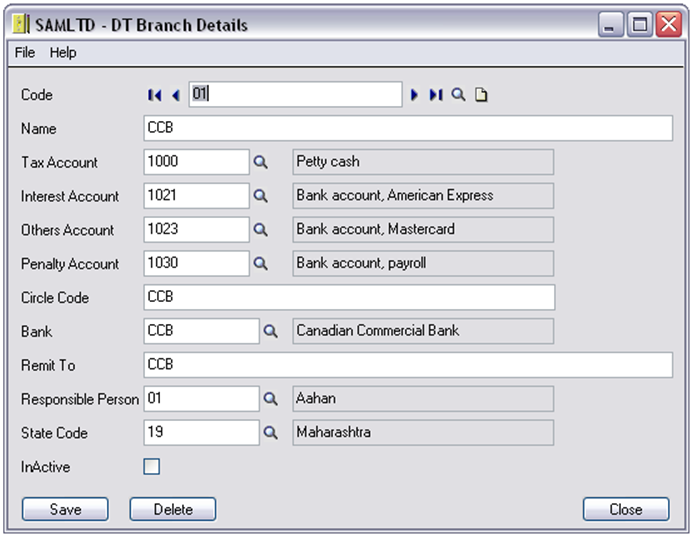

Branch Details: Branch has an option of Responsible Person selection, which in turn will be populated against the company whenever the particular branch is selected.

We have to define branch code where user have to set bank, responsible person and state code.

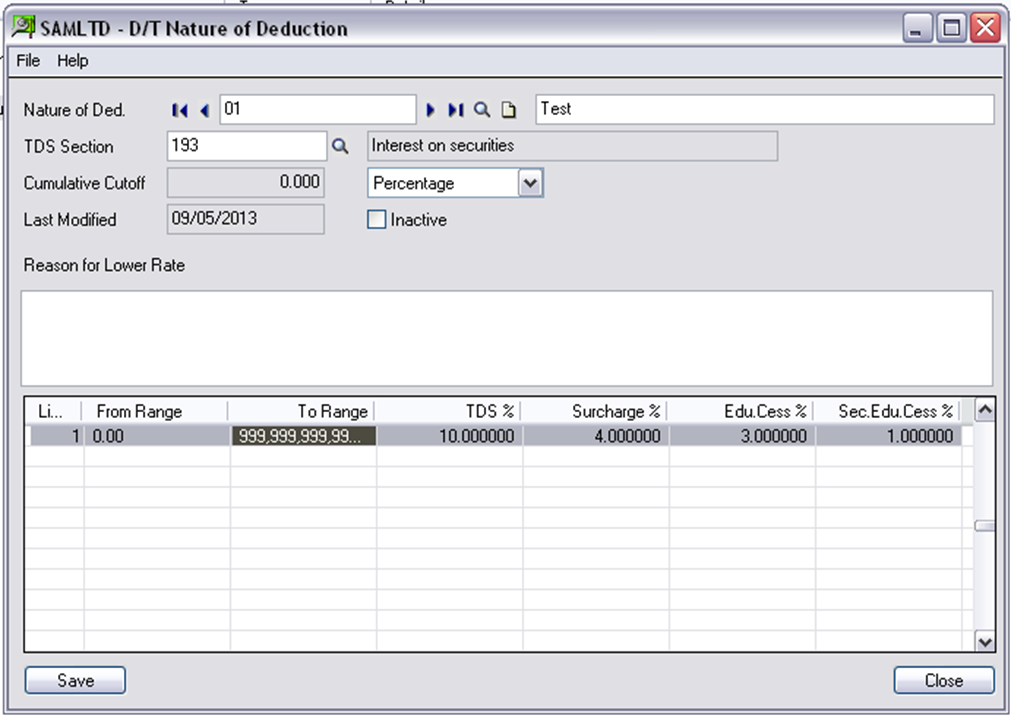

Nature of Deduction: This screen help user to maintain track on what TDS Section and amount range on which TDS should be deducted. Here user can also defined time slabs on which TDS % / amount should be deducted

The “Nature of Deduction” may be Rent Commission Brokerage, Interest etc. Each “Deduction” has TDS limit amount, TDS section and amount/percentage of tax payable for a range of base amount.

We will know more about TDS Options, TDS Sections, Party details and State Code in our next blog.