Sage 300 ERP users sometimes come across this situation where they compare the balances of the sub-ledger control account with the GL and the outcomes are different. What now? How to identify this difference? What basic check needs to be done? A lot of queries running in mind but very few reasoning and analysis steps. In this blog, we will take you through a couple of tips and tricks that might help to short-cut this task.

GreyMatrix (Grid inventory system) – Apparel Solution integrated with Sage 300 ERP

Some basic settings that should be taken care while configuring the system

- Ensure that your control accounts are well-configured in the system with only those sub-ledgers through which the transactions should be routed. Make sure you don’t assign GL for this type of account.

- Setup your Sub-ledgers GL Integration setting in such a way that easily recognizable field such as vendor/customer number and document number is linked to the GL detail Reference and description fields.

- This will make it easier to identify specific AP/AR transactions in the GL Transaction Listing report.

Basic Check-points for analysis of difference:

- Check if there are any direct Journal Entries passed in the Control Accounts. This can be checked from the Account History Inquiry by selecting the source code as GL-JE. If yes, it needs to be reversed and passed from the respective sub-ledgers.

- Check if there are any Error batches created in GL or sub-ledgers in the Batch List. If yes, print the AP Posting Errors report check and rectify such batches.

- Any batches posted from Sub-ledgers and open in GL. You can check the same from the GL Batch List by un-checking the option Show Posted and Deleted Batches. Kindly post the same, if any.

- Run Create GL Batch from Periodic Processing from each sub-ledger to ensure that the batches have been sent to the GL and run day end process and check if it makes a difference in the balances.

- Run GL Transaction history for the control account and check if there any entries originated from some other sub-ledger. For ex, if you are reconciling AP-GL select the AP control account for which there is a difference and check if there are any entries from other sub-ledgers(other than AP).

New Stuff: Sage 300 ERP for Ceramics Industry

If these tricks don’t reveal the difference between your sub-ledger and your GL, a full reconciliation will be required. Here’s how we can make this process simpler.

- Identify the last period where the control account balances of Sub-ledger and GL were last matching. Use that as a starting point to begin your reconciliation.

- Say for ex, you are reconciling the control accounts as on Dec, 2013 and there is a mismatch in the balances. The last period it was matching was Nov, 2013 so in this scenario you need to perform a detail level checking for only one period i.e Dec.

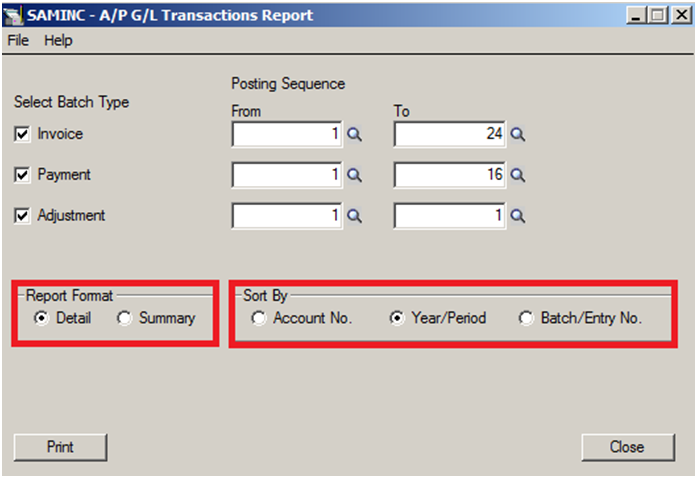

- Export the AP-GL Transactions report with the following criteria

- Once you print and export, it will provide the details of AP transactions year-period wise. Take the transactions of the period you getting the difference, in our case it would be 2013-12.

- Export the GL Transaction Listing report for the control accounts for year-period 2013-12.

- Cross check the transactions in both the sheets using comparison formulas in excel. This would give you the details of those missing transaction either in AP or GL.

- Once you have the list of missing transaction – your variance, you will be able to correct the imbalance by making proper adjustments.

Some more reasons for differences:

- A user might accidentally delete the sub-ledger batch from GL which can be a reason for the difference.

- If the posting date of the sub-ledger document is different from the GL posting date, the ultimatum is the difference when it is reconciled as on a particular period. Say for ex, an AP Invoice is posted in the Feb period and the same document is posted in GL in Jan (back-dated) then the result would be a difference when the reconciliation cut-off date is Jan.

- The changing of the account sets at the transaction level might be one of the reasons.

This way we can identify the difference and make sure that our system is working efficiently and that the sub-ledger always matches with the general ledger.

About Us

Greytrix a globally recognized Premier Sage Gold Development Partner is a one stop solution provider for Sage ERP and Sage CRM needs. Being recognized and rewarded for multi-man years of experience, we bring complete end-to-end assistance for your technical consultations, product customizations, data migration, system integrations, third party add-on development and implementation expertise.

Greytrix offers unique GUMU™ integrated solutions of Sage 300 with Sage CRM, Salesforce.com and Magento eCommerce along with Sage 300 Migration from Sage 50 US, Sage 50 CA, Sage PRO, QuickBooks, Sage Business Vision and Sage Business Works. We also offer best-in-class Sage 300 customization and development services and integration service for applications such as POS | WMS | Payroll | Shipping System | Business Intelligence | eCommerce for Sage 300 ERP and in Sage 300c development services we offer services such as upgrades of older codes and screens to new web screens, newer integrations using sdata and web services to Sage business partners, end users and Sage PSG worldwide. Greytrix offers over 20+ Sage 300 productivity enhancing utilities that we can help you with such as GreyMatrix, Document Attachment, Document Numbering, Auto-Bank Reconciliation, Purchase Approval System, Three way PO matching, Bill of Lading and VAT for Middle East.

For more details on Sage 300 and 300c Services, please contact us at accpac@greytrix.com. We will be glad to assist you.