As per new GOI notification, a new TDS section ‘194Q’ has been introduced which states that the buyer/s having turnover exceeding INR 10 crores in the immediate preceding financial year will require to deduct TDS of 0.1% of the purchase value above INR 50 lakhs at the time of payment or credit.

New Stuff: Sage 300 Product update error

In this blog, we will discuss in detail about deduction of TDS on Purchase of Goods in Sage 300 ERP.

In Sage 300, we can setup the TDS module in the following manner to meet the requirement. The TDS can be deducted from day 1 for vendors from whom goods are being purchased.

TDS Configuration

To deduct TDS on purchase of goods under section 194Q, following configuration is required:

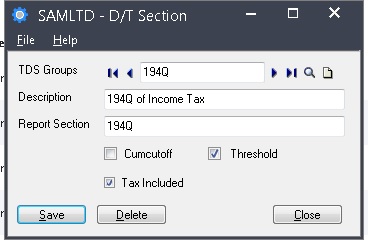

1. Section Creation : A new section can be created in TDS module by navigating to Tax Deducted at Source > D/T Setup > TDS Section. Please refer to below image.

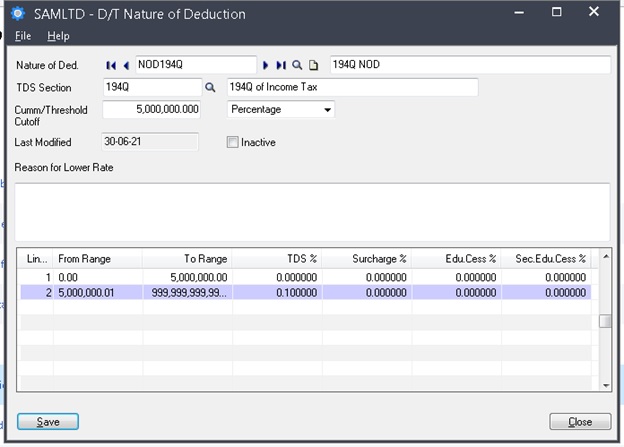

2. NOD Creation : Create Nature of deduction & define TDS rate. You can create NOD from Tax Deducted at Source > D/T Setup > Nature of Deduction UI.

Above NOD can be assigned to respective vendor/s in D/T Party Details.

Deducting TDS on transactions at 0.1%

- AP Invoice.

- AP Credit Note & Debit Note.

- AP Prepayment.

- AP Miscellaneous. Payment.

Example:

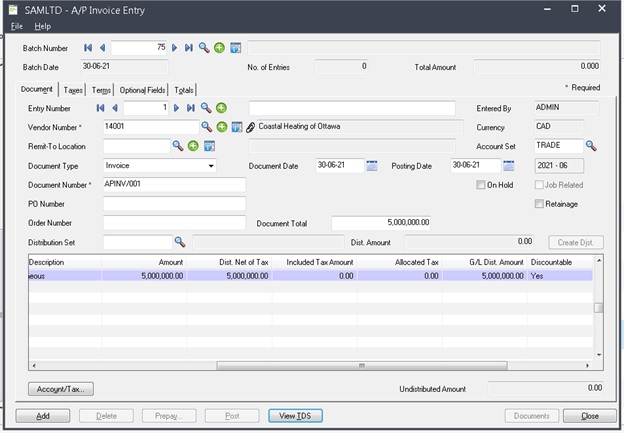

Consider an AP Invoice of 50,00,000 INR as shown below.

Points to Consider:

- This calculation of TDS deduction will be completely based on Vendor & NOD code & fiscal year combination.

- Same functionality will be applicable on AP Prepayment and AP Misc. payments.

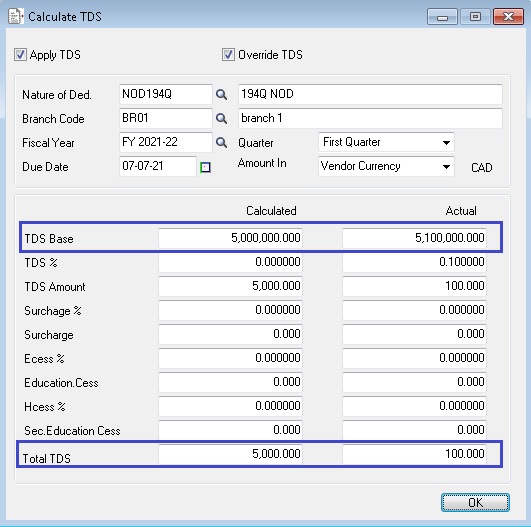

According to section 194Q zero TDS will not be deducted on 50 lakh rupees as the sum didn’t exceed 50 lakhs. By overriding the TDS base from 50 lakhs to 51 lakhs TDS on Goods Purchase functionality will come into role by deducting 0.1% on 1 lakh rupees which is 100 INR.

Please refer to below image:

About Us

Greytrix – a globally recognized and one of the oldest Sage Development Partners is a one-stop solution provider for Sage ERP and Sage CRM organizational needs. Being acknowledged and rewarded for multi-man years of experience, we bring complete end-to-end assistance for your technical consultations, product customizations, data migration, system integrations, third-party add-on development, and implementation competence.

Greytrix offers unique GUMU™ integrated solutions of Sage 300 with Sage CRM, Salesforce(listed on Salesforce Appexchange), Dynamics 365 CRM, and Magento eCommerce, along with Sage 300 Migration from Sage 50 US, Sage 50 CA, Sage PRO, QuickBooks, Sage Business Vision and Sage Business Works. We also offer best-in-class Sage 300 customization and development services and integration services for applications such as POS | WMS | Payroll | Shipping System | Business Intelligence | eCommerce for Sage 300 ERP and for Sage 300c development services we offer, upgrades of older codes and screens to new web screens, latest integrations using Data and web services to Sage business partners, end users and Sage PSG worldwide.

Greytrix offers 20+ add-ons for Sage 300 to enhance productivity such as GreyMatrix, Document Attachment, Document Numbering, Auto-Bank Reconciliation, Purchase Approval System, Three-way PO matching, Bill of Lading, and VAT for the Middle East. The GUMU™ integration for Dynamics 365 CRM – Sage ERP is listed on Microsoft Appsource with an easy implementation package.

The GUMU™ Cloud framework by Greytrix forms the backbone of cloud integrations that are managed in real-time for processing and execution of application programs at the click of a button.

For more details on Sage 300 and Sage 300c Services, please contact us at accpac@greytrix.com, We will like to hear from you.