Withholding taxes are part of day to day transactions that are carried out in organizations. It is basically an income tax that an employer pays directly to the government. The deduction takes place directly from the earnings of an employee by the employer which makes the tax a liability for an individual that is paid to the government. The withhold amount is basically a credit against the income taxes the employees pay during the year. It is a way of taxing at the source of income instead of trying to collect income tax after wages are earned. It is mandatory as per the Income Tax Act, under section 195, for the payee to deduct the tax at the time of payment from the account of the Non-Resident Individual.

Now a basic question, “What is the difference between TDS (Tax Deducted at Source) and Withholding Taxes?” Below is a simple explanation in points to help clear the doubt:

TDS

- TDS is Tax which is deducted at Source and it is done at the time of making payments.

- TDS is for the people of India.

Withholding Taxes

- Withholding taxes is the amount which is deducted in Advance that is before paying the amount to the payee.

- Also, it is applicable for payments made to Non-Residents which is foreign transaction.

When purchasing goods or services from a vendor, you may need to withhold some/all amount from the selling price or the tax amount for the transaction and then remit the withheld amount to a tax authority on behalf of the vendor. A tax that must be remitted in this way is called a Withholding tax.

New Stuff :- Vendor Master Export Utility

Until you make a payment on an invoice, the amount to withhold is considered an estimate, because until the moment of payment you can change the amount to withhold. When you make a payment, the withheld amount is finalized and posted in General Ledger.

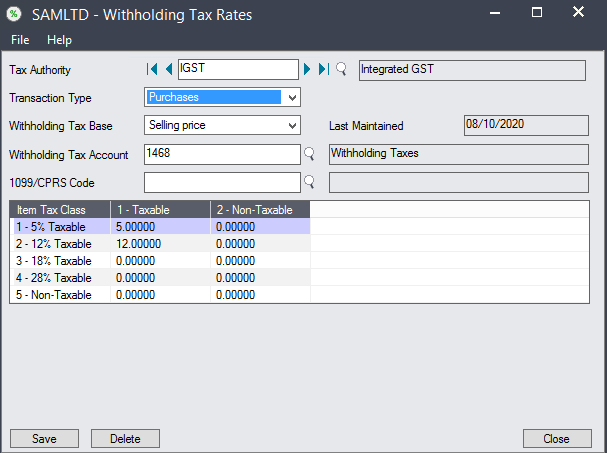

We have introduced this Withholding Tax feature in our latest Sage 300 v2020 ERP. You can find the Withholding Tax Rate screen in Common Services > Tax Services > Withholding Tax Rates.

You can use the Withholding Tax Rates screen to:

1. Enter withholding tax rates for purchases for each tax authority in Sage 300 system. Sage 300 sub ledgers will use these tax rates to calculate withholding taxes on items that are bought.

2. Edit tax rates if they change.

Before configuring this screen we need to add tax authorities, tax classes, and regular tax rates. Also, in General Ledger, we need to set up a liability account to which we will post tax amounts that we have withheld for the tax authority.

There is also an option to select Withholding Tax Base where you can specify whether the amounts to withhold are calculated based on the selling price or the tax amount from an invoice.

For Example:

You have entered withholding tax rate as 10%. You have an invoice of $100.00, which is subject to a regular tax rate of 15%. The amount to withhold depends on the withholding tax base you use:

- Selling price – The withheld amount is $10.00 (10% of the selling price of $100.00).

- Tax amount – The withheld amount is $1.50 (10% of the tax amount of $15.00).

This information will help to configure and Withholding tax in Sage 300 ERP and also to have a brief summary on the topic!

About Us

Greytrix – a globally recognized and one of the oldest Sage Development Partners is a one-stop solution provider for Sage ERP and Sage CRM organizational needs. Being acknowledged and rewarded for multi-man years of experience, we bring complete end-to-end assistance for your technical consultations, product customizations, data migration, system integrations, third-party add-on development, and implementation competence.

Greytrix offers unique GUMU™ integrated solutions of Sage 300 with Sage CRM, Salesforce(listed on Salesforce Appexchange), Dynamics 365 CRM, and Magento eCommerce, along with Sage 300 Migration from Sage 50 US, Sage 50 CA, Sage PRO, QuickBooks, Sage Business Vision and Sage Business Works. We also offer best-in-class Sage 300 customization and development services and integration services for applications such as POS | WMS | Payroll | Shipping System | Business Intelligence | eCommerce for Sage 300 ERP and for Sage 300c development services we offer, upgrades of older codes and screens to new web screens, latest integrations using Data and web services to Sage business partners, end users and Sage PSG worldwide.

Greytrix offers 20+ add-ons for Sage 300 to enhance productivity such as GreyMatrix, Document Attachment, Document Numbering, Auto-Bank Reconciliation, Purchase Approval System, Three-way PO matching, Bill of Lading, and VAT for the Middle East. The GUMU™ integration for Dynamics 365 CRM – Sage ERP is listed on Microsoft Appsource with an easy implementation package.

The GUMU™ Cloud framework by Greytrix forms the backbone of cloud integrations that are managed in real-time for processing and execution of application programs at the click of a button.

For more details on Sage 300 and Sage 300c Services, please contact us at accpac@greytrix.com, We will like to hear from you.