We all know that Sage 300 ERP offers a multicurrency option for the organization which deals with more than on currency. Thus in Sage we can have a functional currency and the rest can be our customer vendor currencies which can be different from the functional currency of the organization.

Secondly when we say multicurrency then our revaluation comes into picture wherein we reevaluate all our outstanding transaction and the exchange gains and losses that rise during this revaluation can be treated as permanent or temporary based on the Gain/Loss accounting method we specify in the common services option. The revaluation process all your transactions present in Accounts Payable, Accounts receivable and transactions preset in GL with non-functional currencies

New Stuff: Set Document Numbering based on Bank Code for AP Module in Sage 300 ERP

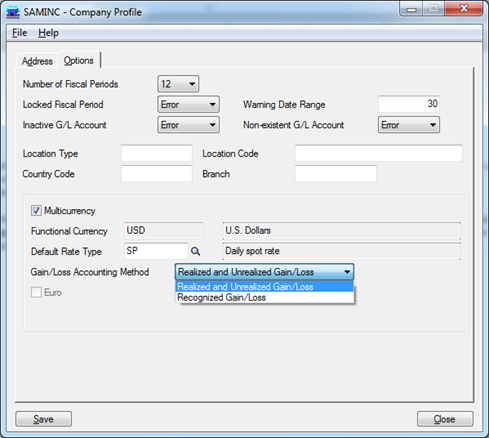

When we setup the company first time we have to make sure we do set up the multicurrency option accordingly in Sage along with the Gain/Loss Accounting method. We set this option in the common services wherein we have the option to select the exchange gain loss accounting method.

Sage 300 ERP generally supports two kind of gain loss accounting methods as described in the subsequent paragraphs.

1. Realized and Unrealized Gain/Loss

Under this accounting method, exchange gains and losses that result from fluctuations in exchange rates are considered unrealized until the transactions are settled.

At each balance sheet date, you revaluate outstanding balances that are updated in foreign currencies. Any exchange gains or losses calculated during revaluation are posted to unrealized exchange gain and unrealized exchange loss accounts, and the balance sheet is stated using current rates. However, because exchange rate fluctuations are considered temporary, unrealized gains or losses are not taken into net income, and they are reversed in the next period. Thus the effect of such revaluation gets reversed in the immediate next day.

2. Recognized Gain/Loss

Under this accounting method, exchange gains and losses are recognized when documents are revalued using the exchange rate in effect at the revaluation date (usually the balance sheet date), or when they are settled. All exchange gains and losses are considered permanent, whether they arise during revaluation or upon settlement, and they are not reversed in the next period. They are posted

To exchange gain and exchange losses accounts and are included on the income side. Also ones we set this method in common services we cannot change the gain/loss method to other one.

Thus we have to make sure we chose a proper gain loss accounting method before we start evaluating the transactions.

Also read:

1. Sage ACCPAC ERP checks your postings

2. Closing Procedure Checklist for Sage 300 ERP

3. Set Document Numbering for Sage 300 ERP on the combination of Account Set and Location

4. General Ledger Period End Maintenance