As we all are aware of TDS in Sage 300 ERP. Tax Deducted at Source (TDS) is a method mandated by the Indian government for collecting taxes directly from the source of income. It entails the deduction of a specified tax percentage by the payer while making payments to the recipient, with this deducted amount subsequently remitted to the government. TDS is applicable across a wide array of income categories, including salaries, interest on fixed deposits, rent, commissions, and others.

New Stuff: Validation of E Invoice optional fields on OE Credit\Debit note screen

Previously, in Sage 300 ERP, transactions with nil-rated TDS were not included in remittances. Now, transactions with nil-rated TDS are considered for remittance. These entries will be visible on the Create Remittance screen and in the TDS Deduction and Remittance Report. However, the system won’t permit posting such invoices on payment entry screen and Remittance Entry screen as they have zero TDS amount. To post such transactions, users need to attach or apply an invoice along with them.

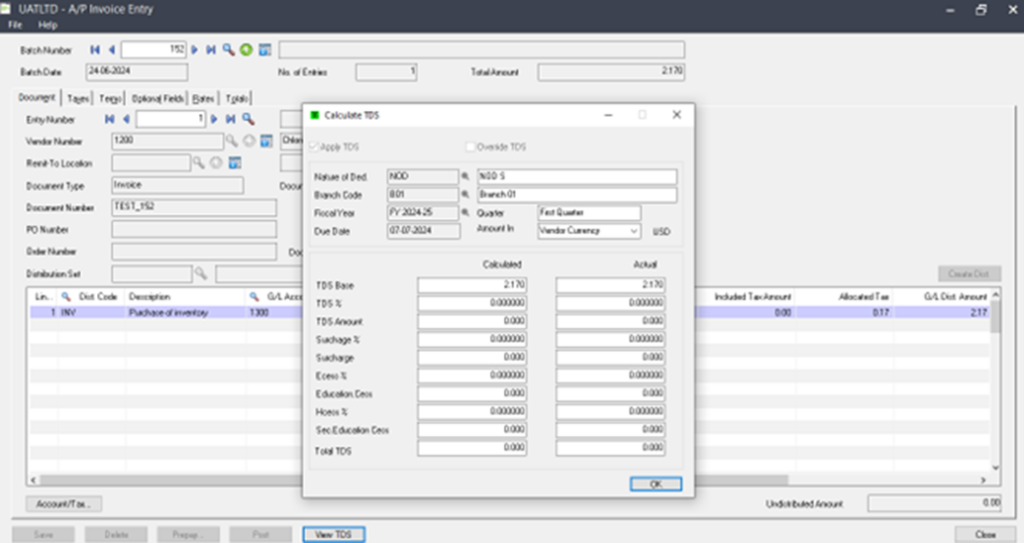

Let’s understand the correct process of remittance of zero-amount invoices. The below image is of a TDS transaction with zero amount.

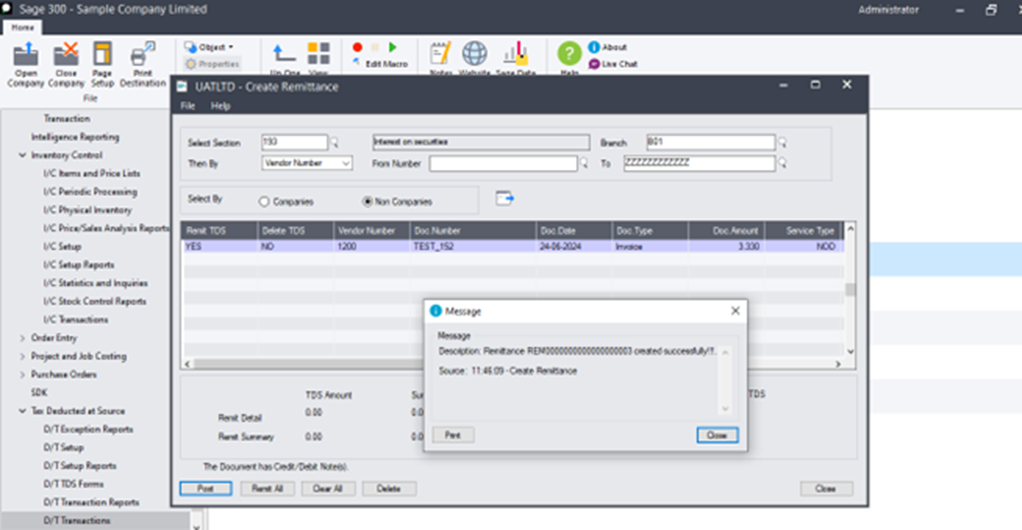

The below image is of create remittance screen where the user has posted the nil-rated invoice.

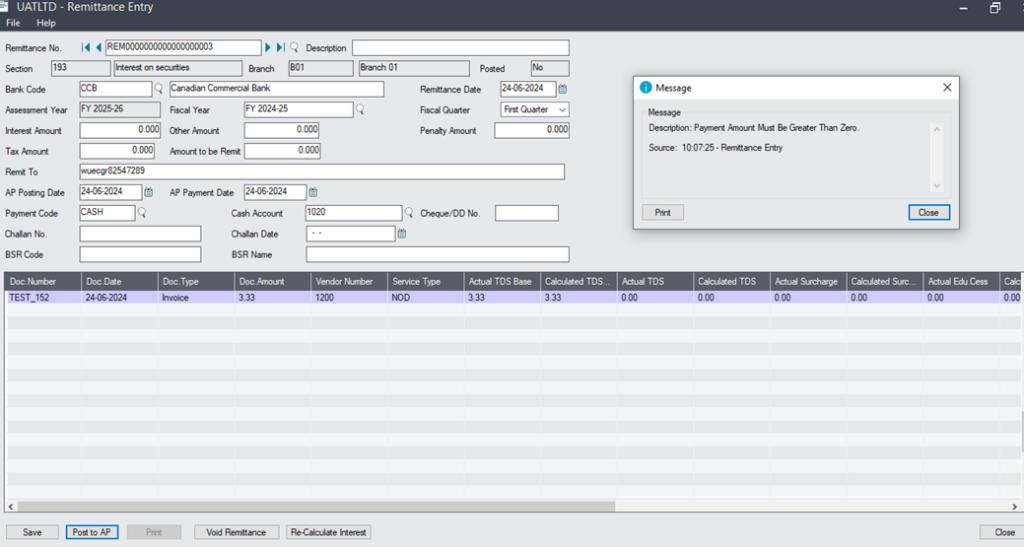

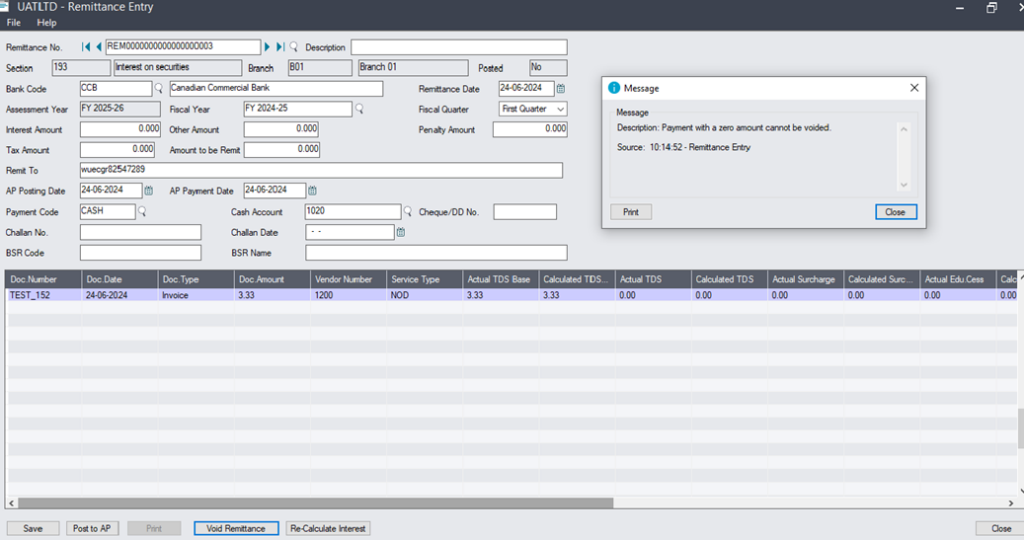

Initially, the system was not allowed to post or void such types of invoices by throwing the below errors on the Remittance Entry screen.

The above problem has been solved in the TDS addon.

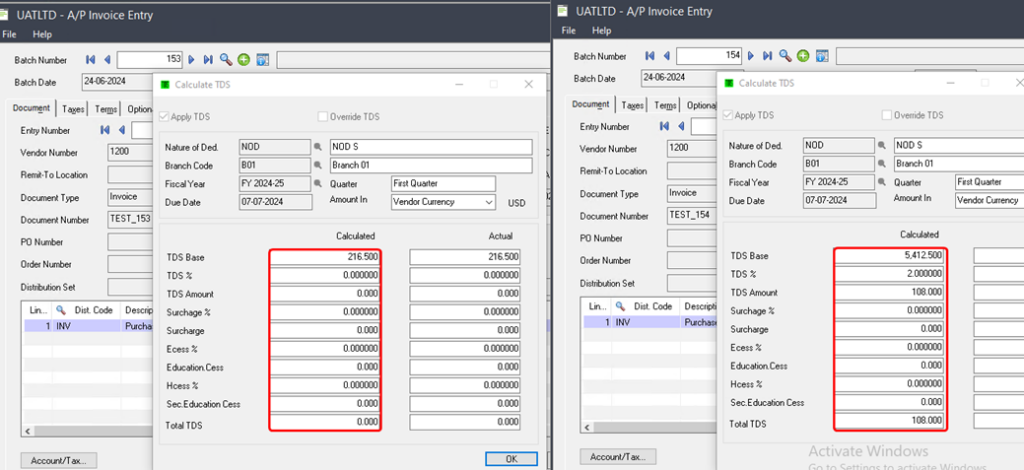

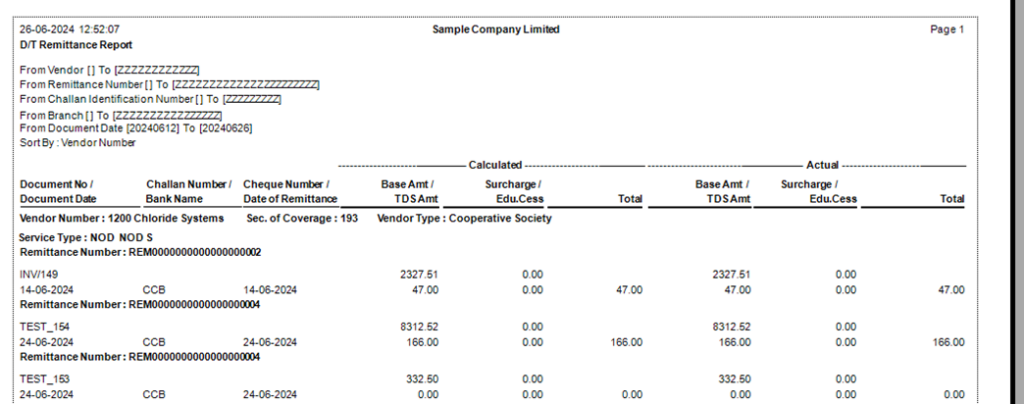

Below is an example of TDS Transactions with zero amount(nil-rated), and another is with TDS amount.

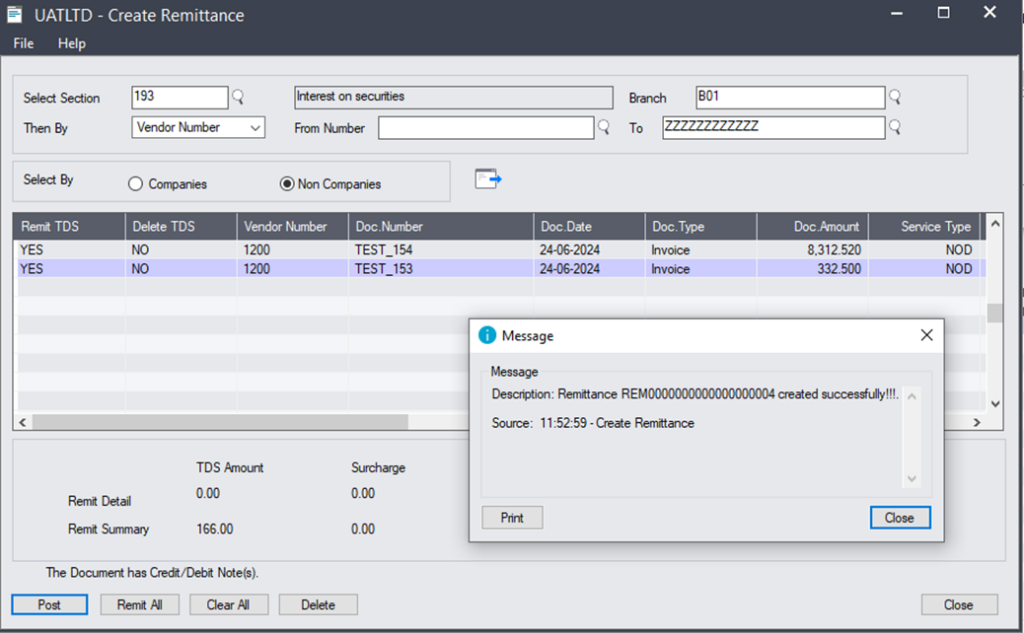

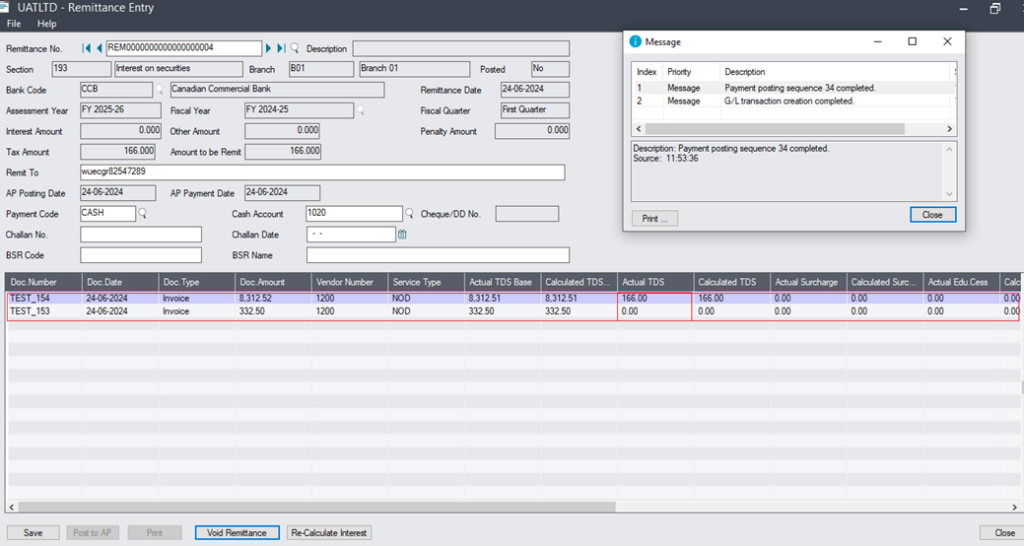

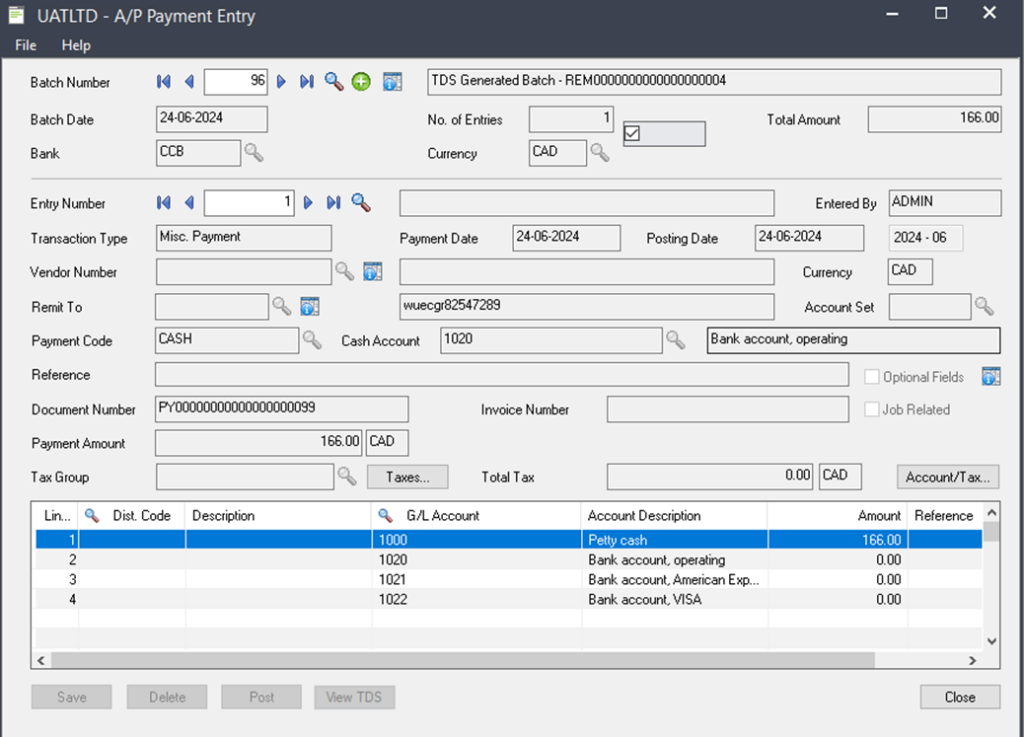

Now, both invoices can be remitted from the create remittance screen. As shown in the below screenshot.

This is how users can process nil-rated TDS invoice/s and check the same transactions in the Deduction and Remittance Report.

About Us:-

Greytrix – a globally recognized and one of the oldest Sage Gold Development Partner is a one-stop solution provider for Sage ERP and Sage CRM organizational needs. Being acknowledged and rewarded for multi-man years of experience, we bring complete end-to-end assistance for your technical consultations, product customizations, data migration, system integrations, third party add-on development and implementation competence.

Greytrix offers unique GUMU™ integrated solutions of Sage 300 with Sage CRM, Salesforce.com, Dynamics 365 CRM and Magento eCommerce along with Sage 300 Migration from Sage 50 US, Sage 50 CA, Sage PRO, QuickBooks, Sage Business Vision and Sage Business Works. We also offer best-in-class Sage 300 customization and development services and integration services for applications such as POS | WMS | Payroll | Shipping System | Business Intelligence | eCommerce for Sage 300 ERP and for Sage 300c development services we offer, upgrades of older codes and screens to new web screens, latest integrations using Data and web services to Sage business partners, end users and Sage PSG worldwide. Greytrix offers 20+ addons for Sage 300 to enhance productivity such as GreyMatrix, Document Attachment, Document Numbering, Auto-Bank Reconciliation, Purchase Approval System, Three-way PO matching, Bill of Lading and VAT for Middle East. The GUMU™ integration for Dynamics 365 CRM – Sage ERP is listed on Microsoft App source with easy implementation package.

For more details on Sage 300 and Sage 300c Services, please contact us at accpac@greytrix.com, We will like to hear from you.