In our previous blog we learned about “Sales Order Action Report”, which gives us the basic idea about all the Sales Order that we have created. In this blog we will discuss about the small customization on Sales Order Entry screen which was to calculate taxes on the basis of Item Tax in Sales.

Sales Order is a document that is given to the buyers before delivering the goods or services. Once you send sales order it means that the sale is now confirmed. The SO will give you a clear information about your sale. It can also help you to check the inventory that are listed in SO.

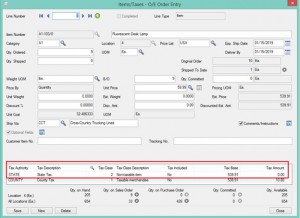

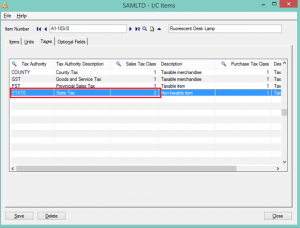

When you create the Sales order, it takes the customer Tax group by default. Tax authorities are taxable or Non-Taxable on the basis of Tax Group assigned to customer. If you want the Sales Tax Authorities to be taxable only on the basis of Items taxes, then here is the solution: We have customized Sales Order Screen in such a way that it compares the sales order detail tax authority with the item master tax authority.

To create Sales Order go to –>

Sage Accpac –> Order Entry–>O/E Transaction –>Order Entry

New Stuff: Update Unit Cost with Base Price while creating Purchase Orders from Order Entry

Consider the scenario where for the OE Order Detail level item tax authority is taxable and at the item master the same tax authority is Non-taxable for that item. In this case, the standard Order Entry will show OE Detail tax as taxable. But in the Order Created from our customized will show Non-Taxable tax as per the item master.

Consider the scenario where for the OE Order Detail level item tax authority is taxable and at the item master the same tax authority is Non-taxable for that item. In this case, the standard Order Entry will show OE Detail tax as taxable. But in the Order Created from our customized will show Non-Taxable tax as per the item master.

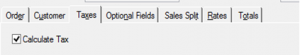

This customization is useful when you want to make the tax calculation automated. The one mandatory requirement for this customization would be that Calculate Tax check box should be checked for Order entry screen.

This customization is useful when you want to make the tax calculation automated. The one mandatory requirement for this customization would be that Calculate Tax check box should be checked for Order entry screen.

About Us

About Us

Greytrix a globally recognized Premier Sage Gold Development Partner is a one stop solution provider for Sage ERP and Sage CRM needs. Being recognized and rewarded for multi-man years of experience, we bring complete end-to-end assistance for your technical consultations, product customizations, data migration, system integrations, third party add-on development and implementation expertise.

Greytrix offers unique GUMU™ integrated solutions of Sage 300 with Sage CRM, Salesforce.com and Magento eCommerce along with Sage 300 Migration from Sage 50 US, Sage 50 CA, Sage PRO, QuickBooks, Sage Business Vision and Sage Business Works. We also offer best-in-class Sage 300 customization and development services and integration service for applications such as POS | WMS | Payroll | Shipping System | Business Intelligence | eCommerce for Sage 300 ERP and in Sage 300c development services we offer services such as upgrades of older codes and screens to new web screens, newer integrations using sdata and web services to Sage business partners, end users and Sage PSG worldwide. Greytrix offers over 20+ Sage 300 productivity enhancing utilities that we can help you with such as GreyMatrix, Document Attachment, Document Numbering, Auto-Bank Reconciliation, Purchase Approval System, Three way PO matching, Bill of Lading and VAT for Middle East.

For more details on Sage 300 and 300c Services, please contact us at accpac@greytrix.com. We will be glad to assist you.