In Sage 300 ERP, we have reports under AR Module, which are standard reports that provide basic information related to the transactions (E-Invoicing). Essentially, current reports provide only the essential information and don’t enable users to gain comprehensive insights.

We have therefore introduced a new report to print transactions that are carried out in the A/R Invoice Screen of AR Module of Sage 300 ERP. This report will print detailed information about the E-Invoicing along with additional details like Tax ARN No, Term due Date, Contact Name, Case Name, Payment Date, Collected Amount and Tariff.

If the supplier generates an E-Invoice for the receiver that adheres to another country than India or different tax system, the E-Invoiced tax report generated in accordance with the Indian tax format will not be applicable. Therefore, we have created this report in an alternative format.

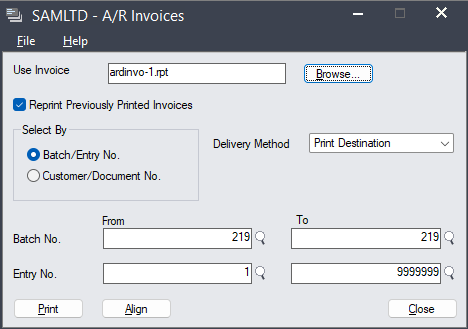

The User Interface of the Report will be as below:

New Stuff: – Store Code Wise Vendor Aging Report

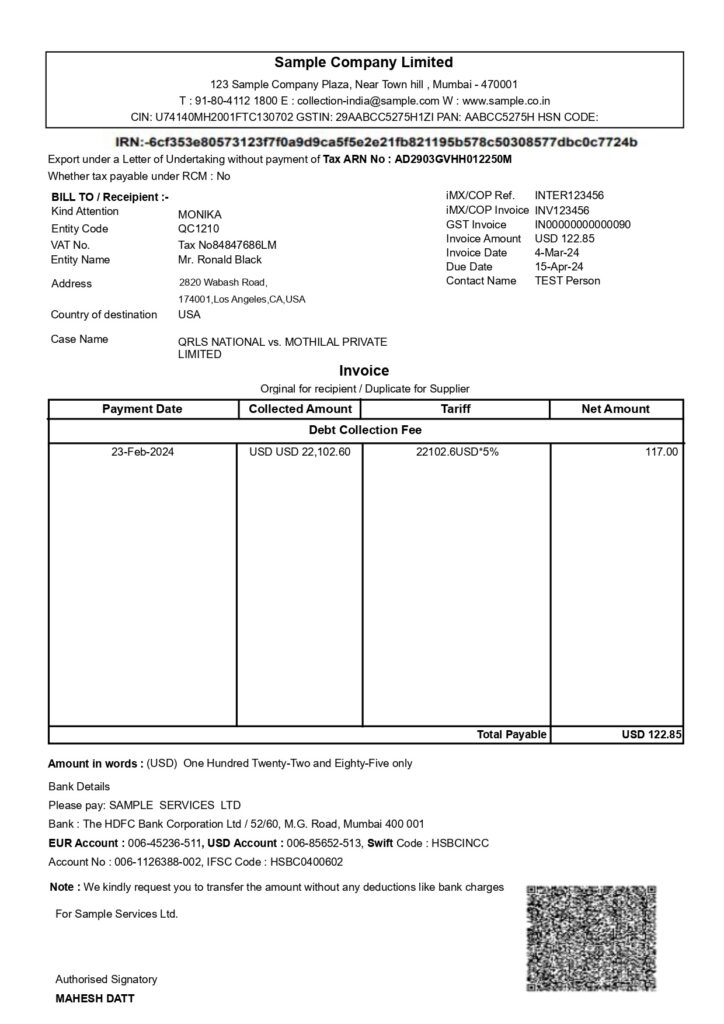

After selecting the desired range of Batch and Entry number the report will print as follows:

The additional Information Printed on report will contain data as follows: This data can be customized according to requirement.

- Tax ARN No – The ARN permits vendors to include GST on a bill of supply even without the GSTIN, and it must be provided for transactions involving multiple tax systems.

- Kind Attention – Details of the mediator existing between the supplier and the recipient.

- iMX/COP Ref – If there are multiple tax system transactions, the supplier keeps a reference number for internal use, which is then retrieved in the report.

- iMX/COP Invoice – The reference Invoice number is associated with the Internal Reference number.

- Contact Name – Details of the recipient contact name.

- Case Name– Additional details and information of the recipient.

- Payment Date – Payment date of the recipient

- Collected Amount – Detail Amount to collect from the recipient.

- Tariff – Tax charge details between the supplier and the recipient.

The Kind Attention field values are retrieved from the customer master, while the values for other fields will be retrieved from the optional Invoice Header field.

In this way, the client can customize the E-invoicing report format based on the recipient’s country or tax system if it is different from India.

About Us: –

Greytrix – a globally recognized and one of the oldest Sage Gold Development Partner is a one-stop solution provider for Sage ERP and Sage CRM organizational needs. Being acknowledged and rewarded for multi-man years of experience, we bring complete end-to-end assistance for your technical consultations, product customizations, data migration, system integrations, third party add-on development and implementation competence.

Greytrix offers unique GUMU™ integrated solutions of Sage 300 with Sage CRM, Salesforce.com, Dynamics 365 CRM and MagentoeCommerce along with Sage 300 Migration from Sage 50 US, Sage 50 CA, Sage PRO, QuickBooks, Sage Business Vision and Sage Business Works. We also offer best-in-class Sage 300 customization and development services and integration services for applications such as POS | WMS | Payroll | Shipping System | Business Intelligence | eCommerce for Sage 300 ERP and for Sage 300c development services we offer, upgrades of older codes and screens to new web screens, latest integrations using Data and web services to Sage business partners, end users and Sage PSG worldwide. Greytrix offers 20+ addons for Sage 300 to enhance productivity such as GreyMatrix, Document Attachment, Document Numbering, Auto-Bank Reconciliation, Purchase Approval System, Three way PO matching, Bill of Lading and VAT for Middle East. The GUMU™ integration for Dynamics 365 CRM – Sage ERP is listed on Microsoft Appsource with easy implementation package.

For more details on Sage 300 and Sage 300c Services, please contact us at accpac@greytrix.com, We will like to hear from you.